Can Russia survive economic sanctions?

President Vladimir Putin is aiming to bring Ukraine back into the Russian sphere of power as it once was. But it seems the Russian people will suffer the economic and financial consequences that may cause them to question Putin’s leadership.

President Putin is waging a bloody invasion of Ukraine in which the cost will be a heavy loss of human life, expenditures of military hardware, and loss of the standing of Russia among the family of nations. It is doubtful whether Putin carefully thought about the consequences of such an action to the Russian people, especially on economic and financial fronts.

While the United States and European Union are not physically invading Ukraine in order to stop the bloodshed, they, and even usually neutral nations such as Switzerland and Sweden, are using economic and financial sanctions in order to make Russia pay for Putin’s policy. Some critics feel that such sanctions will not stop Putin from carrying out his invasion of Ukraine while others hope that the Russian people will rebel and force the action to stop. The answer is not clear as to the result of the sanctions, if they will stop the invasion or cause the Russian people to rise up against Putin. But the real question is whether Russia will survive the sanctions or cause the country to fall into a massive economic depression that will be far worse than what happened when Putin’s military annexed Crimea in 2014.

The reasons for the sanctions

Russia is presently attempting to invade Ukraine and bring it back into the Russian sphere of influence. Ukraine, as far back as under Stalin’s rule, was an area controlled and literally owned by the Soviet Union. Stalin even went so far as to starve Ukraine in a period known as the Holodomor. The word, Holodomor, is a combination of the Ukrainian words for “starvation” and “to inflict death”. Stalin’s cruelty manifested in a campaign of starvation of Ukraine resulting in the loss of approximately 3.9 million Ukrainians or about 13 percent of the its population. Stalin’s motivation for this cruel and inhumane action was to not only eliminate Ukraine’s small farms but replace them with state-run collectives while also clamping down on Ukrainians who wanted independence and were perceived as a risk to his severe and totalitarian rule. Stalin wanted to have a communist controlled macroeconomy and collectivization was part of the scheme. Farmers in Ukraine lived off the land by growing what they consumed and resisted Stalin’s assault even if meant surrendering their land and livelihoods. Ultimately, collectivism failed in the Soviet Union, Ukraine, and other Soviet satellite areas.

Putin was raised under the red banner of the Soviet Union. He rose steadily in the ranks of the KGB to the rank of lieutenant colonel and was stationed in Dresden, which was part of East Germany when the Berlin Wall fell and eventually the collapse of the Soviet Union. Putin felt that he was witnessing the demise of a great and powerful nation that had achieved empire status in a sad and humiliating manner. As Putin later stated, “I had the feeling that the country was no more. . . It had disappeared.” Putin was more concerned about the humiliation the Soviet Union was incurring rather than the cost in human lives or the new possibilities that could lie ahead.

Putin has been more concerned about restoring the glory of the old Soviet Union through taking territory that once was part of the Warsaw Pact nations. These were nations that were behind the Iron Curtain that was slowly rotting due to economic insufficiencies. Putin climbed to the pinnacle of the Russian government by becoming president with the intent of re-establishing Russia as a leading world power. As he wrote in the Russian newspaper, Nezavisimaya Gazeta, in a 1999 article which stated his ultimate goal: “For the first time in the past 200 to 300 years, Russia faces the real danger that it could be relegated to the second, or even the third tier of global powers.” Putin attained control of Russia in order to unite the country into a “first-tier” nation even if this meant a bloody takeover of former satellites of the old Soviet Union.

Putin’s action against the Ukrainian people is a step toward restoring the old Soviet regime and the glory that was once, as he perceives it, the true Russia. His action has resulted in thousands of lives lost in Ukraine, the destruction of any credibility that Russia had on the world stage, and sanctions that could cause the nation to spiral into a severe economic and financial depression that may last for decades.

The sanctions against Russia

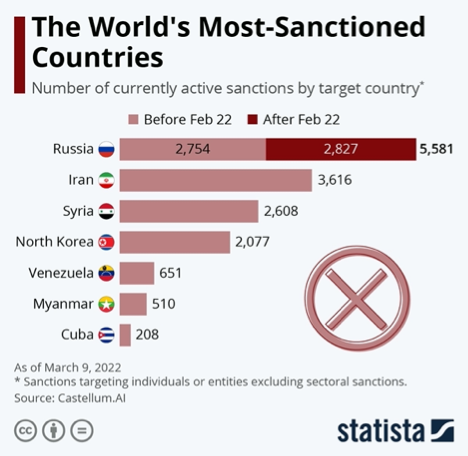

The economic sanctions being levied against Russia for its invasion of Ukraine are quite extensive. Not only is the United States imposing sanctions but also member nations of the European Union as well as countries such as Switzerland, Japan, and Australia. Each sanction from the different nations will ultimately hurt Russia in different ways:

The United States: Through the Treasury Department, there have been sanctions against Russia’s two largest financial institutions which are Public Joint Stock Company Sberbank of Russia (Sberbank) and VTB Bank Public Joint Stock Company (VTB Bank). The sanctions against these two largest Russian banks will result in the disruption of approximately $46 billion worth of foreign exchange transactions globally in which 80 percent are in U.S. dollars. These banks will not be able benefit from cost effective, efficient, and secure transactions of the U.S. financial and banking system. Sberbank has been hit with a directive by the Treasury Department which prohibits U.S. financial institutions from:

- Opening or maintaining a correspondent account or payable-through account for or on behalf of any entity determined to be subject to the prohibitions of the Treasury Department directive, or their property or interests in property; and

- Processing transactions involving any such entities determined to be subject to the Treasury Department directive which forces American financial institutions to reject such transactions.

The United States has also imposed sanctions on other major Russian financial institutions: Otkritie, Novikom, and Sovcom. These financial institutions have combined assets worth $80 billion, have sanctions on them that significantly reduce their access to global markets, attract investments, and have utilization of the U.S. dollar.

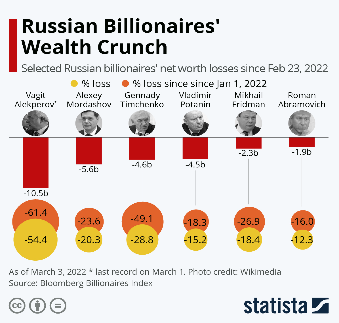

There have also been sanctions placed on elites who have close ties to Putin. These individuals include Sergei Borisovich Inanov who is the Special Presidential Representative for Environmental Protection, Ecology, and Transport. Sanctions have been imposed not only on those individuals who are close to Putin, but also their immediate families such as wives, and children.

The Russian Central Bank has also been sanctioned by the United States by prohibiting it from making transactions in American dollars. There are also sanctions on the state-owned Russian Direct Investment Fund which is regarded as a “slush fund” for Putin and his inner circle of friends.

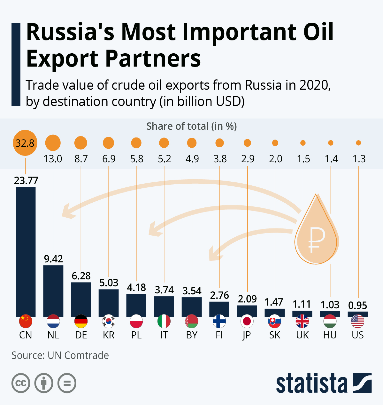

Also, President Biden has announced the banning of imported oil and various other sources of energy from Russia immediately. This includes new Russian shipments of oil, liquefied natural gas and coal, and certain petroleum products under an executive order President Biden signed on March 8th. This order directs companies that they must wind down existing contracts for Russian energy supplies in 45 days.

The European Union: Along with the United States, the United Kingdom and Canada will eliminate Russia from SWIFT which serves as a global messaging service connecting financial systems. SWIFT, or the Society for Worldwide Interbank Financial Telecommunications is necessary for financial institutions to send secure messages and funds to other institutions. This is a severe blow to Russian financial institutions and Russians who need this system in order to send money to pay for goods and services and to receive cash from others around the world. Without funds coming into or leaving Russia, then trade will probably come to a halt in a matter of weeks.

Switzerland: This is a nation that is known for being historically neutral even in World War II. But the Swiss have announced that they are freezing the assets of Putin and top Russian ministers who have assets in their country.

While these are only a few of the sanctions that are being imposed on Russia, the key questions are how will Putin react and what will be his next move in response to these sanctions?

The effect of the sanctions on Russia

Russia and its people will be hit hard by the economic sanctions imposed by the United States, the European Union, and other nations. It is more than just stopping the trade of physical goods and products into Russia to feed its people. The world’s economy has evolved in which the global financial system has now become the most powerful nonmilitary weapon available to try to counteract Putin’s assault on Ukraine.

Through the use of hastily drawn legislation and executive orders by President Biden, Prime Minister Johnson, and other national leaders, this is the weapon of choice being used to make Putin stand down. The global financial system has been frozen for Russia in which their own financial institutions such as commercial banks and investment houses are literally halted from having money enter into or leave. This means that without the flow of cash through the Russian economy, then there will eventually be shortages of key commodities such as wheat, corn, and soy beans, to name a few that Russia cannot purchase on global markets. Russia must be able to buy these commodities and other food products if its people are to survive not only the remaining winter months but the rest of the year. It would not be surprising if Russians either face rationing of food or serious cases of starvation in the coming months. Then it must be asked how will the Russian people react to Putin and his failing conquest of Ukraine?

The problem now is that the Russian ruble has fallen to a record low. Currently, 1 Russian ruble is equal to $0.008360 or 1 U.S. dollar is equal to 121.944 Russian rubles. This will cause inflation in Russia to skyrocket since it will take more money to purchase goods such as vegetables, bread, and eggs. When the Russian people have to pay 100 times more for bread than they did six months ago, will they support Putin’s actions in the Ukraine when it means they cannot feed their children or themselves? Americans are seeing the economic consequences of Putin’s attempted conquest of Ukraine with the cost of a gallon of gasoline going up to $6.00 a gallon. But for the Russian people, Putin’s actions will have far broader and deeper ramifications and possibly send Russia into a deep economic depression.

But shortages of food and huge spikes in inflation are only part of the problem that Russians will face. Russians are now used to the idea of access to consumer goods at reasonable prices that consumers in the West enjoy and come to expect. But now major companies such as McDonald’s, Shell Oil, and Apple are halting doing business in Russia. Other companies who will cease operations in Russia include:

- H&M Group

- Nike

- Adidas

- Levi Strauss & Company

- Ikea

This will mean that Russians will not be able to fill their cars with gasoline, purchase laptops nor cell phones, or even packaged medicines. Numerous companies from around the globe are stopping any investments they would normally make in Russia and pulling their operations and investments out as soon as possible. This will mean that financial capital will go to other countries and that Russia will see its gross domestic product (GDP) shrink substantially in the coming months.

According to Carl Weinberg, the chief economist at High Frequency Economics, these sanctions “are severe enough to dismantle Russia’s economy and financial system, something we have never seen in history.” There is also the case where Russians with foreign investments will see their assets being seized by foreign governments in response to the invasion of Ukraine. The question then becomes, how long will the Russian economy hold out and how bad will the economic and financial repercussions be?

How much pain can Russia take?

Putin is going full steam ahead with the takeover of Ukraine, even if it means destroying the country. Putin’s military has been shelling cities, hospitals, schools, and apartment buildings in a relentless manner. But Russia and the Russian people are starting to suffer economic and financial pain and are paying for Putin’s gamble. Recent sanctions against Russian banks and financial institutions will target more than $1 trillion in assets in Russia by impeding four major banks from having any access to their investments in the United States. These banks need these assets in order to survive and function as commercial financial institutions. If they cannot have access to these funds, they are in a world of trouble.

Putin has already decided to go full bore in his takeover of Ukraine and possibly go after other nations in Eastern Europe that are not NATO members nor part of the European Union. But the question then becomes whether Russia can financially survive even longer and more arduous sanctions and still expend resources in any further military campaigns?