The job of chair of the Federal Reserve Bank is probably the second most important in the United States behind that of President. The Fed chair is responsible not only for overseeing the world’s largest economy but the financial entity that most every other nation on the planet depends on. There have been Fed chairs that have guided the American economy through periods of high inflation, economic collapse, and out of severe recessions. There have been others who have instituted monetary policy that have contributed to extended periods of high inflation, stagnating economic growth, and even been a major contributor to a great depression.

Former chair Alan Greenspan once said that being the head of the Federal Reserve Bank required all the intellectual and mental resources he could muster in order to run the largest central bank in the world. While it is a challenge to run the Federal Reserve Bank, there have been those who have done a good job in navigating the Bank and the American economy in perilous times. This can be said for Jerome Powell, the current Fed chair.

During his brief tenure as Fed chair, he has used the Bank’s resources to help the American economy avoid economic collapse during the Covid-19 pandemic and oversee the nation’s financial rebound. By having the Fed pour trillions of dollars into the American economy, there are signs in which jobs are coming back, consumers are spending again, and the stock market is robust and giving investors good returns. But there are certain individuals who are calling for Chairman Powell to be replaced which actually could be more harm than good for the American economy and the financial markets. There are key reasons why Chairman Powell should stay and continue his role as the nation’s foremost banker.

Dealing with the financial implications of the Pandemic

As Fed chair, Jerome Powell has done the utmost to keep the United States economy afloat during the Covid-19 pandemic. The pandemic has done massive damage to the American economy in terms of businesses shutting down, in some cases either temporarily or permanently. This has resulted in tens of millions of workers losing their jobs, whether for months at a time or permanently laid off. This was a sudden shock to the economic system of the United States that no saw coming. On top of that lenders stopped lending to firms when they needed financial capital, even for the short term, in order to stay afloat so as to ride out the economic and financial crisis.

In order to help the American economy, the Fed acted quickly and on a massive scale. The Fed used strategies that had been implemented under Ben Bernanke during his tenure as Fed Chair during the Financial Crisis of 2008-2009: massive infusions of cash into the American economy along with drastic reductions in interest rates. The difference between the actions of Jerome Powell and Ben Bernanke is the time element. Under Bernanke, the Fed took a few years to inject immense sums of cash into the American economy in order to keep it afloat. Under Powell, the Fed put massive amounts of cash into the American financial system in a matter of a few weeks along with huge cuts in interest rates.

Under Powell, the Fed Board of Governors held unscheduled meetings resulting in interest rates being cut to zero percent in order to make borrowing cheaper and quicker for those who needed the cash for emergency reasons. Cheaper borrowing meant making cash more accessible to those who needed it in order to survive while also allowing it to keep flowing through the American economy.

Also under Jerome Powell, the Fed started purchasing huge amounts of both mortgage and government bonds so that the nation’s central bank was making a massive cash injection into the American economy when it needed it the most. From March 2020 through June, the Fed purchased $2.2 trillion in bonds when investors were liquidating Treasury securities and other assets for cash as soon as they could. This was vital because purchasing mortgage and government bonds was an action that would put money into the U.S. economy in a shorter period of time and more immediate impact that lowering interest rates could. Lowering interest rates was an important tactic by the Fed but it would take a few months or perhaps a year until it would have an impact on the macroeconomy and eventually trickle down to workers who lost their jobs. The immediate infusion of cash through a bond purchase program meant money could keep flowing through the American economy with little to no interruptions.

But the Fed also promised to purchase more government and mortgage securities as needed without any hesitation or even a cap in order to keep money coming into the U.S. economy and the system to keep moving from lenders, savers, and investors to users such as firms and borrowers. Once the system is cut off and money stops moving from one group to another, getting things to start up again is extremely difficult if not impossible. Also, this action by the Fed was a distinct and important sign to market participants, investors, lenders, and savers that they should have confidence that the American economy will continue to move along and thrive despite the uncertainty of the Covid-19 pandemic.

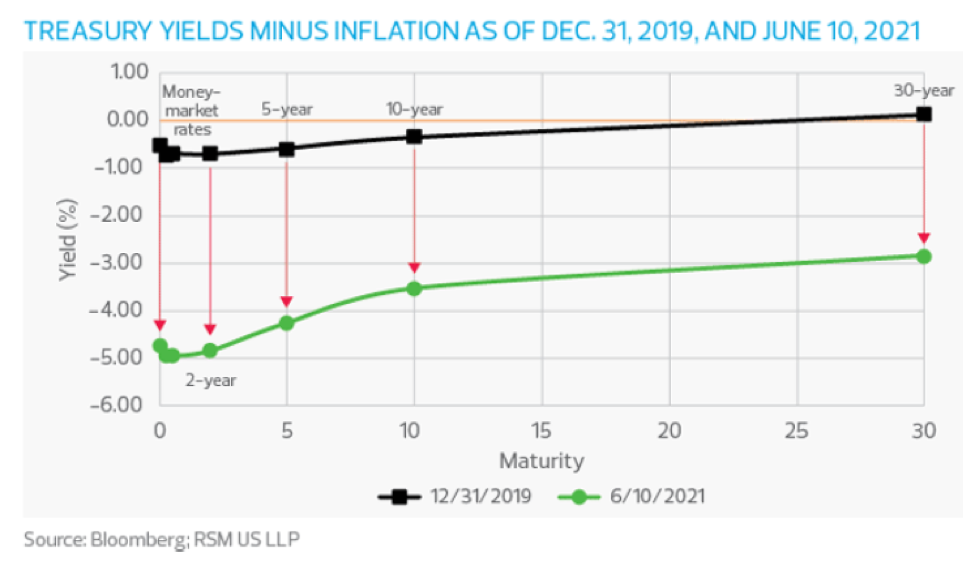

The Fed also showed to the markets, investors, and lenders that the massive infusion of cash through bond purchases and reducing interest rates does not mean sudden spikes in inflation. Yes, inflation is currently higher than normal but it is not a result of the Fed’s cash injection into the American economy. But rather because there has been pent up demand and that consumers are looking to spend again and therefore causing prices to spike in the short term. Inflation has not gone into double-digit territory as some analysts and economists feared. But it has gone into levels that Fed analysts expected and Powell feels could be dealt with through appropriate central bank actions. The Fed’s actions are based on monetary policy that has been used previously and has a proven track record.

“I give the Fed very high marks for its Covid response,” says Sonal Desai, chief investment officer of Franklin Templeton Fixed Income. “They’ve gone further than people thought was possible, quicker than people thought was possible.”

Powell’s actions as Fed Chair

There are other areas that the Fed has been focusing on. Under Jerome Powell, the Fed will stay with its concern regarding inflation but not if it means slowing down economic growth. As Chairman Powell told the House Financial Services Committee in February 2021, the Fed would still permit cheap money to flow until the Fed has made “substantial further progress” taming employment, which he predicted will “likely to take some time.”

Powell has made a significant change in how the Fed deals with the problem of inflation. The Fed would have a nominal target that inflation should hover around 2 percent. Very often the Fed treated the 2 percent mark as a cap or maximum limit. This could sometimes hurt the macroeconomy in not giving it enough room to expand or grow as it needed to. But under Jerome Powell, the Fed will have a target of an average inflation rate of 2 percent. This gives the American economy more freedom and flexibility since those periods of low inflation would be offset by other periods of higher inflation, allowing the target to be achieved over a longer period of time. This strategy seems to make more sense since it allows for economic growth and sees inflation as a result and byproduct of an expanding economy. The benefit of this is to have the macroeconomy grow and that the Fed will not be dogmatic in raising interest rates when a small sign of inflation is detected by economists and analysts. The Fed, under Powell, now holds that unemployment can be further reduced without causing undue inflation or create stock market bubbles. Here the Fed will now focus on job creation and full employment as its main goal.

Also, Jerome Powell has been his own man by putting the nation’s economic well-being ahead of politics. This can clearly be seen in his conflicts with the person who appointed him to the job as Fed Chair, Donald Trump. Trump was expecting complete loyalty from Powell as Fed Chair even if it meant putting policies into play that could hurt the American economy. When Powell first took over as Chair, the Fed was raising interest rates in 2018 which was done in response to tax cuts and an increase in government spending that the Fed was concerned would really hike up inflation. Powell felt his concerns were justified since the American economy was already in a healthy state and there were no signs of a pandemic or any financial crisis on the horizon. Powell was just worried that too much money was coming into the U.S. economy and causing prices to escalate to a dangerous level.

Donald Trump, however, saw the tax cuts and increase in government spending as a way to solidify his chances for re-election in 2020. With interest rates going up, Trump tweeted that Powell was a bigger threat to the United States than China’s President, Xi Jinping. Trump even advocated negative interest rates which are in direct conflict with Powell’s stand against them. “Powell at crucial moments proved he was not someone who could be pushed around by Trump,” said Ed Mills, Washington policy analyst at Raymond James. “It seemed as though Trump was more likely to try to find a way of firing Powell than to ever consider reappointing Powell.” The speculation was that if Trump won a second term, he would have not reappointed Powell in order to punish him for perceived disloyalty.

Powell Criticisms

Jerome Powell has come under some criticisms as Fed Chair. For example, Powell has been criticized for not doing more to regulate commercial banks regarding the situation of climate change. There are those who feel that the Fed should force member commercial banks to play a more prominent role in addressing the risk of climate change in their roles as lenders to businesses. Powell has stated that the Fed would severely hurt its political autonomy if it became involved in what he perceives as a very controversial topic and become a policy maker where even voters and legislators have not reached common ground.

There has been criticism from Republicans in Congress such as Senator Pat Toomey from Pennsylvania who has stated that the Fed’s accommodative policy has placed the central bank at the risk of being “behind the curve” when it needed to deal with inflation. As Senator Toomey has stated, “Past experience has shown it’s very difficult to get the inflation genie back in the bottle.”

Powell has also been criticized that the Fed has not done nearly enough regarding the disproportionate harmful economic and financial effects of the pandemic on racial minorities and low-income families. Some feel the Fed should do something to help minorities and low-income families the same way the Fed helped firms with financial capital during the worst of the pandemic.

Powell should be reappointed

While no Fed Chair has been perfect, Jerome Powell has made every effort to lead the nation’s central bank through a perilous time. In the short period he has been Fed Chair, he has managed to get the American economy back on its feet with an improving gross domestic product and jobs being created at a substantial rate. Powell realizes that inflation could create a serious problem for the nation’s economic and financial rebound and he is trying to tackle that situation. He probably also knows the delta variant of Covid-19 could get serious and cause more economic problems. On top of that, there could be other variants that could make things even more difficult in terms of economic recovery. There is only so much the Fed and its Chair can do in terms of reviving the nation’s economy. But at least Chairman Powell has been proactive in his actions and his policies reflect the concern he has for the nation’s economic wellbeing.

Jerome Powell should be reappointed in order to maintain continuity regarding monetary, economic, and financial policy and stability in the financial markets. A new Fed Chair would undergo a steep learning curve even if it is someone who has experience in serving on the Fed’s Board of Governors. Jerome Powell already has that experience and knowledge that is invaluable at a time like now.