Can SPACs work?

Alternative methods of investing or raising capital can result in diverse ways a company can expand its operations and grow. Yet, now there is a method to possibly benefit investors and fledgling enterprises while minimizing risk.

Investors are always looking for new schemes to get onto the ground floor of the next big thing. Whether it is looking for the next Microsoft or Amazon.com, investors keep their eyes open to what is next and ultimately bring them a sizable return, whether in the short or long term. It is not an easy task since the chances of failure often outweigh success. Finding the next Apple or Facebook means being willing to take on a huge risk while hoping to beat the odds against failure.

From the entrepreneur’s perspective, they often feel they have the next big thing at their fingertips that will achieve a bountiful return. Oftentimes, these entrepreneurs feel they have the next Microsoft or Amazon.com if they could obtain the right amount of financial capital to get their idea off the ground. They do not see failure as an option as long as they have the dream, desire, know how, and the cash to make it work. Both investor and entrepreneur need each other, but finding each other is very often a super difficult task. This is where special purpose acquisition companies (SPACs) come into play.

What are SPACs?

A SPAC is a shell company established by a group of investors who have the intent and purpose of raising financial capital in order to eventually acquire a company. The premise is that these investors contribute money into a trust that is formed for the specific and sole reason of purchasing a company. The funds must stay in the trust of the SPAC which has no other asset but the money from investors.

The SPAC could be considered an initial public offering (IPO) because the investors intend to use the funds to purchase a company. The SPAC acts as a waiting place for an investment opportunity since the investors have no real idea what will be the eventual target company that will be acquired. It could be said that a SPAC is really money looking for an acquisition. It is easier for institutional investors to form a SPAC since they may have a successful track record in investing in unknown, unique, and untried investment opportunities. SPACs are also known as a “blank check company” since the investors who pool their money are giving the individual or individuals forming the SPAC a blank check as to the amount and where to invest the funds.

A SPAC is a publicly traded company without any special operations, no liabilities nor any assets other than the cash that investors have put into the trust. The whole objective of the pooling of these funds by these investors is to eventually purchase a company. These investors, known as sponsors, usually have a strong and knowledgeable background in a certain industry or business field. They usually know what to look for, know the ins and outs of the industry and which particular companies are prime targets for an acquisition or a takeover at a fair to decent price. These investors will usually seek out a company that is privately held and is looking for a substantial amount of financial capital that a SPAC and its sponsors could bring in. This will also give the privately held company a chance to go public and raise even more financial capital through an offering to the general buying public.

The sponsors who launch the SPAC really have no specific target company or acquisition in mind which gives them freedom and flexibility as to who they will purchase and the amount they will ultimately spend. There is a time limit as to when they must make a purchase which is usually 18 months to two years. If the acquisition does not occur within the 18 months or two years when the SPAC was formed, then the SPAC is liquidated or dissolved and the financial capital that was raised must be returned to the investors. While the funds are in the trust, they are invested in financial instruments such as Treasury bills so that if a SPAC does not make an acquisition, at least the investors will get some type of return on their money.

The shares of a SPAC can be publicly traded at a price of $10 per share. The hope of the investors is that when an acquisition is made and the target company goes public through its own IPO, then the share price will go beyond the $10 per share the investors originally paid. The investors also have the option of holding onto to the shares with the hope that the price will appreciate beyond their expectations. A key idea to remember about a SPAC is that the target company being acquired must be worth at least 80 percent of the money raised in the SPAC IPO.

Who uses SPACs?

SPACs have a ready appeal to investors who want to save time, and substantial amounts of money, in taking a company public versus the traditional IPO process. With a traditional IPO, there is the due diligence process which is an arduous, possibly lengthy, and expensive journey since the company seeking to go public must submit a registration statement to the Securities and Exchange Commission (SEC). This can involve numerous rounds of reviews by the SEC and its attorneys as well as comments and expensive changes before the actual offering occurs. An IPO can also involve the use of investment bankers, accountants, attorneys, financial consultants, and a roadshow to drum up financial support for the offering, all of which can cost a phenomenal amount of money.

A SPAC can avoid these costs as well as the uncertainty of being able to raise the cash the IPO needs. A SPAC allows the target company to have ready access to public stock markets by way of a merger or acquisition with a SPAC that is already a publicly traded company. A company looking to go public can allow itself to be purchased or merge with a SPAC and have access to the financial capital it needs in a relatively shorter time period with much less cost and uncertainty as opposed to the traditional IPO method.

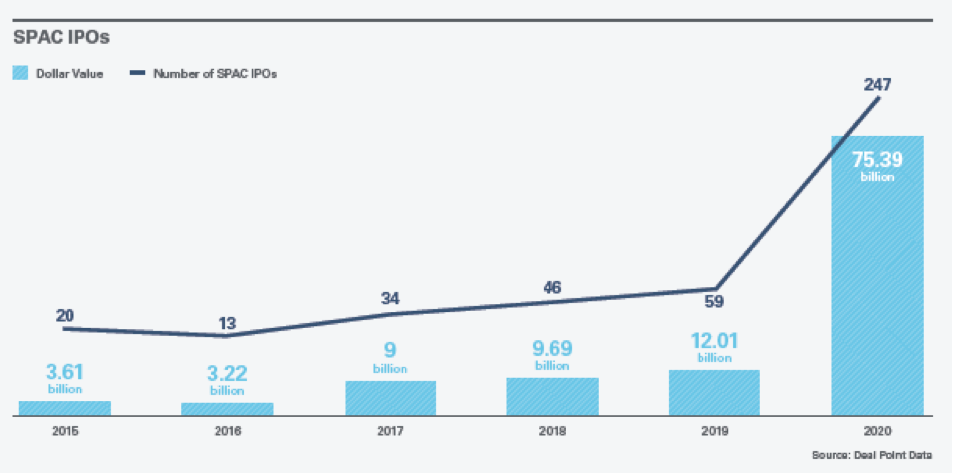

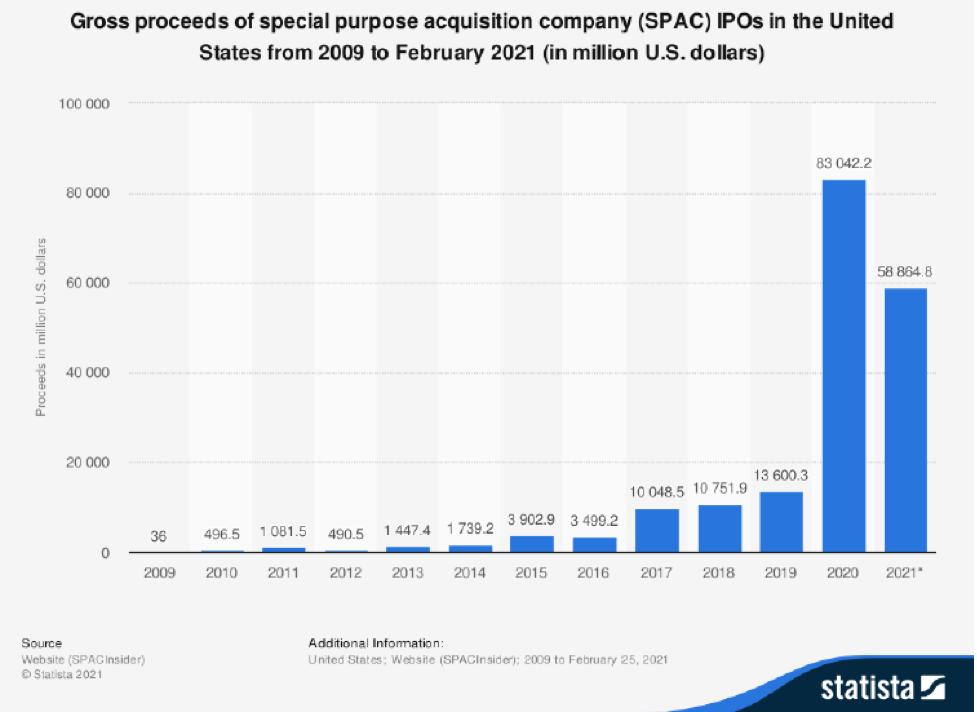

SPACs have grown in popularity and appeal to investors. In 2015, there were nearly $4 billion in offerings using SPACs while in 2017 SPACs issues exceeded $10 billion through 34 offerings. The year 2019 saw 59 SPAC IPOs which raised $13.6 billion. In 2020, there were 238 SPAC IPOs worth over $80 billion.

Among the other advantages in using SPACs is that investors have the opportunity to trade both their stock and warrants during and after the intervening stage as they wait for an appealing target company for the SPAC to acquire or merge with. If the stock goes beyond the $10 per share price, the reward for those investors can make up for any initial risk they undertook.

Another advantage to a SPAC is greater investor involvement in any merger or acquisition that may occur. SPAC investors do not get involved in choosing the deals that will occur, but they have the chance to sell their shares and receive reimbursement of their original investment. This gives the SPAC sponsor an opportunity to minimize their risk if they feel a possible merger or acquisition will not succeed. SPAC sponsors can also vote on any possible deals presented as a target in a reverse merger transaction. In sum, the sponsor has a say in the how, when, what, and why of a potential deal.

There have been some high-profile SPAC deals in recent times that have raised substantial amounts of financial capital for the acquired company. For example, Richard Branson’s space travel venture, Virgin Galactic, merged with Social Capital Hedosophia in July 2019. The merger saw the creation of a company having an enterprise value of $1.5 billion and that Branson’s Virgin Group held 58.7 percent of the company while Social Capital retained the balance.

Another large SPAC transaction occurred on July 21st, 2020 as Pershing Tontine Holdings sold 200 million shares at $20 per share, raising $4 billion in the offering. This has been the largest SPAC transaction in history, so far. The reason the offering was so huge was due to investor demand. Hedge fund manager Bill Ackman was in charge of the SPAC and used it to find a mature unicorn having scale, market share, and a substantial advantage over its competition.

There have been other SPACs in recent years that have raised billions of dollars in financial capital. For example, in 2019 DraftKings and SBTech merged with Diamond Eagle Acquisition Corporation in a SPAC worth $3.3 billion. The merger created a vertically integrated sports betting and online gaming company. SPACs are growing and there seems to be no end in sight. However, SPACs have their critics who express their concerns.

The Risks of SPACs

While SPACs are being used more often by investors, they do have some drawbacks that could involve risks. A key risk is that a SPAC is regarded as a blind investment in which financial capital is gathered from investors, but the investors really do not know where, when, or what the money will be invested in. There is a great deal of uncertainty for the investors or sponsors and if the worst happens in which the funds are never invested, then the money will be returned to the investors. The problem is that the investors may have been given high expectations of where the funds will be invested and that nothing of the sort ever materialized. This could mislead the investors and, unless they accept this downside risk of a SPAC, leave a sour taste.

Another risk is the lag time that could be involved in a SPAC. The rule is that the funds must be returned to the investors in 18 months to two years if the SPAC cannot find a suitable investment target. While the funds will be sitting in an escrow account earning some type of interest as a return, the financial capital is idle when it could be placed in an alternative investment earning appreciation. Even if the money is invested in an S&P 500 Index fund, at least it is getting the return of the market place. Unless the investors have the time and patience for such a long time, a SPAC may carry more risk than they want.

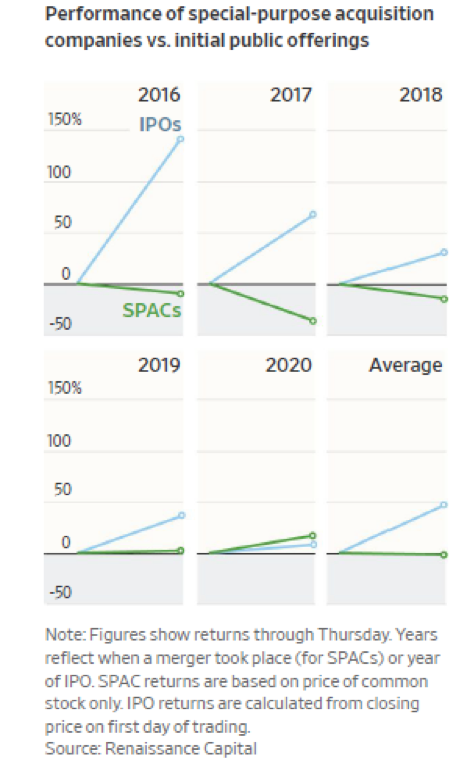

SPACs are also known to have a mixed track record in the investing world. The investment house, Goldman Sachs, published a report in July 2020 in which an analysis was done on the performance of 56 SPACs in the fields of energy, financial services, technology, and industrials and the results were not impressive when merged with target companies starting in January 2018. The report stated that “during the one-month and three-month periods following the acquisition announcement, the average SPAC outperformed the S&P 500 by 1 percentage point and 11 percentage points, respectively, and beat the Russell 2000 by 6 percentage points and 15 percentage points, respectively.” While this may sound like good news, the report also stated that, “However, the average SPAC underperformed both indexes during the 3, 6, and 12-months after the merger acquisition.” For investors this is not good news and they may seek safer and better alternatives for their investment capital.

Another risk is whether there has been a proper valuation done of the target company. The problem often is that valuations of privately-held companies may not be correct and this will impact future returns to the investors. If such items as cash flow, operating cash flow, operating profits, and net profits are overvalued just to make the target company look more attractive than it really is, then the investors have been severely misled. This may have been done in order to make the target company look like a better investment than it really is. Quite often retail investors have no proper basis to evaluate a target company if it is privately held and is desperately seeking financial capital so it can expand its operations and subsequently attract more funds. Unfortunately, many start-ups have unproven strategic plans, unknown future growth potential, or management that has little to no experience in doing an IPO. Private-equity firms, venture capitalists, and hedge funds have the knowledge and experience on how to handle start-ups while the investor in a SPAC may be a novice in this area.

Go with a SPAC or . . . .?

A SPAC is like any other investment in which it has its potential for substantial rewards and risks that could cost the investor the investment capital. While SPACs have been around for a while, there is still a degree of uncertainty in the investment community as to how they will perform in the future. Also, how will SPACs perform when the macroeconomy takes a major downturn or that there is a scandal involving a substantial amount of money. Then the key test will be the reaction of the investment community as to whether SPACs are still a “hot” item.