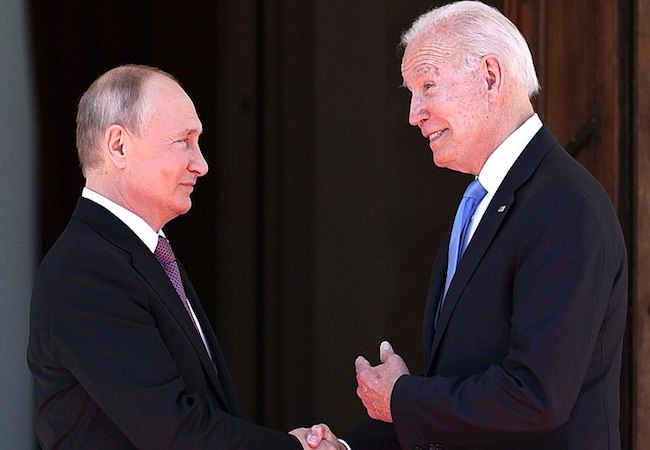

Joe Biden’s harsh statements about Russia (“Putin is a murderer”), the withdrawal of ambassadors from both countries and the veiled threat from the US to implement new sanctions against Russia symbolized the high point of the so-called Cold War 2.0. However, the Geneva Summit between Biden and Putin laid the foundations for a new global geopolitical architecture that will be embodied with the implementation of the G2 (USA and Russia) that will try to isolate China economically and militarily, condemning the Union to ostracism. Europe and the BRICS countries that will be mere comparsas in the new geopolitical Order that is being developed.

Geopolitical earthquake in Europe

The strategic agreement between Australia, the United Kingdom and the United States known as AUKUS, involves the sale of North American nuclear-powered submarines to Australia at the same time as an economic failure for France estimated at 50,000 million euros. Thus, the unilateral rupture by the Australian Government of a mega-contract with France for 12 conventional submarines, would have provoked the anger of the French Government and the call for consultations of its ambassadors in Washington and Canberra, which together with the possible stoppage of the sale of Rafaele fighter jets to India, could provoke the disaffection of France towards the “once American partner” and could translate into the exit of France from NATO structures.

On the other hand, we witness some surprising statements by the former British Foreign Minister, Philip Hammond collected by the newspaper “The Telegrah” in which he affirms that “London could host US nuclear missiles on British soil amid tensions with Russia”, what could be understood as the return to an arms race like the one maintained during the Cold War with the USSR (reviving the Partnership project between the USA and Europe to supply the United Kingdom with Polaris missiles of July 1962). On the other hand, after “the stab in the back” that the signing of the AUKUS agreement has meant for France, Macron will take advantage of the EU Presidency that begins in January 2022 to promote the initiative of the European Defense Agency, a defensive entity which will mean cutting the umbilical cord with the United States, which NATO represented and which will be made up of the countries of the original area of influence of the Franco-German Axis (Holland, Denmark, Norway, Belgium, Luxembourg and Italy), as a result of the reaffirmation of sovereignty French and German nationals as a defensive strategy against the drift of the once “American partner” and which will translate into a rapprochement with Russia and the suspension of the sanctions imposed by the European Union.

On the other hand, the Russian-German coalition of interests devised the Nord Stream project that connects Russia with Germany through the Baltic Sea, with a maximum transport capacity of 55,000 million cubic meters (bcm) of gas per year and with a validity of 50 years, a vital route for Germany and the Nordic countries, which is why it was declared of “European interest” by the European Parliament and crucial for Russian energy geostrategy. Thus, Russia will achieve the double geostrategic objective of ensuring an uninterrupted flow of gas to Europe by two alternative routes, turning Poland and Ukraine into energy islands and leaving the countries of the “European fracking arc” (Poland, Czech Republic, Slovakia and Hungary, Ukraine, Romania and Bulgaria) under the US orbit and exposed to new gas wars.

Regarding Ukraine, Biden would have promised Putin that said country “will not enter NATO” and that the Ukrainian dispute will be outlined with the division of Ukraine into two almost symmetrical halves separated by the 32nd meridian East, leaving the South and East of the country (including Crimea and the Sea of Azov) under Russian orbit while the Center and West of present-day Ukraine will sail in the wake of the EU. Regarding Syria, the agreement between Biden and Putin would include the acceptance by the US of the Assad regime and the reinforcement of the Russian presence in that country after the modernization of the Tartus naval base with the aim of resuscitating the extinct Mediterranean Fleet, (dissolved in 1992 after the extinction of the USSR) complemented by the Jableh military base in northwestern Syria, much more sophisticated than the previous one, with which Putin will control maritime traffic through the Eastern Mediterranean.

Doctrine of Containment against China

The strategic agreement between Australia, the United Kingdom and the United States known as AUKUS would symbolize a change in the world geopolitical cartography by displacing the Atlantic scene through the Indo-Pacific as the epicenter of the geopolitical pulse between the United States and China with the aim of establishing an arc of nuclear crisis around China that would span from Indian Kashmir to Japan, passing through South Korea, Singapore, Vietnam, Thailand and the Philippines and closing the arc with New Zealand and Australia to dissuade China from its adventure of dominating the China Sea. This would symbolize the creation of the new economic and military alternative to Obama’s failed project to create a Trans-Pacific Partnership (TPP) and the leitmotif of such an enveloping maneuver by the US would be to apply the Doctrine of Containment against China. The bases of this doctrine were exposed by George F. Kennan in his essay “The Sources of Soviet Behavior” published in Foreign Affairs magazine in 1947 and whose main ideas are summarized in the quote “Soviet power is impervious to the logic of reason but very sensitive to the logic of force ”, which will have as a collateral effect the increase of the nuclear race in China that by mimicry will extend to the geographic space that extends from Israel to North Korea (including countries such as Iran, Pakistan, India and China).

This enveloping maneuver would be complemented with the US attempt to dry up China’s energy sources, for which Putin’s collaboration seems fundamental, since China suffers from a severe Russian energy dependence that makes it highly vulnerable. Thus, Russia and China sealed a stratospheric oil contract that becomes one of the largest in the history of the energy industry by which the Russian company Rosneft, (the largest oil company in the country), will supply oil to the Asian giant for 25 years for value of 270,000 million dollars (about 205,000 million euros). This, together with the gas mega-contract signed by the Russian Gazprom and the Chinese CNPC by which Russia will supply the Asian country with 38,000 million cubic meters of natural gas for an approximate amount of $ 400,000 million and with a term of 30 years through the Sila Sibiri gas pipeline (The Siberian Force), which laid the economic foundations of the Eurasian Union that began its journey on January 1, 2015 as an economic and military alternative to the United States but could have its days numbered before the new secret agreement of Biden and Putin.