Inflation is here. . . at last

The latest government data shows that inflation is higher than a year ago. While there are some who are in a panic, inflation at this point should not have been unexpected and could actually be a good sign for the American economy.

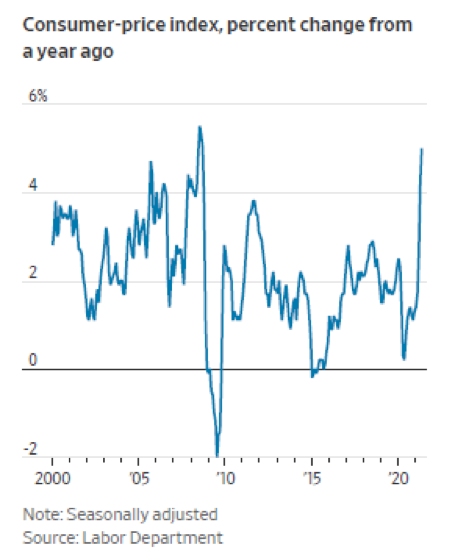

The recent data released by the U.S. Bureau of Labor Statistics showed that the Consumer Price Index (CPI), over the last twelve months increased by 5 percent before seasonal adjustments. The Bureau cites that this is the largest twelve-month increase since the period ending in August 2008 when the CPI was 5.4 percent. While there are certain economic analysts who have started sounding the alarm of inflation creeping even higher, this rise should not be a surprise given what has occurred in recent months.

The American economy as well as the global macroeconomy is coming out of its severest slump due to the Covid-19 pandemic. Economies were shut down and governments were focused on battling the pandemic, finding a cure or a vaccine to battle Covid-19, and consumers and companies were keeping money in their purses due to the uncertainty of the future. Consumers were worried about their jobs, catching the virus, and how long this uncertainty would last. Businesses, large and small, were worried about their financial position and whether they had enough cash to survive the unknown length of the pandemic. But because of government aid such as that provided to businesses in the United States and stimulus checks received by many Americans, the economy is starting to open up. However, with the rebirth of the American economy comes a side effect: inflation. Specifically, there are key reasons for inflation kicking in.

Pent-up demand

American consumers have been in lockdown regarding purchases and spending for over a year. This is very difficult for them since the United States is a consumer driven economy based on spending. Consumption, especially for goods and services are for quick use, and has helped the American economy thrive and grow since the early twentieth century. If Americans are spending then companies not only in the United States but in Europe, China, and Asia will reap the benefits of increased revenues and higher profits.

Americans, since the moment they are born, are taught to consume. But due to the pandemic, they have not been able to because of government imposed rules regarding crowd size, social distancing, and school closure. This is not an attack on these government actions since they were necessary in order to stop the spread of Covid-19 until there was a better understanding of what it was, what it could do, and how to deal with it. It is just that American businesses heavily rely on American consumer spending in order to keep their doors open, maintain a healthy cash flow, and employ their workers.

Americans actually saved more cash during the pandemic because they cooked at home, had time with their families, and spent less money on gasoline for their vehicles. Many Americans worked from home and found that using Zoom or WebEx could be an effective tool for meetings and communicating with their colleagues. But this works up to a certain point. Many Americans were itching to get out of the house, even if it meant going back to the office and the two-hour back and forth commute.

Americans wanted to return to a normal way of life and this meant buying products, goods, and services as they were accustomed to. Ordering online increased substantially as companies such as Amazon.com and Chewy saw sales rise along with their net profits. But with more Americans getting the vaccine to combat Covid-19, many are more comfortable to go out in public and make purchases in stores, malls, and shopping districts and then go to a restaurant or diner afterwards. Spending levels are increasing because vaccination rates are rising, there are lesser business restrictions, and Americans are eager to spend the cash they have been hoarding for many months. It has helped that the Federal Reserve Bank has kept interest rates at or near 0 percent, made huge purchases of Treasury securities and bonds, and done an extraordinary job in a matter of a few months of pumping trillions of dollars into the American economy. The Congress has helped by sending economic stimulus checks to millions of Americans in order to get cash into their hands so they can buy food, pay the rent, and be able to survive. There were those who took the government monies and put it into savings. But now those same Americans are ready to spend.

This ultimately means that pent-up demand will see Americans spend at amazing rates in the coming months, especially with the summer just around the corner. But the demand will more than likely outweigh the supply. Corporations, manufacturers, and suppliers have been dormant this past year due either to the uncertainty of what the future will hold, poor planning on their part, or being too cautious. Therefore, with demand growing and supply at either the same or below normal levels, the result will be that prices will take a significant jump in the coming months. Until corporations, manufacturers, and suppliers ramp up production to necessary levels, prices will increase and inflation will be here at least until the end of the year.

The problem is that policymakers, ordinary people, and businesses wanted the pandemic to end, however it would happen. But they failed to have the foresight as to what the consequences would be when a vaccine was found: a booming economy with inflation as a side effect.

Businesses are starting to produce again

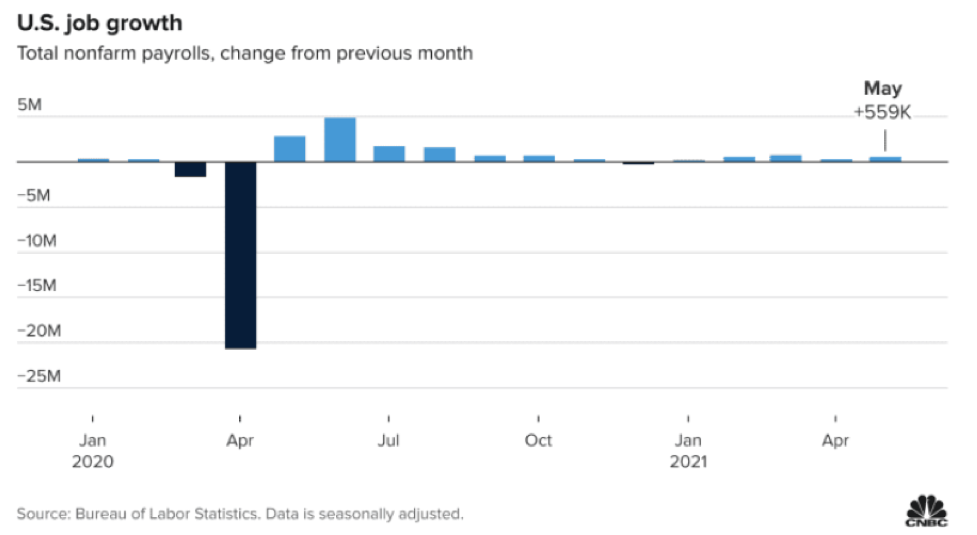

For many businesses in the United States, the past year has been a severe dormant period. Due to the pandemic, people have been forced to stay at home whether because of their employers laying off or that working from home became the new norm. But this also meant that stores, restaurants, and other establishments were closed or significantly reduced their hours. This caused unemployment to greatly increase and people had reduced amounts of money to spend. Therefore, businesses lowered their inventories of goods and products to the point where their backrooms were nearly empty.

The problem also is that numerous manufacturers use just-in-time (JIT) manufacturing process. The idea behind JIT is to just make the correct number of parts, products, and goods that are needed and not have any excess in a warehouse or storage facility. Excess inventory is not a value-added measure that will help a company in terms of revenues or cash flow. Excess inventory can actually be regarded as an expense since it needs to be stored in a warehouse which means extra storage costs and reduce profits. Also, other expenses can be incurred such as insurance on the excess goods in case of damage from a fire or flood. Through JIT, manufacturers want to make the parts or products just when they are needed in the manufacturing process, not before (being too early) or later (being too late). The parts or products must be delivered just at that point in time when they can roll off the delivery truck or railroad car at the customer’s loading dock and be taken directly to the place in the manufacturing plant where they are needed in the assembly line. Here the supplier has met the customer’s product or part specification and that there is no need for inspection or quality control. It is a given that the part or product has met the specifications for quality, size, color, and others aspects in order to produce the finished good in a timely manner.

The key element here is that no products or goods can be placed in storage waiting for orders from distributors or wholesalers who will sell the items to retail customers. It is completely forbidden that inventory accumulates so that it can be sold in stores to retail customers in two, three, or six months from now. Storage of inventory is considered an outdated manner of manufacturing and not cost effective. In fact, storing inventory can be seen as hurting a company’s income statement, balance sheet, cash flow, and financial analysis. Prior to the Oil Crisis of 1973-74, accumulating inventory was the norm for all manufacturers globally except in Japan which first used JIT manufacturing. But due to the spike in oil prices, consumers in 1973-74 went to smaller, high quality cars built by the Japanese not gas guzzling, poorly made vehicles from America that were much larger and more expensive. Eventually, even American automakers switched over to JIT manufacturing.

However, JIT manufacturing is not perfect. A major flaw with the process is that if there is a disruption in the supply chain, then not only does the entire manufacturing process come to an abrupt halt but shortages will eventually occur and the products that are available will see their prices skyrocket. Consumers will either pay more for the product or not buy them at all. Manufacturers using JIT will eventually be able to work out the disruptions in the supply chain and start making more product in order to meet customer demands. But this will take some time, perhaps weeks or months. Manufacturers, suppliers, distributors, and retailers will not hold down prices or take a financial hit just for the sake of keeping their customers happy. These parties will just pass the increases on to the customers and lower prices when supplies return to normal.

This is now occurring globally since manufacturers have not stored any excess inventory since it is not in their financial best interest. Manufacturers, just like everyone else, had no idea how long the Covid-19 pandemic would last. Manufacturers feel they have a financial responsibility to their stockholders and creditors and to be extremely careful in the planning process. But the situation regarding the Covid-19 pandemic will pass eventually and supply will meet up with demand resulting in prices coming back to their equilibrium or normal point.

Worker shortage

Workers are a vital part of any organization or business. They can make a business succeed if they have the proper training and background for the job. A key point to remember is that it is not just quality, but the quantity of workers, also. Currently, American firms are experiencing a severe worker shortage. American companies are looking for workers to staff factories, fulfillment centers, and offices in order to meet customer demands. Analysts have given a number of reasons for the worker shortage crisis.

A key reason, analysts suggest, is that due to the extra $300.00 per week in unemployment benefits, workers have no incentive nor motivation to return to the labor market. These analysts claim that workers making their unemployment benefits plus the extra $300.00 per week plus periodic stimulus checks from the Federal government have no real reason to return to work. As long as workers are getting these payments, and they are meeting their living expenses, why return to their jobs? Analysts claim that the extra money workers are getting allow them a paid vacation that could last indefinitely.

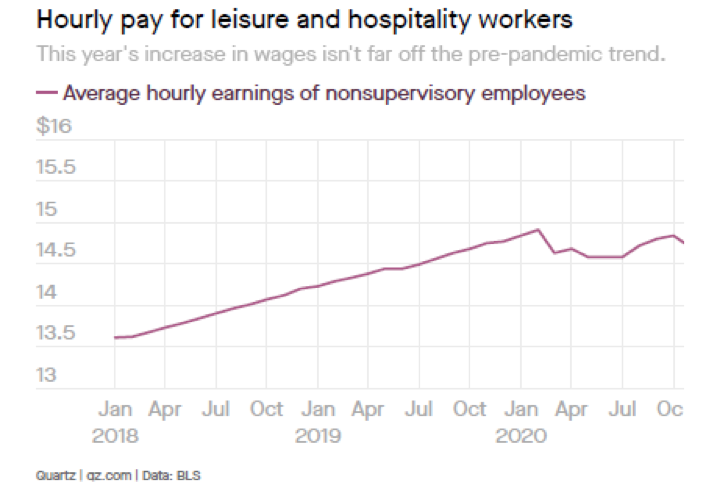

On top of that many workers feel that they do not need to return for the same salary they were making pre-pandemic. For those workers making the minimum wage of $7.25 per hour (pretax), returning to their low paying job is just not worth it. Many may feel that they could make more money doing something else, perhaps even more rewarding and fulfilling. In the meantime, employers need workers to wait in restaurants and diners, work on the assembly line, and mow lawns but at the same wage as before the pandemic. Workers feel the market has shifted in favor of them after many years of being on the employer’s side.

But that is the way markets generally work: Shifts occur in the labor marketplace that sometimes favor workers and at other times swing toward employers. Perhaps if the minimum wage was higher than the current $7.25 per hour, adjusted periodically for inflation, with better benefit packages such as improving health care insurance, and child care was available, workers would come back in full force. Perhaps this will be a message to employers that they should create incentives, monetary and otherwise, for workers to want to return to the workforce now that the pandemic crisis seems to be letting up.

Finally, if more immigrants were allowed to come to the United States, the worker shortage would be substantially diminished. Immigrants are generally ready to work and earn wages they could not receive in their home country. If the United States had a plan in place to readily accept immigrants and immediately put them into the nation’s workforce, then the current worker shortage would be nonexistent. Employers have been begging for more immigrant workers for a number of years to fill numerous positions. Now those vacancies are causing a national economic and financial problem in inflation and possibly another slowdown.

Inflation could actually be a good sign

Despite the alarm bells going off about inflation, it could actually be regarded as good news. I bring this point up, because I tend to see the glass half full. Inflation has usually been regarded as the fact that there is too much money chasing too few goods and services. And this generally true from a purely Economics 101 perspective. As I have previously stated, there is a substantial pent-up demand by the American consumer who cannot wait to spend their money. And I regard this as a great sign because it means the American economy is in a growth stage and probably will be for at least one to two years.

Money will be flooding the consumer market for goods and services unlike what this country has seen in a long time. This will cause GDP to increase in each quarter for a year or two and perhaps outpace China’s economic growth. However, a side effect of this huge influx of cash into the American economy will be inflation. It is a side effect that Americans will need to learn to live with for a while. Inflation will eventually slow down, whether it is because of demand slowing, supply meeting up with demand, or the Federal Reserve Bank raising interest rates, which many argue is long overdue. Many Americans have never experienced severe bouts of inflation as the United States saw in the 1970’s and early 1980’s. That was a time when inflation pervaded the lives of every American, lasted for a number of years, and the nation did not see economic growth ultimately resulting in stagflation. This time it is different and could be regarded as a sign of better things to come.