Is a $15 per hour minimum wage feasible?

The movement for a new minimum wage has brought controversy to the labor market pitting workers against business owners. The goal is to provide workers with a livable wage but still allow business owners to function and keep their enterprises.

American workers who labor in menial jobs are fighting for better wages at a time when the nation’s economy is struggling. These workers have families to feed, keep a roof over their heads, and be able to afford decent medical care. As the minimum wage stands currently, it is not possible to accomplish any of these objectives and they endure a 40-to-50-hour work week and still exist in the throes of poverty. Many policymakers and economists are seeking a fair wage for the members of the American workforce who occupy its lower rungs. But there are business owners as well as other policymakers and economists who argue that a salary hike that would double the minimum wage would do more harm than good.

The problem is how to achieve some type of balance between the needs of workers and business owners so that both can survive especially in the midst of a present-day pandemic. Both groups need each other and there must be a solution that will help both sides or else the economic consequences could be quite severe.

The history of the minimum wage

The concept of a minimum wage came into fruition in New Zealand through the Industrial Conciliation and Arbitration Act of 1894. The Act was in response to shipping workers in New Zealand who conducted a huge strike in protest against low wages and poor working conditions. The Act was passed by the government of New Zealand and put into effect a system of a minimum wage in 1894. The workers were able to obtain the settling of trade disputes, working hours, wage rates, and working conditions. Other legislation enacting minimum wage laws were subsequently enacted in Victoria, Australia in 1896, South Australia in 1900, and New South Wales, Australia in 1901.

The movement for a minimum wage in the United States took root in nine states in 1912 and 1913. The first state to pass a minimum wage law was Massachusetts in 1912 that was the result of the Lawrence textile strike. Other states passed similar laws over the next two years including California, Oregon, and Washington. Later states such as Utah and Wisconsin through their industrial commissions also fixed maximum hours and working conditions.

It was not until the Great Depression that a minimum wage law was nationally mandated. The Fair Labor Standards Act (FLSA) was passed by Congress in 1938 and signed into law by President Franklin D. Roosevelt introducing the federal minimum wage law. The most amazing aspect of the legislation was that the federal government now enforced a stated amount for worker’s wages. This had never occurred in the history of the United States on a federal levl and was considered revolutionary in its nature. The Act became effective on October 24th, 1938 and set the hourly minimum wage at $0.25 per hour. But the FLSA was only the beginning in establishing federal laws affecting worker’s wages.

In 1947, the FLSA saw a change through the Portal-to-Portal Act in which it settled as to what constituted compensable hours for workers under the Act. This helped to expand the FLSA. The FLSA was further expanded to cover more workers and actually increased the minimum wage in 1949. In that was changed again in 1949 in which the minimum wage went from $0.40 per hour to $0.75 and covering all workers. The amendment of 1949 also saw wage coverage expanded to include the air transportation industry workers. An amendment in 1955 saw an increase in the minimum wage to $1.00 per hour without any changes in coverage.

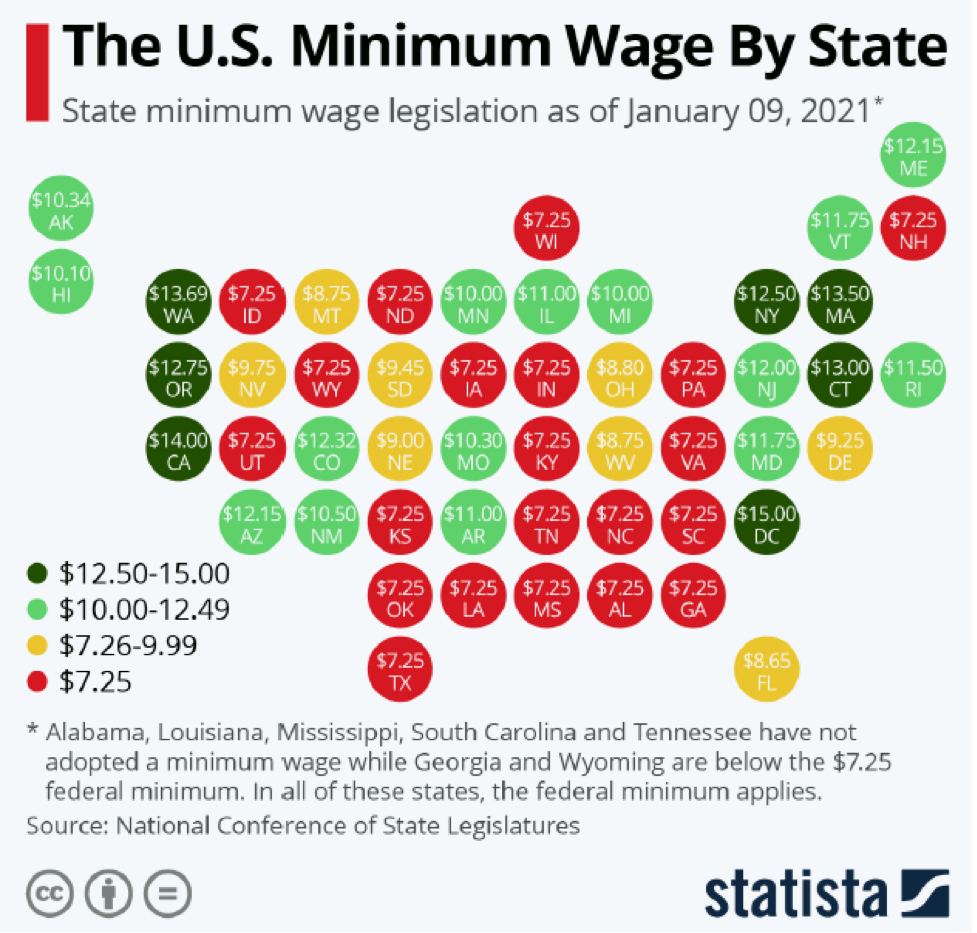

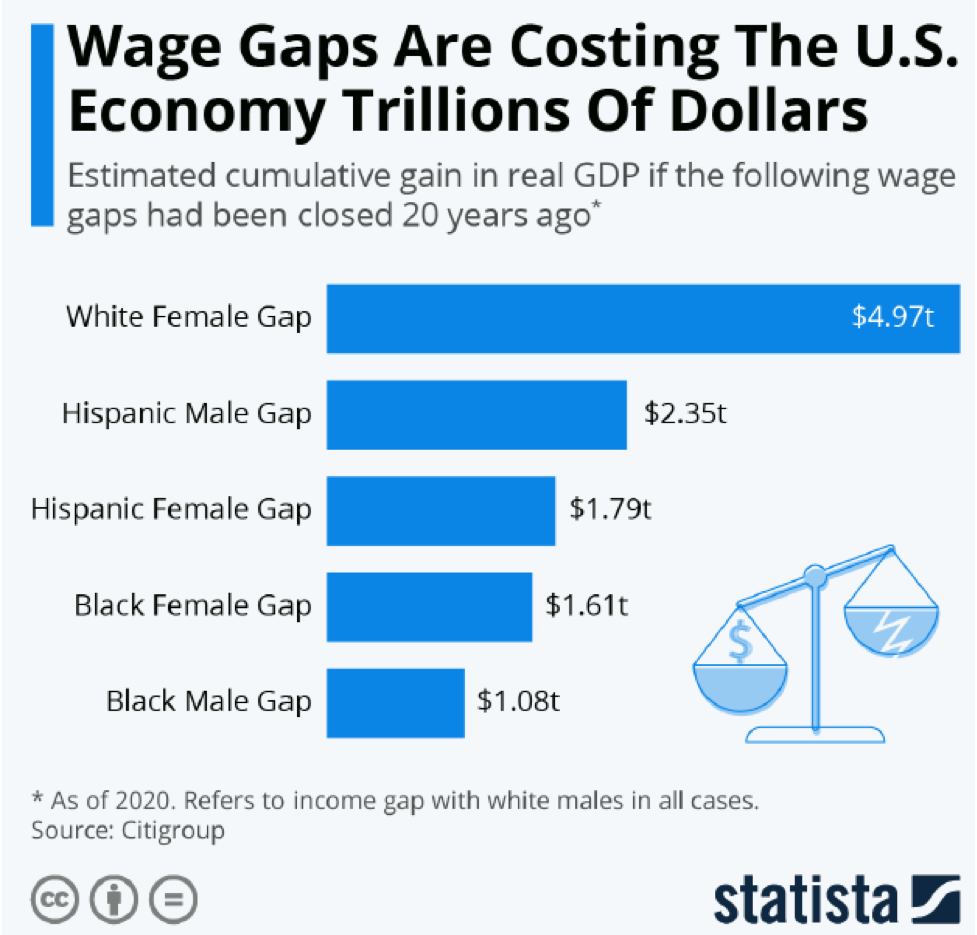

Other increases in the minimum wage occurred in 1961 to $1.15 per hour and to $1.25 an hour in September 1963. In subsequent years, Congress passed laws permitting other increases in the minimum wage. The most recent wage increase occurred in 2009 when the minimum wage was raised from $6.55 per hour to $7.25. Since then, there has not been a wage increase passed by Congress. There have been federal laws passed that prohibit wage discrimination based on sex or age. These laws include the Equal Pay Act of 1963 signed into law by President John F. Kennedy, the Age Discrimination in Employment Act of 1967, and the Lilly Ledbetter Fair Pay Act of 2009. While the objectives of these acts have been to create a level playing field regarding wages and compensation, Congress has still not been able to raise the minimum wage to a step or two above the poverty level. To matters worse, since 1968, the minimum wage has not been able to keep pace with the increase in inflation.

The case for a minimum wage increase

There are a number of reasons why a minimum wage increase is necessary and should be implemented immediately. Among the reasons are:

- An increase is long overdue: The last time an increase in the minimum wage occurred was in 2009 when it went from $6.55 an hour to $7.25. That means that it has been 12 years since a raise and that the minimum wage has failed to keep pace with inflation. Prices for goods and services have been increasing over the years, but the minimum wage has not and this has caused low-wage workers to suffer financially. Also, the macroeconomy of the United States, in terms of its gross domestic product (GDP), has grown substantially in the past 12 years, but the pay of workers, especially those making minimum wage, has not. The Center for Economic and Policy Research has noted that if the minimum wage had been increased by keeping pace with productivity upswings, it would be approximately $24 per hour today. What makes a raise even more necessary is that in 1991 the average pay difference between CEOs and workers was 59 to 1. However, by 2018 the difference had rocketed to 361 to 1. A raise in the minimum wage could hopefully start to close disparity in wages.

- Reduction in income inequality: There has long been income inequality between men and women and between ethnic and racial groups. The Economic Policy Institute reports that 27 percent of the total American workforce would experience a significant benefit from an increase in the minimum wage while 39 percent of Black and Latina women would gain as opposed to 18 percent of white men. The Institute also reports that 38 percent of African American workers would see a benefit from a raise while 32 percent of female workers would be helped. The idea is that groups that, in the past, worked at or below a sustainable wage would now see a significant increase that could help their economic and financial situation. It could be regarded as a first small step, but a significant one.

- Reduction in poverty: A raise in the minimum wage would help to reduce the level of poverty in the United States. According to the Congressional Budget Office (CBO), in a study from 2019, raising the minimum wage to $15 per hour would increase the incomes of underpaid workers in the United States while significantly reducing the number of families suffering in poverty. Currently, at $7.25 per hour, a worker employed at 40 hours per week brings home a paycheck of $290, before taxes. However, at $15 per hour that same worker at 40 hours per week would be making $600 per week, before taxes. This could be regarded as a significant pay raise, but also allow approximately 25 percent, or 40 million workers, to escape poverty, food insecurity, and possibly allow for better living conditions without the need for new or extended government programs.

There are numerous other reasons for raising the minimum wage. However, there are also opponents of the increase and they are well-armed with their arguments.

A minimum wage increase could affect businesses

Opponents of raising the minimum wage feel that it would do more harm than good. But these opponents strongly argue that small to midsize businesses would be especially impacted by a minimum wage increase. These reasons include:

- Costs would increase: Raising the minimum wage will increase expenses for small to midsize businesses in a relatively short time period. At a point in time in dealing with a massive global pandemic, many businesses have had to make drastic cuts in order to survive. Among these cuts have been reduction in personnel, salary decreases for workers, or a combination of both. If a hike in the minimum wage is established as law, then the effects could be very bad. The Office of Economic Analysis for the city of San Francisco has stated that an increase in the minimum wage to $15 per hour would reduce the employment force in the city by approximately 15,270 private sector jobs. This would come at a time when the economy in California is having enough of its own problems in dealing with Covid-19 cases. Businesses would do what they could to reduce their costs in order to offset with raising the minimum wage, even if it means laying off workers.

- Elimination of entry level jobs: For many young people, the opportunity to work at their first job is an experience they will remember for the rest of their lives. It can teach these individuals a work ethic that will last a lifetime. However, as many economists and financial analysts argue, if the minimum wage is raised to $15 per hour, then many businesses will probably not hire young people as workers since they will be too expensive to do so. An increase in the minimum wage could possibly limit the availability of entry level jobs. This will hurt young people who are going to school and need work in order to pay for tuition or to save for college.

- A possible increase in prices: An increase in the minimum wage could mean that businesses may need to raise the prices of their products or services. The problem is that even if employers cut costs, slash their workforce, and reduce the hours of the remaining workers, they may be forced to increase prices in order to stay profitable. Businesses, big or small, must maintain a certain profit margin so that they are allowed to grow in the long run. But a boost in the minimum wage would most likely mean raising prices and causing inflation to spike upwards which will be felt nationwide. Many consumers cannot afford a price hike and they may be forced to reduce their consumption of goods and the demand for services due to the increase in the minimum wage.

A proposal

The idea of a minimum wage for workers has long been regarded by business owners, some economists, and policymakers as very controversial. It has long been argued that the market should determine the wages of workers and that the market knows best. But, even with a $15 per hour minimum wage, this concept is not perfect. If there is to be an increase in the minimum wage in the future there would need to be legislation passed by the United States Congress and signed into law by the President. This process takes time and involves playing the game of politics by those for and against a rise in the minimum wage.

A possible proposal would be to raise the minimum wage through a federal law and then allow an annual Cost of Living Adjustment (COLA). The COLA is currently made to Social Security and Supplemental Security Income to counterbalance the impact of inflation. COLA usually equals the increase in the Consumer Price Index (CPI) for a set time period. This adjustment is automatic and does not require any laws passed by the Congress. Workers making minimum wage would not need to worry about if and when there would be a pay hike since it would be written into law that employers would need to raise wages automatically every June 1st based on the COLA of the previous year. Such an idea would eliminate the uncertainty for business owners as to if, when, or how to increase salaries for their workers. If the COLA policy can be used for retirees, why not use it for people currently working.