What President Biden’s budget means

President Biden’s budget proposal is a stark contrast to the past presidential administration. The key differences in the two budgets reflect diverse policies and what the Biden Administration regards as vital to the nation’s future.

President Joe Biden has put a $6 trillion budget proposal before Congress that reflects his administration’s key priorities and is wide ranging in its scope. The budget focuses on important areas that many contend have been either ignored or underserved. The proposed budget plans on putting more funds into research and development, clean energy, infrastructure, education, and housing, to name a few. The budget proposal is an attempt to spur on economic development in areas that need it desperately while spurring on economic growth.

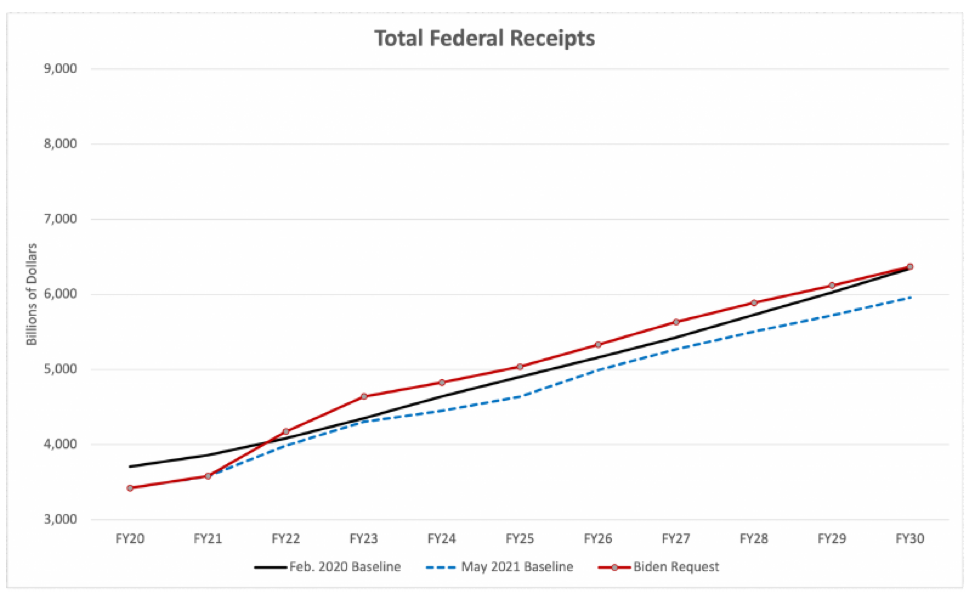

The budget proposal also looks to make changes in the taxation of high-income individuals and revamp the corporate tax code. The aim is to make the wealthy finally pay their fair share while attempting to close loopholes that corporations have enjoyed for a long time. Corporations will see an increase in taxes, a repeal in tax exemption for foreign oil and gas extraction income, and limits on foreign tax credits from sales of hybrid entities. The goal is to level the playing field between those who have paid too little taxes in the past and those who have paid too much.

A budget proposal is just that: A proposal. The budget more than likely will have many parts accepted by Congress, but the Biden Administration will especially try to get those projects and programs it deems necessary to help the American economy but also for those Americans who severely need a boost in order to improve their economic and financial standing.

Key budget components

President Biden’s budget contains numerous requests that are actually increases in funding from the Trump Administration.

Department of Agriculture at $27.9 billion: The Agriculture Department’s budget is seeing an increase of 16 percent from the fiscal year (FY) 2021 budget. Among the proposals that have been made are $6.7 billion for the Special Supplemental Nutrition Program for women, infants, and children which is an increase of $1 billion from FY 2021. The goal is to assist an anticipated increase in the number of participants and to deal with rising food insecurity.

The Agriculture Department is also hoping to see funds going to the Rural E-Connectivity (“Reconnect”) Program of $700 million. The aim of the program is to make a down payment for loans and funds in order to make broadband available to unserved and underserved parts of the United States. Rural America has seen itself fall far behind urban and suburban areas regarding advancements in telecommunications which is considered vital as part of the nation’s economic and financial development. Rural America needs broadband infrastructure development in order for the attraction and retention of new firms and industries. If funds can be used to advance telecommunications infrastructure in rural America it can also mean improvements in healthcare services through the use of telemedicine, as well as long distance education, and improving wages, salaries, and job skills.

The Biden budget also proposes $6.5 billion in loans for rural electrical facilities, that would support more initiatives for clean energy, power storage, and electrical transmission projects. The proposal is also looking to provide $400 million in new funds to provide rural electric providers financial flexibility as they attempt to get away from carbon-based electrical power by the year 2035.

Department of Education at $102.8 billion: This part of the Biden budget represents a 41 percent increase from FY 2021 which aims to put new funds into programs for disadvantaged students. This will mean that $30.5 billion will go for schools located in high poverty areas by going to Title I Grants directly to the individual states while $15.7 billion will be designated for special education programs. These programs include the Individuals with Disabilities in Education (IDEA) which will see a $2.5 billion increase from FY 2021. The funds in this case are specially designed to help education programs in kindergarten through 12th grade.

Department of Energy at $46.2 billion: This department will see a 10.4 percent increase from FY 2021 in which money will be channeled toward clean energy programs. Among the programs that will see a significant benefit is the creation of a new Building Clean Energy Projects and Workforce Initiative in which $1.9 billion will go to fund the changeover to a net zero energy sector by 2035. The program also seeks funds for local and state governments for the deployment of clean energy initiatives for communities that are underserved and overwhelmed. The objective is to put into place programs that will reduce air pollution, promote energy efficiency, and start renewable energy projects.

Department of Housing and Urban Development at $68.7 billion: There will be a 15.2 percent increase over the FY 2021 budget for this department in which there is a proposal for $3.8 billion for Community Development Block Grants. The aim and purpose of these grants is to incentivize communities so as to direct funds to modernize and rehabilitate public infrastructure and facilities in areas that have not received enough funds in the past and those communities dealing with nagging and persistent poverty.

Other parts of the department’s budget will see $3.5 billion for assistance for the homeless in order to help 100,000 additional households and Section 8 housing vouchers at $30.4 billion. The idea is to assist those who are not only homeless but also fleeing households with domestic violence.

American Families Plan at $1.8 trillion: The Biden Administration is looking to place significant funds into education, income support, and other safety-net programs over the next decade. This will include $225 billion in expanded child care, $225 billion to institute a universal paid leave program, $200 billion to have universal preschool programs, as well as $200 billion for tuition-free community college. The plan is also looking to make key investments in child nutrition programs while also looking to have expansion over the long term of the refundable tax credits supporting families and children.

American Jobs Plan at $2.6 trillion: This program is a decade long investment in the country’s infrastructure fund for areas that include education to drinkable water to roads and bridges. This plan hopes to fund $621 billion for transportation, $111 billion for water systems, and $400 billion for home health care workers. While the plan is regarded as ambitious and covers a wide variety of not very traditional sectors, the premise is to encourage job growth and give the nation the financial stimulus many are calling for.

While these are only some of the government departments and programs that will receive significant increases, the key is what these mean as to what is important for the Biden Administration.

Biden’s key priorities

The budget put forth by the Biden Administration attempts to put more money into programs that will ultimately benefit the American people. The budget will include traditional infrastructure projects, green programs, as well as child care and elder care expenditures. The idea is to give the American people the public goods and services that are desperately needed. Rather than provide tax refunds, these public goods and services will provide a better long-term return in places that need them.

In the case of the Department of Transportation, the Biden budget is proposing $1 billion for BUILD Grants or Better Utilizing Investments to Leverage Development. The goal is that counties across the United States will use the program’s flexible funding in order to fulfill local infrastructure programs and projects which includes 45 percent of public roads and 38 percent of public bridges owned and operated by diverse counties. These counties will be able to skip the application process of going to state departments of transportation for needed funds. The benefit here is that funds go directly to local counties and municipalities without having to wait for state approval. This can make vital road and bridge repair and construction faster and easier than before.

Another key priority of the Biden Administration is encouraging green programs and this is seen in the proposed $250 million for grants to transit agencies. The goal of these grants is to make easier and faster to move public transit bus fleets away from fossil fuels and go to an electric fuel source. This will help counties and municipalities to encourage mass transit by using clean energy, help increase ridership, cut energy costs, and, hopefully, increase revenues from more use of public transportation.

The Biden Administration is also placing more money into the Economic Development Administration (EDA) in order to support and build up locally sponsored projects that will foster and encourage economic development. The EDA program will allocate $84 million for the Assistance to Coal Communities program in order to create jobs, boost economic diversification, investment in human capital, such as workforce development, and opportunities at re-employment for those communities and areas that have been hit hard by the changes and slowdown in the coal industry. The goal is to help coal communities that have seen a serious economic depression as well as those parts of rural America in which financial and technical resources are quite often low or non-existent.

As stated by Shalanda Young, acting director of the Office of Management and Budget, “The budget will reduce the deficit and improve our nation’s finances. That’s because its front-loaded investments are more than paid for through permanent tax reforms that will ensure corporations and the wealthiest Americans pay their fair share.”

What Director Young means is that in order to help pay for these programs, plans, and projects, the Biden budget is seeking large tax hikes on capital income. At present, capital gains are taxed at a substantially lower rate than income and wages that are generated through gainful employment. Also, savings are taxed at a much higher rate than capital gains. However, there has evolved a wide disparity in tax rates between capital and income acquired from accumulated wealth as opposed to income and wages coming from work at a salaried or hourly job. Over time a severe inequality has occurred in which the manager of a hedge fund will pay lower taxes than an administrative assistant or a factory worker.

The Biden budget wants to see an increase in corporate tax rates as well as higher capital gains taxes. Corporate stockholders who have, in many cases, huge ownership in companies that are either private or public, are doing exceedingly well since they pay much lower taxes than ever before. Those who make their wealth and income through the selling of common stocks and other financial instruments at a substantial profit, also are able to skirt paying taxes through the current regulations in the Federal tax code. According to recent data from the Federal Reserve Bank, the wealthiest 1 percent of households by themselves own more than 50 percent of corporate equity, yet the wealthiest 10 percent have ownership of more than 85 percent of companies equity. The ultimate goal by the Biden Administration is to level the playing field between the wealthy minority paying low to no taxes and the working majority who pay the largest part of taxes.

In sum, the budget proposal is, as President Biden stated, “Where we choose to invest speaks to what we value as a nation. This year’s budget, the first of my presidency, is a statement of values that define our nation at its best.”

Points of contention

There are critics of the Biden Administration budget who feel that it will actually harm the American economy in the long run. A major point of contention is that too much money will be released into the American economy causing inflation to severely spike, such as we are currently seeing. The problem is that the American economy, at present, is starting to rebound from the financial impact of the Covid 19 pandemic. Consumers are putting money into the American economy through their purchases and this is causing companies to hire once again. But this also means more money going into circulation, thereby causing inflation to take an aggressive turn upwards.

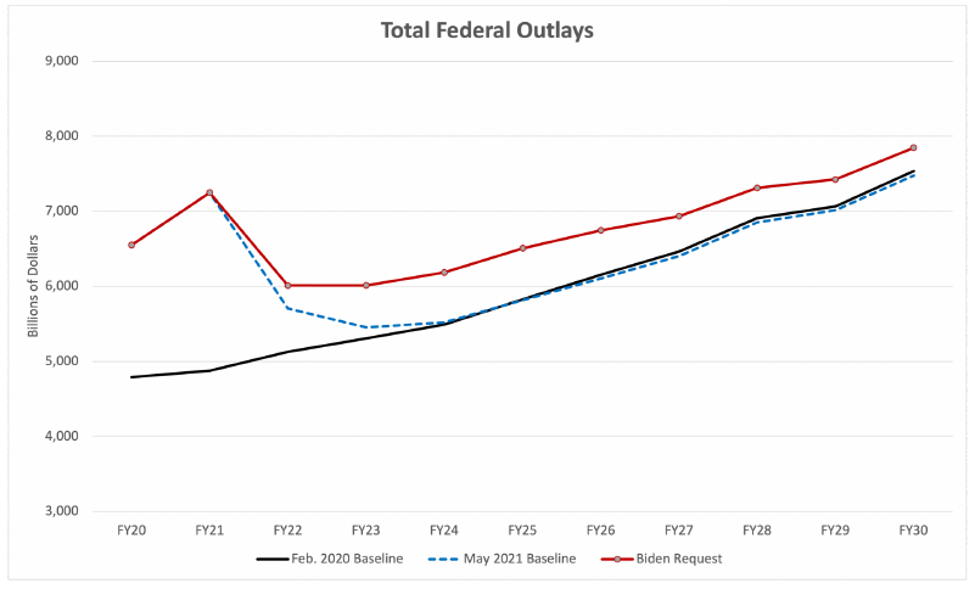

With the Biden Administration proposing a $6 trillion budget, even more money will be put into the American economy causing inflation to take a higher trajectory. On top of the concern for higher inflation there is the concern that the national debt will go even higher. The Biden Administration is projecting that its budget plan will see an additional $14.5 trillionadded to the national debt over the next ten years. However, the Biden Administration is not concerned since it projects that the plan will be completely paid for in 15 years due to tax increases that will reduce any projected budget deficits.

The bottom line is this: The budget proposed by the Biden Administration is vastly different from the previous president in that it is more geared toward social programs, infrastructure, and rescuing the environment. While it may be deemed expensive, it addresses current problems that, if further ignored, will be irreversible and more expensive to deal with in the future.