By Hazrat Hassan

With the global economy and the business environment becoming more complex every day, companies and CFOs are increasingly keen to transform the finance function from a slightly aloof department within an organization into an integral part of the business. For many companies, “transforming” finance is no longer a choice; it is the only way forward. [1]

Yet, in spite of huge investments in new IT systems, shared service centers, process re-engineering, etc., our research has found that fewer than one in three finance transformations succeed. Leading CFOs attribute high failure rates to conventional transformation approaches focusing on the wrong levers of efficiency. As a first step on a transformation journey, most companies benchmark transactional effectiveness and finance IT capabilities. Often, the benchmark score results in an efficiency goal and the goal then becomes the cornerstone of the transformation strategy. This over-reliance on efficiency benchmarks is flawed for two reasons

First, these metrics only provide a backward looking perspective on departmental costs and, second, they focus on finance cost as a proportion of annual revenue even though functional complexity is just as much of functional cost. Benchmarking exercises are usually followed up with back office efficiency targets, often achievable only through greater levels of automation and centralization. While better integrated finance IT solutions and shared service centers can be an attractive means to improving reporting capabilities, this is not a silver bullet for improving finance effectiveness and delivering targeted business support. [2]

Advanced technologies not only enable finance to reduce operational complexity, but they also create the capability to contribute to strategic business decisions.

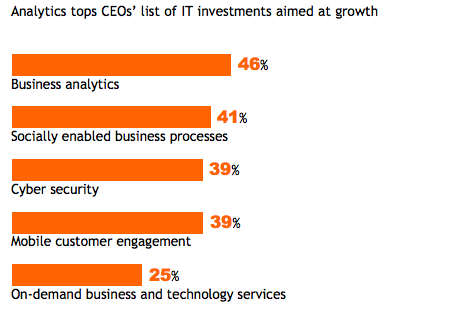

According to Pricewaterhouse Coopers’ 2014 U.S. CEO Survey, 88 percent of chief executives expect technological advances to transform their business in the next five years. As a result, 46 percent are investing in analytics and one-fourth expects to spend more for on-demand business and technology services to help their companies grow. [3]

Technology for Transformation

What makes using these new technologies especially attractive, says Frank Niedermeyer, managing director, Accenture Strategy, CFO and Enterprise Value, is the growing volatility of the global economy. Simply put, the ability to crunch data at vastly higher speeds and deliver it in real time or nearly so can help companies respond to market vicissitudes more rapidly. Niedermeyer reports that a growing number of clients have become “desperate” for that ability in the past few years. Predicting cash flow more accurately is imperative, he adds. [4]

What makes using these new technologies especially attractive, says Frank Niedermeyer, managing director, Accenture Strategy, CFO and Enterprise Value, is the growing volatility of the global economy. Simply put, the ability to crunch data at vastly higher speeds and deliver it in real time or nearly so can help companies respond to market vicissitudes more rapidly. Niedermeyer reports that a growing number of clients have become “desperate” for that ability in the past few years. Predicting cash flow more accurately is imperative, he adds. [4]

New technologies make it easier to incorporate nonfinancial data into the analysis. For example, analytics can help companies reduce fraud by detecting unusual patterns of customer behavior. John Lucker, principal with Deloitte, points out the considerable success the insurance industry has had using predictive analytics to reduce false disability or loss claims. He thinks retailers could find similar success reducing fraudulent product returns. In each case, CFOs could more accurately forecast cash flow, long a major challenge in every industry. [5]

To be successful, Finance must act like a profit center; so here is a call to action for finance. It’s time to be fearless. Drop the service center mentality. Currently, 90% of finance departments aim to support every business partner request. In a resource constrained environment, it is simply not possible to meet an increasing volume of demand and simultaneously delight the internal customer. Instead, think about a finance department as profit centers and act accordingly. In practice, this means doing following:

Build a finance strategy based on alignment with business goals rather than hitting a cost target.

Tier support based on business need and appropriate levels of risk.

Track the time and cost of ad-hoc requests.

In a business climate where the only certainty is continuous change, finance departments should not fall into the trap of trying to look like everyone else. Instead, build a vision for supporting business growth, scale back the activities that don’t contribute to this vision, and actively manage your internal customer to bring them with you on this journey. [6]

References

- Friedman, Dennis P. Finance transformation: Everyone is doing it but few get it right. The Economist. Transform the Finance Function. CFO, F. Vol.37,Issue September 26, 2013.

- How to Transform the Finance Function. HBR (Harvard Business Review),VoL.20, Issue on APRIL 24, 2016.

- Teitelbaum , The Wall Street Journal, MetLife Sets Changes in Finance Group,Vol.29, Issue on 2013.

- Jeong Bon Kim, Operational finance. Finance 2020, Vol.100, Issue 3,June,2011.

- Building High-Performance Finance Functions, CFO Research, Dec. 9, 2014.

- Michael Lounsbury, Institutional Transformation and status Mobility, the Professionalization of the field of Finance, VoL,71, Issue June 2016.