By Marriyam Siddique

Abstract

China-Pakistan Economic Corridor (CPEC) is an inter-state multidimensional profit-seeking venture for Pakistan & China. This phenomenal project “…. is some four and a half times larger in total US economic aid to Pakistan since 9/11”. CPEC is a structural platform for Pakistan to foster its dilapidated economy, seriously hit by security threats, terrorism and corruption. China named it a “flagship project”, a paradigm of new diplomatic move by President Xi Jinping, under the tenet of new regional diplomacy after the “New Normal”. This paper seeks to address the following questions that ‘why did China initiate the CPEC in Pakistan? What were the domestic economic realities, which forced China to start this project? In order to answer these issues a combination of qualitative and quantitative methodology will be used. This paper seeks to address these issues in the interpretation of economic interests. After the financial crisis of 2008, China had a chance to rebalance its economy, so made a shift in its economic strategy and moved towards “New Normal” to transform the economy for sustainable growth. CPEC is a way or a tool of China for the practical implementation of China Dream. The construction of economic corridor will bring peace, affluence, richdom, weal etc. by securing economic ties on the basis of economic interests.

Introduction

China-Pakistan Economic Corridor (CPEC) is initiating an economic paradigm ultimately based on national interests. The first and the paramount element of the state is its national interest that helps in ligaturing with other state. According to an old apothegm “in international politics there is neither a permanent friend nor an enemy but national interest”. China and Pakistan are all weather friends for the last sixty years despite having the difference in their social and political systems due to the congruence of their national interests. In the past, states traditionally move their diplomatic assets to maintain peace, and now the modern diplomatic initiatives are for economic prosperity. This is a world where economic globalization is the most considerable phenomena that offers us varied possibilities. States rationally act to pursue their national interests and the logic of selfishness underwrites into collective interest. Most importantly states as an individual seek their economic interests as a prime principal mean to materialize their security.

The relations between Pakistan and China are based on every aspect of life whether it’s social, cultural, political, diplomatic or economic but the symbolism in the China-Pakistan Economic Corridor project is profound. With CPEC, China has become the largest investor in Pakistan. This corridor prompts a shift from classical geopolitics to critical geopolitical where in focus is on “rational regionalism” and strategic alternatives. Basically, CPEC a multi-billion mega-project is the paramount node of “One Belt One Road” (OBOR) initiative proposed by China in 2013. Being an inclusive node in OBOR, the CPEC represents an international extension of China’s effort to deliver security through economic development both in Pakistan and China at the same time. Security and economic prosperity runs parallel. The economic growth of Pakistan is not very considerable and the issues remain full of disparities. Through CPEC, investments in Pakistan are intended to create jobs, minimize anti-state sentiment and generate public resources for further improvements in law and order situation.

The Chinese land based Silk Road Economic Belt and sea based 21st century Maritime Silk Road is a strategy for win-win cooperation that promotes common development, connectivity and prosperity. Primarily advocates peace, trade-cooperation, friendship, openness, inclusiveness, and all-around exchanges. The Belt and Road runs through the continents of Asia, Europe and Africa, connecting the vibrant East Asia economic circle at one end and developed European circle at the other, and encompassing countries with huge potential for economic development.

The highly ambitious initiative is a global strategy of China to shape the global landscape and practical realization of the Chinese dream. The aim of the Chinese Dream is the great rejuvenation of the Chinese nation, achieving economic prosperity and shape the global landscape. The financial crisis of 2007-2008 hit the China’s economy hard, slowdown its economic growth so, consequently pushed China towards economic reforms. After the global financial crisis, growth in China’s economy had become too dependent on investment-led and exports.

The pragmatic attitude of China to reform its economy after the financial crisis of 2008 has lead towards the “New Normal”. Basically, New Normal is an economic policy to rebalance the Chinese economy from the high speed to more reasonable or sustainable path .The new economic strategy of China is primarily focused on domestic driven and transforming the economy into a more sustainable model, so that the economy can grow more rapidly and in a balanced form. As Wen Jiabao said, “To boost domestic demand is a long-term strategic policy for China’s economic growth and the way for us to tackle the financial crisis and stave off external risks”.

The fifth generation leaders of China primarily initiated such plans to boom the China’s economy like “New Normal”, “OBOR” and CPEC is one of the main components of OBOR. This paper is an attempt to answer the queries that why did China initiate the CPEC in Pakistan? What were the domestic realities of China to start this project? In sum paper argues that China has grown rapidly and became the second largest economy in the world yet it has all the regular features of a developing state with an unbalanced economy (based on export-led economy).

To make a practical implementation of the China Dream, China made a shift in its economic policy and moved towards “New Normal”. Simultaneously, to boom its economy especially the trade sector, which was disturbed after the global financial crisis of 2008, initiated OBOR, and CPEC are the main component of this strategy. The geographical attribute of Pakistan convinced China to start this multi-billion project with Pakistan. This paper would analytically elaborate the rationale of China behind CPEC though the main focus will be the Chinese economy after the global crisis of 2008, which forced China for these pragmatic initiatives. Categorically, this paper would undertake a process by breaking down the issue very systematically into different sections like Global financial crisis of 2007-2008, Chinese economy, New Normal, China Dream, and then the implications and fore deal of CPEC.

Global Financial Crisis of 2007-2008

The world economy faced its most serious recession in 2008 since the Great Depression of the 1930’s. The contagion was started in 2007 and the epicenter of the financial crisis was U.S when sky-high home income prices in the turned downward spread quickly, first to the entire U.S financial sector and then to financial markets overseas. (Havemann, 2008). The collapse of Lehman Brothers, a sprawling global bank, in September 2008 almost brought down the world’s financial system. The reason is, Banks were creating too much capital very rapidly and used this money to push up house prices and cogitate this money in the financial markets that’s why the world economies faced the financial depression.

According to the former chairman of the UK’s Financial Services Authority, Lord Turner, another description about the recession of 2007-2008 crises, “The financial crisis of 2007-2008 occurred because we failed to constrain the financial system’s creation of private credit and money.” (Money). In the depression phase, GDP was below and is still below in many rich countries, especially in Europe, where the financial crisis has changed into the Euro crisis. (Martin Neil Baily, 2008).

The effects of global financial crisis hit the economy of China hardly. The subsequent global recession made matters worse in the export sector, around 20 million workers lost their jobs in the export sector simultaneously damaged the GDP of China. Trade sector received a serious hit and it contracted, resulting in a negative contribution of net exports to China’s GDP growth in 2009.The government consumption remained strong and the credit goes to the Chinese government who performed proactive actions as well as advantageous preconditions. (Bulman, 2010, p. 21).

Apart from the government consumption, the household consumption fell and reached to only 35.3% in 2008. The dependence was on investment and export led growth model. Matters in China became serious in 2007, when China’s economy began to slow at the end of the year. Right after that, Chinese economists realized the serious need to reform the economy. In March 2007, at the National People’s Congress, Premier Wen Jiabao urged, “the biggest problem with China’s economy is that the growth is unstable, unbalanced, uncoordinated, and unsustainable”(Dunaway, 2007). Before the financial crisis of 2007, on the one hand the trade of China rapidly grew about 10 percent of GDP in the first half of 2007, up from 3 percent in 2004. On the other side, the gross investment share has also increased over the same period. The share of the investment reached to a record high of 43 percent of GDP and it was at 35 percent at the beginning of the decade. This is controversial as well as arguable, according to the judgments of the world economists because first time in 50 years they had seen something like it. (Anderson, 2007).

Normally, the sharp rising investment ratio causes the current account into deficit but China is an exception, because in China the rising investment ratio and high current account surplus have gone parallel. According to the definition, “if both ratios are increasing, then it must be that the domestic saving rate is rising even faster, which in turn implies that the domestic consumption share of GDP must be falling- and falling precipitously at that. The overall Chinese consumption spending has fallen from more than 60 percent of GDP at the beginning of the decade to about 50 percent today, with household consumption at a record low of 37 percent of GDP” (Anderson, 2007).

Chinese Economy

The above scenario clearly projected that the main culprit of the unbalance economy of china is the weak consumption. The economy of China has been become more dependent on investment and exports, and this model of economic growth is unsustainable. The investment ratio, current account and the domestic consumption of China are completely unbalanced. Now, there is an urgent need to sort out this issue by balance the domestic and external imbalances of China. The only driver, to boost the economy, is the consumer spending.

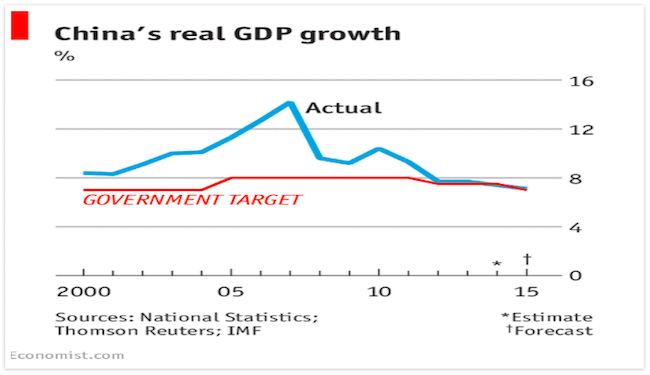

The financial crisis of 2008 has left behind three issues for the Asian nations, a sharp drop in trade and economic activity with the western nations and the biggest economies are facing the issue of new public and private debt. Simultaneously, China’s position with respect to the debt is vulnerable as well. Overall, its total debt was 168.48 trillion yuan ($25.6 trillion) at the end of 2015 and it is equivalent to 249 percent of GDP (Whalen, 2016). The range of the borrowers is varying from local governments to private enterprises. The economy of China is a command economy, where capital flows represented political priorities rather than commercial factors. The biggest issue of concern behind the China’s debt is the slowdown in economic growth. In the first half of 2012 growth of Chinese GDP decelerated to 7.8%, was 9.6% in 2011 and it will further slow at 6% over 2020-2030. The economic slowdown of China is a matter of concern for the rest of the world and is still the envy for most of the nations. The government of China has relatively calmed, only taking measured steps to stabilize growth (Huang, 2012).

The economic slowdown of the world’s second largest economy is basically a policy shift; the government has implemented a range of economic policy reforms to get China’s economy on the right track. This macroeconomic policy is called ‘New Normal’, basically, a rationale to settle the growth around its new potential. This new economic policy of China is clearly elaborated by President Xi Jinping at the Beijing APEC summit in 2014. So, what is New? As a terminology, “new normal” is not an official Chinese creation but this term is especially used by China as a new economic policy. The term “new normal” was first popularized by the California based fund giant Pacific Investment Management Co. to explain the below average growth right after the financial crisis of 2007-2008. So, what New Normal is? Basically new normal has several profound features, as mentioned by President Xi Jinping:

- The economy has shifted gear from the previous high speed to a medium-to-high speed growth.

- The economic structure is constantly improved and upgraded.

- The economy is increasingly driven by innovation instead of input and investment (Xinhuanet, 2014).

The Chinese economy does need a break from the old normal. As, President Xi’s repeated reference to the phrase indicates a recognition that three decades of almost uninterrupted double-digit growth came at a high price (Daojiong, 2015). China wants to pursue political liberalization and market reform but on a basic level, it was impossible for China that their growth rates of the past three decades, which averaged 10% a year, would wane (Economist, 2015).The rule in economics, law with respect to large numbers (financial, rather than statistical) applies to the companies as well as to the nations: the bigger the economy gains, it is hard for the economy to keep growing at a fast clip. The new growth rate of China 7% would generate more additional output than a 14% pace did in 2007. “Structurally, China’s economy faces headwinds. In the long run, growth is a function of changes in labor, capital and productivity. When all three increase, as they did in China for many years, growth rates are superlative but they are slowing now” (Economist, 2015).

Every Action by Chinese authorities to rebalance the economy upsets and create anxiety among investors, consumers, and leaders worldwide because in the past China has become an engine of global economic growth. Now the economic slowdown of the world’s second largest economy in the world will automatically assure negative spillover to other nations. Chinese officials consider this slowdown a positive aspect and it will prove a new hallmark on the basis of these reasons:

1: China’s Demographics are restructured; in the past, the one child policy of China has decreased the productive workers in the labor class. Now, the two-child policy would automatically increase the daily consumption. Moreover, due to the income shortcomings, parents would have no choice except to work harder and earn as much as they can, just to invest more in the bright future of their now larger families.

2: Rebalancing is accelerating; the reason behind the economic slowdown is the unsustainable growth, which means this model allow foreign capital to enter, enhance domestic investment, and bridge the gap between domestic investment and consumption through exports. Now older industries are declining due to the sharp drift in the export sector, new business are vigorously developing like mature high-tech sector and potentially helping China to gain its global confidence.

3: The Yuan is now an IMF elite currency; in October 2016 Yuan will join the Special Drawing Rights (SDR) basket. This is a very progressive step for China because after this inclusion, China may facilitate to gain higher currency demand from the global economy. When the demand of Yuan will increase then it reduce China’s reliance on export of manufacturing goods and refocus its economy towards the service sector. Moreover, the Yuan’s inclusion to SDR will also demand from China to further liberalize its financial sector and open up new investment areas despite the traditional ones of manufacturing and real estate.

4: Financial reforms is on the way; China for a long while maintained a firm peg of the Renminbi against US dollar. In the mid of 2015, China loosened its peg and shocked the financial world. By loosening its currency they are allowing the stakeholders of global financial markets to determine its currency. They have reduced the level of intervention in its currency. Now China is managing the currency fluctuations to provide room for new markets to behave rationally and to avoid unexpected actions. This policy of China will allow it to be more competitive with the rising market economies.

5: China is simply too big to fail; for more than 30 years, it has been a primary engine of global growth, simultaneously a source of cheap labor and profound stakeholder for Foreign Direct Investment worldwide. World leaders are very much cautious with respect to China’s economy. However, predicting the future of China that it will collapse is far too premature and insensitive, especially considering that its growth is still above average for rising market economies (Michelini, 2016).

So, do we really need to worry about a Chinese economic slowdown? The answer should be probably not, Paul Krugman, a famous American based economist believe on the slowdown of China that it is worrisome but the economy of China is more complicated to predict any outcomes. In the past fifteen years, China has grown mainly by adding physical capital in the economy, now it’s the time to grow by using its capital more systematically and efficiently. (Naughton, 2013). The entire world economy understand this lesson, after the bankruptcy of Lehman brothers in 2008, that entire world economy requires stable collateral and payments to operate. The 12th Five Year Plan of China is clearly focused on transforming the economy through structural reforms. The entire plan is based on the sustainable model, so that the state can grow very well for another 30 years (Yueh, 2012).

A vision of inclusion: The Chinese Dream

The 18th party Congress formalized the entry of the fifth generation of Chinese leaders. The fifth generation leader, Xi Jinping began to indicate innovations in foreign policy approach of China and coined the new phrase “Chinese Dream” after the economic policy of “New Normal”. Basically new normal is one of the tools of China’s new economic policy to accomplish China Dream. The notion of “Chinese Dream” can be understood as a new guiding principle of China’s own development and how China relates to the rest of the world. In November 2012, President Xi Jinping articulated a vision for the Chinese nation’s future which he proclaimed the “China’s Dream”. The notion of the Chinese Dream presented on his visit to “The Road towards Renewal” exhibition at the National Museum of China (USA C. d., 2014). The Chinese dream meant for him the “great renewal of the Chinese nation”. The great rejuvenation of the Chinese nation “is a dream of the whole nation, as well as of every individual”.

The architecture of the vision, President Xi Jinping clearly elaborated the China Dream in March of 2013 in his speech at the closing ceremony of the First Session of the 12th National People’s Congress. “Xi accented that the Chinese Dream means the great rejuvenation of the Chinese nation. It embodies achieving prosperity for the country, renewal of the nation and happiness for the citizens, only when the country is doing well, can the nation and people do well.” (USA C. d., 2014). President Xi Jinping, further elaborated that “the Chinese Dream in essence means the dream of the people. The Chinese Dream is to let people enjoy better education, more stable employment, higher incomes, a great degree of social security, better medical and health care, improved housing conditions and a better environment. It is to let our children grow up well, have satisfactory jobs and live better lives” (USA C. d., 2014).

Xi also stressed “the Chinese Dream is a dream for peace, development, cooperation and mutual benefit for all. It is connected to the beautiful dreams of the people in other countries. The Chinese Dream will not only benefit the Chinese people, but also people of all countries in the world. The “national Chinese Dream” is a big dream for the Chinese nation: “History tells us that everybody has one’s future and destiny closely connected to those of the country and nation” (USA C. d., 2014).

The China dream is a personal dream of every individual of the nation. It is very much related with the heart of every native of the China. For instance the “personal Chinese Dream” is a dream, which focuses on the wellbeing of every citizen of China. And further it will modify the traditional notions of the primacy of the collective over the individual. President Xi proposed taxonomy of five dimensions from which to analyze the concept:

- National

- Personal

- Historical

- Global

- Antithetical

Dreams are powerful. The profound aspect of China dream is its insight vision. For the advancement of the China Dream, the government is uniting the people around a shared mission and provoking them for change. The special focus is on the people who are from lower-tier cities and rural areas just to provide better opportunities and increased affluence.

On the global level, the China Dream will improve the image of China as a fast-growing nation who is striving to enhance and improve the welfare or wellbeing of its people and secure its image as an honorable leader of the International community. In addition, externally, it will upgrade the global perception about the Chinese products and services from “Made of China” to “Brand of China”. It will collaborate to glorify the national identity of the Chinese Civilization.

Martin Jacques, a visiting senior fellow with the London School of Economics and Political Science urged in 2013 at the two-day dialogue in Shanghai, “The Chinese Dream will change the global landscape, which was shaped by Western countries over the past two centuries during industrialization”. Further he elaborated his remarks, “It is a good thing for the Chinese Dream to integrate with the world”, which will be established through international rules and experiences of both developed and emerging countries.

CPEC, a Symbolic Project

Economic corridors connect economic agents along a defined geography (Brunner, 2013) similarly CPEC, Pakistan and China share a common border with a length of 523 kilometers. The relationship between Pakistan and china is based on the geo-strategic and geo-economic calculations. Pakistan is a junction of south Asia, west Asia and central Asia: a track from resource efficient states to resource deficient states. The geo-graphical attributes of Pakistan interplay a decisive role that states cannot ignore while formulating their geo-economic policies.

“It (Geography) is the mother of all strategies” Colin S.Gray

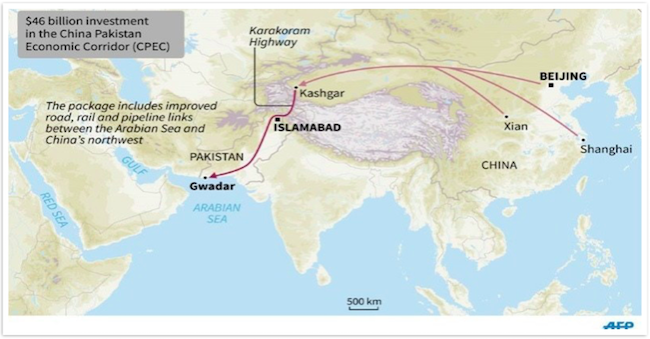

The construction of China-Pakistan Economic Corridor (CPEC) announced by President Xi Jinping during his visit to Pakistan in April 2015 where official dignitaries from both states signed 51 Memorandum of Understanding (MoUs) relating to distinct aspects of bilateral relations, including the Pakistan-China Economic Corridor, after that this project gained momentum in the world. Some of the projects are already in a process like highways and energy projects, which would be completed by the end of 2016. Apparently it is a 3,000-km network of roads, railways and pipelines linking Kashgar in northwest China’s Xinjiang Uygur autonomous region and Southwest Pakistan’s Gwadar Port (China Daily, 2015). So far, the planned Chinese investment for this project is $46bn, which is some four and a half times more than the total US economic aid to Pakistan since 9/11 (though admittedly largely in the form of low-interest loans) (Lieven, 2015).

One Belt One Road (OBOR) Map

CPEC development falls under the mega Chinese stance of regional economic connectivity, the great “One Belt, One Road (OBOR) initiative, outlined by China’s National Development and Reform Committee (NDRC). OBOR consists of a continental Eurasian “Silk Road Economic Belt” and a Southeast Asian “Maritime Silk Road” and Pakistan has the potential to cover both these routes due to its geographical location. That’s why China called CPEC a “flagship project”.

Though, CPEC is an inter-state agreement but it will greatly contribute ensuring Regional Connectivity. Due to its geographical position in Asia, China will make Pakistan a logistic hub to connect Africa, Europe, India and Middle East with western China and central Asia. This regional connectivity through CPEC will boom the economic activity greatly around the region. As per China’s assurance this interconnectedness will bring prosperity in the states economies by making trade easiest.

The net worth of sea-borne trade of China is over US$ 5 trillion. All the sea-borne trade of China passes through the South China Sea where the straits of Malacca are the source of bottleneck. Right after this corridor, sea-borne trade of China would pass through Gwadar Port by adopting the land route, which access into western china. Such connectivity will give a unique paradigm in China’s global trade and provide the safe route to reach to the Arabian Sea.

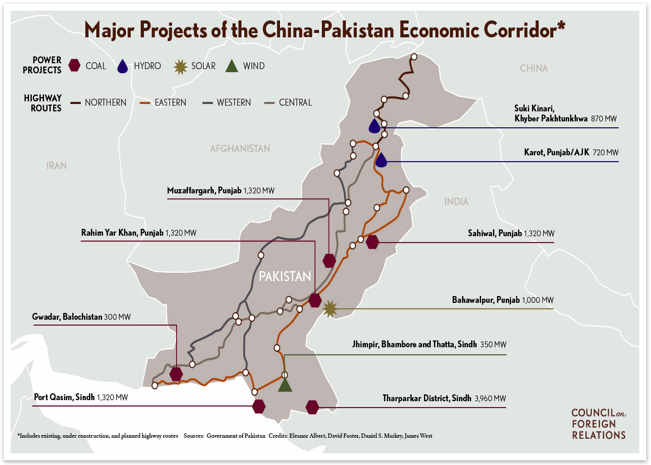

The projects of CPEC in Pakistan are being managed by the Ministry of Planning and Development with the collaboration of China’s National Development and Reform Committee (NDRC). Both of these institutions made a joint Cooperation Committee, which is working on the four main areas: the Gwadar port, transport infrastructure, energy, and industrial cooperation. Gwadar port is one of them that are under construction.

The virtual “corridor” of the CPEC is based on the interconnected highways, railways and energy pipeline system. According to Pakistan’s government, there are “three highway routes for the project: a western route through Baluchistan and Khyber Pakhtunkhwa provinces; an eastern route primarily through Sindh and Punjab provinces; and a central route crisscrossing the country. A northern highway route connects to Kashgar, via the Karakoram Highway, itself a major symbol of China-Pakistan cooperation and their only linkage” (Daniel S. Markey, 2016).

With respect to railways, more than 1,200 kilometers of new track will be setup and upgrading of another 3,100 kilometers. The major share of Chinese investment will move towards energy sector projects, including coal, solar, hydroelectric, liquefied natural gas, and power transmission. Almost twenty-one new projects will produce around 17,000 megawatts of energy if all goes according to the plan. Those of twenty-one projects, the government of Pakistan expects fourteen “early harvest” projects to add 10,400 megawatts to the national grid by 2018 (Daniel S. Markey, 2016).

Trade activity is a concerned phenomenon for states. It is primarily related to buying and selling of goods and services on the basis of mutual skills and special training. CPEC will give an unprecedented sharp of trade in between Pakistan and China. Moreover, 27 Special Economic Zones (SEZs) would be set up across the country under the CPEC. These SEZs would be the source of industrial and agriculture production in Pakistan.

Conclusion

National Interests shape the possibilities of states to behave collectively and provide immediate context to change their identities. The China-Pakistan input to create a regional commons by means of CPEC is an epitome of strategic cooperation. The strategy would definitely prove a fate changer for the both ends of CPEC i.e. Balochistan (Pakistan) and Xinjiang (China) because these areas are least developed and have apparent volatile circumstances. The timing of the economic corridor is very appropriate because Pakistan facing hostile environment led by instability due to sectarianism, terrorism, and most prominently by weak economic indicators and bad governance led by corruption. The reality cannot be nullified that the cooperation of Pakistan and China can interplay a decisive role in shaping the region into a harmonious region, which would be the practical implementation of the China Dream. The initiative of CPEC will provide South Asia a regional connectivity, which is the least integrated region in the world; meanwhile, ties would pave a way towards revitalization of “One Belt -One Road”.

Bibliography

- USA, C. d. (2014, 03 26). Background: Connotations of Chinese Dream. Retrieved from China Daily USA: http://www.chinadaily.com.cn/china/2014npcandcppcc/2014-03/05/content_17324203.htm

- USA, C. D. (2015, August 19). China-Pakistan Economic Corridor gains momentum in Pakistan. Retrieved from China Daily USA: http://usa.chinadaily.com.cn/world/2015-08/19/content_21649724.htm

- Whalen, C. (2016, june 19). Xi struggles to reform China’s Politics-and its Economy, too. Retrieved from National Interest: http://nationalinterest.org/feature/xi-struggles-reform-chinas-politics%E2%80%94-its-economy-too-16632

- Xinhuanet. (2014, 11 9). Xi’s “new normal” theory. Retrieved from http://news.xinhuanet.com/english/china/2014-11/09/c_133776839.htm

- Yueh, L. (2012, June 1). China’s strategy towards the financial crisis and economic reform. Retrieved from http://www.lse.ac.uk/IDEAS/publications/reports/pdf/SR012/yueh.pdf

- Anderson, J. (2007, september). Solving China’s Rebalancing Puzzle. Retrieved from International Monetary Fund: http://www.imf.org/external/pubs/ft/fandd/2007/09/anderson.htm

- Bulman, D. J. (2010, Summer). China and the financial crisis. Retrieved from https://web.stanford.edu/group/sjeaa/journal102/10-2_03%20China-Bulman.pdf

- Brunner, H.-P. (2013, August). What is Economic Corridor Development and what it achieve in Asia’s subregions. ADB working paper series on Regional economic integration.

- Economist, T. (2015, march 11). Why China’s Economy is slowing. Retrieved from The Economist: http://www.economist.com/blogs/economist-explains/2015/03/economist-explains-8

- Dunaway, J. A. (2007, September). China’s Rebalancing Act. Retrieved from International Monetary Fund: http://www.imf.org/external/pubs/ft/fandd/2007/09/aziz.htm

- Daniel S. Markey, J. W. (2016, May 12). Behind China’s Gambit in Pakistan. Retrieved from Council on Foreign Relations: http://www.cfr.org/pakistan/behind-chinas-gambit-pakistan/p37855

- Daojiong, Z. (2015). Chinese Economic Diplomacy: New Initiatives. S. Rajaratnam School of International Studies (RSIS), Nanyang Technological University (NTU).

- Huang, Y. (2012, October 14). The ‘new normal’ of chinese growth. Retrieved from East Asia Forum: http://www.eastasiaforum.org/2012/10/14/the-new-normal-of-chinese-growth/

- Havemann, J. (2008). The Financial Crisis of 2008: Year in Review 2008.

- Lieven, A. (2015, 11 16). The China-Pakistan corridor: A fate changer? Retrieved from Al Jazeera: http://www.aljazeera.com/%20indepth/opinion/2015/11/china-pakistan-corridor-fate-changer-151111080012375.html

- Naughton, B. (2013, July 24). Do we need to worry about a Chinese economic slowdown ? Retrieved from The Atlantic: http://www.theatlantic.com/china/archive/2013/07/do-we-need-to-worry-about-a-chinese-economic-slowdown/278080/

- Martin Neil Baily, R. E. (2008, November). The Origins of the Financial Crisis. Initiative on Business and Public Policy at Brookings .

- Michelini, M. (2016, May 2). 5 Reasons Why the Worst of China’s Economic Slowdown Might be Over. Retrieved from News Max: http://www.newsmax.com/Finance/MichaelMichelini/china-economy-slowdown-invest/2016/05/02/id/726689/

- Money, P. (n.d.). Finacial Criss and Recessions. Retrieved from Positive Money: http://positivemoney.org/issues/recessions-crisis/

Marriyam Siddique is a PhD candidate in International Relations at School of International & Public Affairs (SIPA), Jilin University China.