The Fed’s response to COVID-19

The United States is in a recession that promises to be of epic proportions. In response to this economic crisis, The Federal Reserve Bank is taking unique and different actions it deems necessary to keep money flowing throughout the American financial system.

The United States is currently in a recession rooted in the Covid 19 pandemic. At last count, approximately 40 million Americans are out of work and the nation’s Gross Domestic Product (GDP) has dropped 5% in the most recent quarter. Policymakers and economists realize that the American economy is in real trouble and it is unclear how long this economic crisis will last.

Decades ago, the Federal Reserve Bank was given the job of being the steward of the American economy. In dealing with this crisis, the Federal Reserve Bank is using different methods in order to rescue the American economy. But the real question is: Will these methods will work and are they enough?

Actions by the Fed

Federal Reserve Chair Jerome Powell realizes the deep hole the American economy is in and is implementing various programs in order to rescue it. The Chairman’s job is extremely difficult and there is no guarantee that the implementation of these programs will work right away or even be effective. Among the actions the Fed is taking includes:

Policy rate cuts: The fastest method that the Fed has available is through the Federal Open Market Committee (FOMC), the key monetary policy making body of the Fed, in March 2020 when it lowered the federal funds target range 150 basis points to 0% to 0.25%. The premise here is to lower the interest rates for short term funds transfers between financial institutions, such as Fed member banks, that are usually for a period of one day. In other words, the fed funds program allows member banks of the Federal Reserve System to borrow from one another on an overnight basis. By having the fed funds rate go to 0 or near zero percent, this allows member banks to more easily borrow money at much cheaper rates. The aim and purpose of the fed funds rate is making money not only cheaper but also more liquid and allow it to move faster through the banking system and eventually the American economy.

The amazing part is that the FOMC cut rates so fast in response to the Covid 19 emergency. On March 3rd, the FOMC reduced the target range by 50 basis points and on March 15th further lowered the rate by an additional 100 basis points. In other words, the Fed reduced the fed funds rate on March 3rd from a range of 1.5% to 1.75% to a range of 1% to 1.25% in order to allow cheaper money rates to make it easier to borrow. On March 15th, the Fed lowered the range to 0% to 0.25%. This far this fast was a drastic emergency move by the Fed in response to a severe crisis.

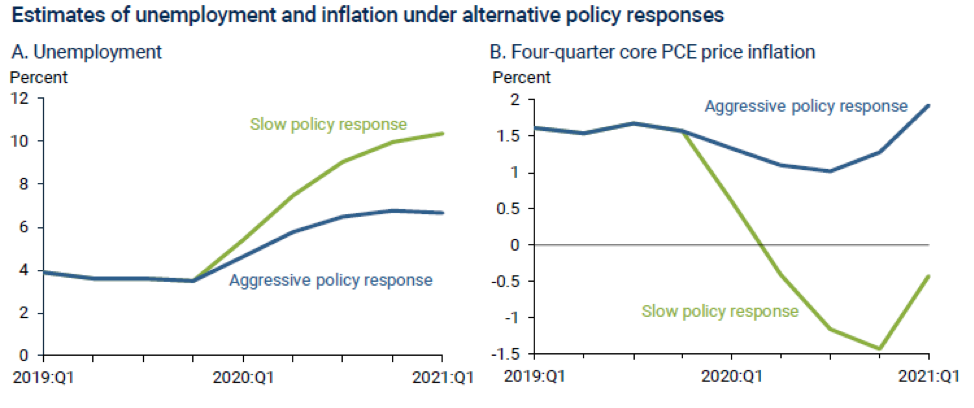

Lowering these rates helped to reduce interest rates on a broader scope for business and personal borrowing, put more money into circulation in the American economy, and hopefully spur on spending by companies and average consumers. The Fed learned valuable lessons from the Financial Crisis of 2008-2009 by lowering the fed funds rate at a faster pace. In the Financial Crisis, the fed funds rate was 5¼% in mid-2007. However, it was not until December 2008 that the fed funds target rate was lowered to zero lower bound. The tactic by the Fed was to take immediate action since the very real possibility that the American economy could sink faster and deeper than what happened in the Financial Crisis of 2008-2009.

The Fed has also used forward guidance, a policy tool implemented during the Financial Crisis and the Great Recession of 2008-2009, in which it gives an idea to the general public, businesses, and the markets on the future road of its key interest rates. The Fed has clearly stated that interest rates will stay on the low side “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” This ultimately means that not only will the fed funds rate stay low but also longer-term rates.

Asset Purchase Programs: The goal in this policy objective is to purchase diverse financial instruments in order to put more money into mass circulation in the American economy. This was implemented in the Financial Crisis of 2008-2009, but the unique move by the Fed has been an open-ended purchase program. This involves purchases by the Fed of Treasury securities and agency mortgage-backed securities (MBS).

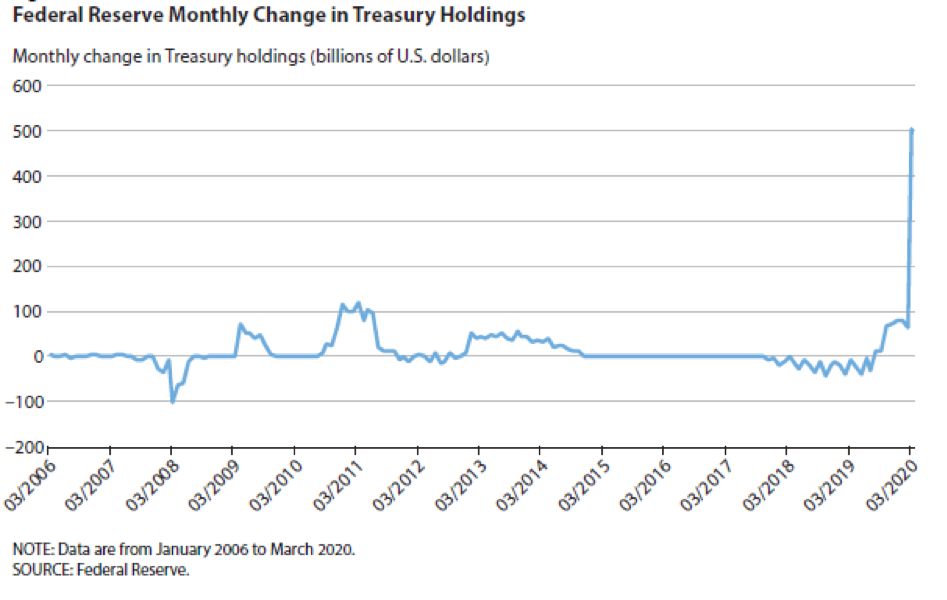

The objective here is to make substantially more money available to commercial banks and other financial institutions so they ultimately make the funds available to businesses and consumers. The purchase of Treasury securities reached a peak of $75 billion in late March 2020 and has gone to a rate of $51 billion per day. This rate far surpasses and comes at a quicker rate than the peak of $120 billion on a monthly basis during the Financial Crisis of 2008-2009. The Fed is buying more assets in the form of securities and at a much faster rate than ever before. Even though this has caused the Fed’s balance sheet to increase substantially ($2.9 trillion in less than three months) and reverse direction from its earlier policy goal of getting rid of diverse assets, the idea is to put more money into circulation at a time when those funds are desperately needed. Other central banks, such as the Bank of Japan, the European Central Bank, and the Bank of England have made similar moves in response to the Covid 19 pandemic.

The Fed is trying to covert financial instruments into cash as soon as possible. During the Financial Crisis, the Fed purchased $600 billion in Treasury securities over several months in 2010. However, in March 2020 the Fed purchased approximately $543 billion worth of Treasury securities in one week. The incredible part of this situation is that in 2007, the Fed had a balance sheet that was approximately 6 percent of the size the U.S. macroeconomy. Yet, by the end of 2020, the Fed’s balance sheet will probably be 40 percent of the nation’s economy. The purchase of these assets means the Fed will most likely increase its balance sheet to levels far above the heights seen during the Financial Crisis of 2008-2009.

In essence, the Fed is repeating its strategy of quantitative easing (QE) from the Financial Crisis of 2008-2009. The idea is not only to make more money flow through the U.S. economy but also to make sure that the credit markets can operate as they would in normal times. The Fed will do what it can, how it can, in order to make sure money is flowing through the American economy. On June 10th, the Fed stated that it will purchase at least $80 billion monthly of Treasury securities, and $40 billion worth of residential and commercial MBS securities as long as it needs to. This incredible purchase of this type of assets has seen the Fed’s securities portfolio grow to $6.1 trillion from $3.9 trillion in the time period between mid-March and mid-June of 2020.

Lending facilities: While purchasing securities assets can help, the Fed realizes it needs to diversify its programs to help the American economy. The Fed has restarted its lending programs from the Financial Crisis of 2008-2009 while also expanding its facilities. But because the situation is so dire, the Fed has been forced to expand its lending programs to include municipalities, corporations, and small and medium-sized enterprises (SMEs). On April 9th, the Fed announced a $2.3 trillion emergency loan program in order to give a boost to local governments and municipalities as well as SMEs. The program involves giving increased liquidity to commercial banks which in turn would lend to small firms under the Paycheck Protection Program (PPP). The Fed also expanded its lending program by lending directly to SMEs through the Main Street Lending Program. As explained by Professor Kinda Hachem of the University of Virginia Darden School of Business: “The banks will make the loan, but the Fed will take on the exposure, and there’s collateral from the Treasury so that the Fed is not knowingly taking on credit risk. I think that’s the [program] economists are the most excited about, because it has the potential to very pointedly direct funding to the places that need it most acutely.”

Other programs include the New Loans Facility, Expanded Loans Facility, and the Priority Loans Facility in the Fed will make loans totaling $600 billion for terms of up to five years. Participation in the programs include firms having up to 15,000 employees or a maximum of $5 billion in annual revenues. The premise is to expand not only the amount of loanable funds, but make more money available to more businesses.

While there are other lending programs the Fed has implemented, the objective is to make more funds available than what commercial banks would normally do.

Other actions: There are other actions that the Fed has taken in order to strengthen the financial services industry and different financial instruments. In the Primary Dealer Credit Facility program, the Fed has brough back a plan from the Financial Crisis of 2008-2009 designed to provide low interest rate loans at 0.25 percent for a maximum of 90 days to twenty-four of the largest financial institutions that are regarded as primary dealers. The role of these dealers is to give the Fed equities and investment securities as collateral and this includes commercial paper and municipal bonds. The Fed has brought back this program so that credit markets can continue to operate when the financial markets are in stress since institutions and individuals have a strong tendency in avoiding risky assets and move toward hoarding cash. Here, dealers may run into barriers in financing growing security inventories that may have been accumulated as they make markets. The objective here is to provide emergency credit facilities for nonbank financial corporations and the nonbank financial system.

The Fed also established the Money Market Mutual Fund Liquidity Facility in order to help money market mutual funds in meeting any and all redemptions made by their clients such as individual investors and corporations. When these outflows occur en masse, these funds will sell their securities, but when done in huge volumes it is very difficult to sell, regardless of the short maturities and high quality. This allows the money markets to function and the commercial credit markets to continue even in difficult times.

The Fed has also created a repo facility to make it easier to allow dollar-denominated lending conducted by monetary authorities on an international basis. The Fed established this program so that money markets have access to substantial amount of cash as needed and allow cash to continue moving through the U.S. economy. Repos, or repurchase agreements, are essentially short-term loans allowing companies to borrow and lend cash and securities, usually overnight. If the repo market is somehow disrupted, then companies cannot borrow money to shore up their cash flow situations or have extra cash that is needed for a busy weekend if they are a retail establishment. The Fed’s plan permits the availability of cash to primary dealers in return for Treasury and other types of government-backed securities. Prior to the Covid 19 problem, the Fed offered $100 billion in overnight repos but now it is offering $1 trillion in daily overnight repos. The Fed understands the necessity of these short-term loans and the key role they play in keeping the commercial credit markets open.

Will these actions save the American economy?

Desperate times call for desperate measures and this is the situation the Fed is facing. It realizes that if the flow of money stops, for however long, in the U.S. economy, there will be serious repercussions. The high unemployment, the number of businesses that are closed, employees that still have jobs facing reduced hours or cutbacks in their salaries and wages are a few of the problems that economists and policymakers must deal with in addition to a shrinking GDP. The Fed knows it must do what it can to help get the nation’s economy up and going again. The Fed also knows the task will be difficult and take time. The least the Fed can do now is to keep money flowing through the American economy and be the ultimate source of emergency funds for businesses, large and small, so that they have at least a fighting chance of surviving. The Fed’s task is not easy but at least Jerome Powell is trying as best as he can.