By Arthur S. Guarino

The economic superpowers of the United States and China have entered into a significant trade war. Each nation has its own agenda in order to promote its economic plan. Even if it means tariffs and retaliatory tariffs that will harm their respective economies and possibly stun the growth of their gross domestic product (GDP). But in order to understand why these leading economic superpowers are at loggerheads, it is necessary to know the reasons why.

Reasons for the United States – China Trade War

The reasons for the United States – China trade wars are numerous and somewhat complicated, but they are responsible for these nations engaging in a serious economic conflict.

Trade deficit increase

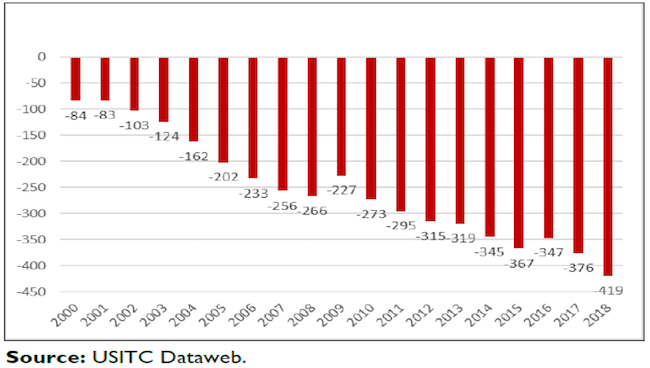

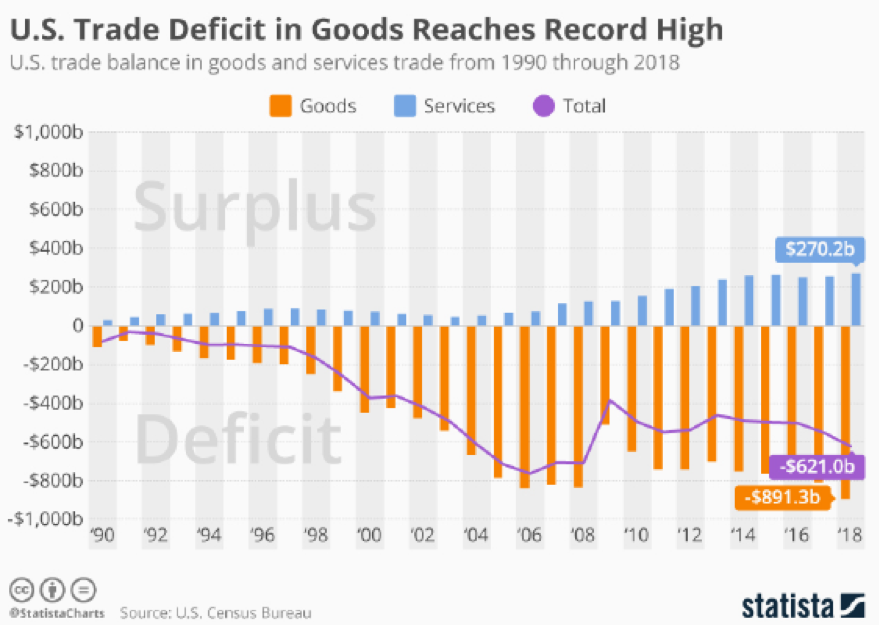

The trade deficit between the United States and China has been increasing every year since the early 1980’s. The United States’ merchandisetrade deficit with China went from $83 billion in 2001 to $376 billion in 2017. This represents an annualized increase of 21 percent. Due to the growing American economy, more Chinese goods are sold in the U.S. market. Along with the low cost of Chinese goods and the strong American dollar, the trade deficit will more than likely continue to increase despite tariffs on imports. As the Chinese make the change from manufacturing exports to technology development and sales to other nations, the trade deficit with the United States could actually increase even more than an annualized 21 percent.

Differing ideologies

The United States and China have divergent views regarding their economic and political philosophies. The United States believes in a high degree of openness that encourages competitiveness, creativity, prosperity, and individualism. China is more concerned about setting a national economic agenda that will grow its macroeconomy at a rapid pace so that it can catch up to and surpass the United States as the leading world economic superpower. While the United States pushes the concept of open and free markets that espouses the ideas of innovation and uniqueness, China looks to controlling its economy from its commercial banks to its money markets to its manufacturing infrastructure. China’s leadership believes that market forces can be problematic and that the state must play a direct and controlling role in the economic growth of its macroeconomy. China’s leadership believes in having a controlled economy, while American policymakers believe in a hands-off approach. While each philosophy has its long and short-term consequences, they are now playing a key role in the trade war the two nations are currently engaged in.

Limit China’s state-led economic model

The United States is very concerned about China’s state-led economic model since this could be a long-term benefit to bolstering the Chinese economy. The state-led economic model is focused on bolstering diverse industries within China even if some are losing money in the short-term. China is willing to subsidize many industries and companies as long as they will help bolster the macroeconomy in the long-run while also creating new jobs. While American policymakers want to see new industries pop up in order to increase GDP, they want job creation to be the primary focus of American-based companies. China is taking a long-term view by educating more engineers, scientists, and technicians so that it can lead the way globally for such areas as electric cars, artificial intelligence (AI), and robotics. But this is being done by the policies, actions, and financial capital coming from the Chinese central government. The Trump Administration sees this as a threat to American economic superiority as opposed to investing more financial and human capital into high-tech investments.

Investment restrictions

China has had restrictions on foreign investments for many years as part of its state-led economic model. As part of its long history, China has been quite restrictive in investments by companies from other countries. This has brought resentment not only by the United States but counties in Europe and by Japan. In order for China to be a leading player in global trade and international business, it must make the difficult decision of allowing more international companies to invest in China with minimal to no restrictions. This means American and European companies can open plants and facilities in China without the worry of surrendering their technological know-how. This also means allowing more joint ventures with American and European companies without the fear of losing intellectual property as part of the relationship. This will be difficult for China to accomplish, but a major concession if they wish to have more companies establish plants, facilities, and share knowledge in the future.

Made in China 2025

If there is one main concern that American policymakers have it is the aggressive goal by China to advance in a short time its development of technology so that it can shift away from manufacturing. China feels it must play serious catch-up to nations such as Japan, Germany, and the United States in the field of advanced technology in order to be considered a major player on the world economic stage. China has instituted a strategy called “Made in China 2025” in which it is investing billions of dollars in key areas such as robotics, AI, solar power, and clean-energy vehicles. China is working feverishly to lessen its reliance on foreign imports of advanced technology and actually become a leader and innovator in which other nations, such as Japan, Germany, and the United States, will purchase high-tech products and services from them. Made in China 2025 was initiated during the 2015 National People’s Congress with the goal of fostering 10 core industries dealing with advanced technology, aerospace, and biotech. The plan also calls for achieving a target rate of 70 percent supply of parts and components to be produced in China. American policymakers are concerned because they know the Chinese have the determination, financial and human capital, and subsidies in place to develop and encourage Chinese companies that are ready to make the leap into the field of advanced technology. American policymakers want that China reduce its subsidies and eliminate technology transfer requirements, while also eliminating intellectual property theft by enforcing strict protection rules and regulations. China must make some difficult decisions in order to have their strategy become a success or else face serious backlash from Europe, Japan, and the United States in the area of advanced technology trade.

Both sides remain adamant

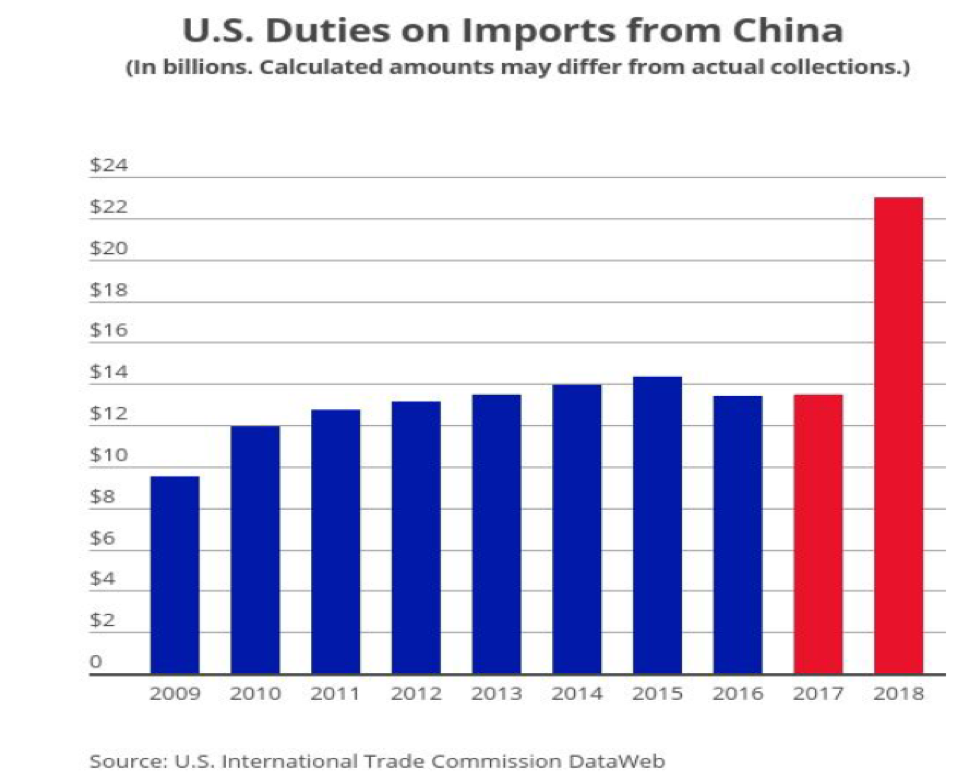

With the imposition of tariffs and retaliatory tariffs by both sides, the Americans and Chinese are adamant in their stands. The Trump Administration, led by National Trade Council Director Peter Navarro, United States Trade Representative Robert Lighthizer, Commerce Secretary Wilbur Ross, and President Trump, are trying to fulfill promises made during the 2016 presidential campaign of a better trade relationship with China. But the question is: At what price?

Companies such as Kohl’s, Wal-Mart, JC Penney, and Home Depot are stating that sales and profits are down significantly due to the trade war and who knows which will still be in business one year from now due to the conflict. China is unlikely to change its course for their long-term economic development and will keep plans such as Made in China 2025 in place. China has made trade agreements with many countries in Europe, Africa, and Asia even if it engages in a long and costly trade war with the United States. Chinese President Xi Jinping has stated that, “No one is in a position to dictate to the Chinese people what should or should not be done.” But this could come at the cost of a reduction in China’s GDP in 2019 and possibly 2020 and a severe loss of jobs for the Chinese people. Then the question is: Could this lead to political instability in China?