The situation regarding Covid-19 has had a significant impact on the American economy. In order to combat the spread of Covid-19 the medical community urged the states governors to shut down literally everything from grammar schools to universities to businesses and have everyone operate from home. This has caused numerous businesses from small to large to suffer severe financial setbacks and has resulted in many closings becoming permanent. School children have felt the effect that may result in falling behind in their social skills that could have significant long-term implications as they enter adulthood and subsequently join the American workforce.

The Federal Reserve Bank (the Fed) under the leadership of Jerome Powell has tried to deal with the economic and financial impact of Covid-19. The policymakers at the Fed have attempted as best as they could to keep money flowing through the American economy. Keeping the national economy going was the primary objective of the Fed and they did it by any means necessary. Unfortunately, this has resulted in the side effect of inflation at a rate that has not been seen since the early 1980’s in the days of Paul Volcker, former chair of the Fed. But there are critics who blame the Fed for the high rate of inflation and that it is the reason the stock market and the major stock indices are in a serious slide. Some critics even feel we are currently in a recession and if not, then we will be in a recession at the end of 2022 or at the latest in 2023.

However, another view to seriously consider is that the Fed has not failed its mission and perhaps it has done its job as well as can be expected.

What the Fed needed to do

In 2020, the Fed was confronted with a dilemma that was unique in its scope and size. A virus was making its way from China to Europe and finally to the western hemisphere and the United States. The origin of the virus was unknown. How fast it could travel from one person to another and whether it affected animals was a mystery. But what was known was that those who caught the disease became very sick with flu-like symptoms and could be bed ridden for days if not weeks. Also, people were dying from this virus because it attacked their lungs. People who came down with this virus were being isolated and could not have human contact of any kind.

For scientists and medical doctors around the world, the scramble was on to find the cause of the illness, how to treat it, who was most likely to become infected, a cure, and a vaccine to prevent its spread. But until then, people were dying at horrific rates with the number of those infected reaching dangerously high levels. Hospitals were overrun with patients infected with the virus and those who died had their bodies placed in freezer trucks until they could be brought to a funeral home and eventually buried in nearby cemeteries.

Scientist and doctors were baffled on how fast this virus could travel and they were advising government officials to literally shut down businesses and restrict travel. They also advised that people avoid physical contact with one another, the wearing of surgical masks, and washing hands with soap and water on a frequent basis. Even with these precautions, the virus, given the name, Covid-19, was still spreading, people were still falling ill, and many were dying agonizing deaths.

On the orders of state governors and city mayors, businesses, large and small were ordered to shut down with no date scheduled for reopening. The United States, whose economy is based on consumer consumption, saw a severe and drastic decline in its gross domestic product (GDP) in a matter of weeks. Brick and mortar retail stores, restaurants, manufacturing plants, and churches were forced to shut down or else face repercussions from state and local governments. The only businesses that were able to survive the crisis were those that had plenty of cash, were innovative in being able to get their products delivered to their local customers, or were e-commerce businesses that made their money selling over the internet. Those that did not use the internet to sell their products or had low cash reserves or could not innovate, would soon close their doors permanently. The Fed realized that the economy of the United States could collapse due the sudden shut down of businesses and firms.

The Fed took immediate action with the infusion of massive amounts of cash into the American economy. Among these actions were:

Policy rate cuts: The fastest method that the Fed had available was through the Federal Open Market Committee (FOMC), the key monetary policy making body of the Fed, in March 2020 when it lowered the federal funds target range 150 basis points to 0% to 0.25%. The premise here was lowering the interest rates for short term funds transfers between financial institutions, such as Fed member banks, that are usually for a period of one day. In other words, the fed funds program allows member banks of the Federal Reserve System to borrow from one another on an overnight basis. By having the fed funds rate go to 0 or near 0 percent, allowed member banks to more easily borrow money at much cheaper rates. The aim and purpose of the fed funds rate is making money not only cheaper but also more liquid and allow it to move faster through the banking system and eventually the American economy.

Lowering these rates helped to reduce interest rates on a broader scope for business and personal borrowing, put more money into circulation in the American economy, and hopefully spur on spending by companies and average consumers. The tactic by the Fed was to take immediate action since the very real possibility that the American economy could sink faster and deeper than what happened in the Financial Crisis of 2008-2009.

Asset Purchase Programs: The goal in this policy objective was to purchase diverse financial instruments in order to put more money into mass circulation in the American economy. This was implemented in the Financial Crisis of 2008-2009, but the unique move by the Fed was an open-ended purchase program. This involved purchases by the Fed of Treasury securities and agency mortgage-backed securities (MBS).

The objective here was to make substantially more money available to commercial banks and other financial institutions so they could ultimately make the funds available to businesses and consumers. The purchase of Treasury securities reached a peak of $75 billion in late March 2020 and went to a rate of $51 billion per day or $357 billion per week. This rate far surpasses and came at a quicker rate than the peak of $120 billion on a monthly basis during the Financial Crisis of 2008-2009. The Fed was buying more assets in the form of securities and at a much faster rate than ever before. Even though this caused the Fed’s balance sheet to increase substantially ($2.9 trillion in less than three months) and reverse direction from its earlier policy goal of getting rid of diverse assets, the idea was to put more money into circulation at a time when those funds were desperately needed.

The Fed was attempting to convert financial instruments into cash as soon as possible. During the Financial Crisis, the Fed purchased $600 billion in Treasury securities over several months in 2010. However, in March 2020 the Fed purchased approximately $543 billion worth of Treasury securities in one week. The incredible part of this situation is that in 2007, the Fed had a balance sheet that was approximately 6 percent of the size the U.S. macroeconomy.

The Fed’s objective was not only to make more money flow through the American economy but also to make sure that the credit markets could operate as they would in normal times. The Fed did what it could and how it could, in order to make sure money was flowing through the American economy. On June 10th, 2020 the Fed stated that it would purchase at least $80 billion monthly of Treasury securities, and $40 billion worth of residential and commercial MBS securities as long as it needed to. This incredible purchase of this type of assets saw the Fed’s securities portfolio grow to $6.1 trillion from $3.9 trillion in the time period between mid-March and mid-June of 2020.

Lending facilities: While purchasing securities assets helped, the Fed realized it needed to diversify its programs to help the American economy. The Fed restarted its lending programs from the Financial Crisis of 2008-2009 while also expanding its facilities. But because the situation was so dire, the Fed was forced to expand its lending programs to include municipalities, corporations, and small and medium-sized enterprises (SMEs). On April 9th, 2020 the Fed announced a $2.3 trillion emergency loan program in order to give a boost to local governments and municipalities as well as SMEs. The program involved giving increased liquidity to commercial banks which in turn would lend to small firms under the Paycheck Protection Program (PPP). The Fed also expanded its lending program by lending directly to SMEs through the Main Street Lending Program. As explained by Professor Kinda Hachem of the University of Virginia Darden School of Business: “The banks will make the loan, but the Fed will take on the exposure, and there’s collateral from the Treasury so that the Fed is not knowingly taking on credit risk. I think that’s the [program] economists are the most excited about, because it has the potential to very pointedly direct funding to the places that need it most acutely.”

Other programs included the New Loans Facility, Expanded Loans Facility, and the Priority Loans Facility in the Fed would make loans totaling $600 billion for terms of up to five years. Participation in the programs included firms having up to 15,000 employees or a maximum of $5 billion in annual revenues. The premise was to expand not only the amount of loanable funds, but make more money available to more businesses.

While there were other lending programs the Fed implemented, the objective was to make more funds available than what commercial banks would normally do.

The side effect of massive cash infusions

In finance and economics, every action has a reaction, whether it is good or bad. This may sound too simplistic, but that is what happened with the Fed’s actions regarding its infusion of massive amounts of money into the American economy in 2020 and 2021. The action was that the Fed pumped trillions of dollars into the American economy to keep it functioning and that the flow of money would continue from savers and investors to the parties who would need it. This includes business owners and corporations who needed cash to keep their doors open and stay afloat. Without this infusion of financial capital, businesses would close their doors, lay off workers, and given the domino effect, have a serious impact on the nation’s macroeconomy. The Fed was that party that put cash into the American economy by reducing interest rates to 0 percent, purchased massive amounts of Treasury securities, and made emergency loans to local governments and municipalities.

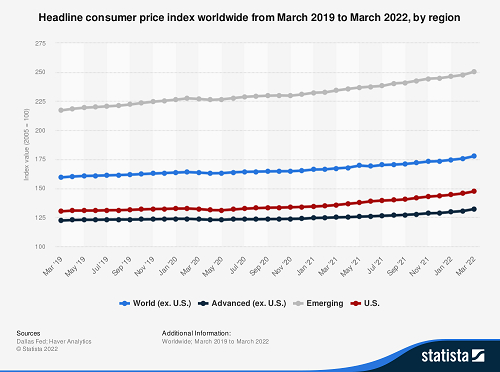

However, the side effect to this massive infusion of cash is the inflationary situation the United States is now experiencing. As of July 13th, 2022, the consumer price index (CPI) was reported at a year-over-year (YOY) rate of 9.1 percent. This is the highest rate since the mid-1980’s and that many hope will be the peak rate for 2022 and years to come. That remains to be seen. But for now, this is the repercussion of the Fed’s previous action of injecting cash into the American economy.

The Fed was placed in a very difficult position in 2020:

- Do nothing and witness a financial collapse of the American economy that would make the Great Depression of the 1930’s look like a child’s fifth birthday party

- Pump massive amounts of cash into the American economy and see the CPI reach close to 10 percent

But even with the CPI reaching new heights, the American economy is still in good shape with companies showing record profits, unemployment at 3.6 percent, job creation at or above 400,000 on a monthly basis, and companies such as Coca Cola, Levi Strauss, FedEx, and Target Corporation who have actually raised their quarterly dividends.

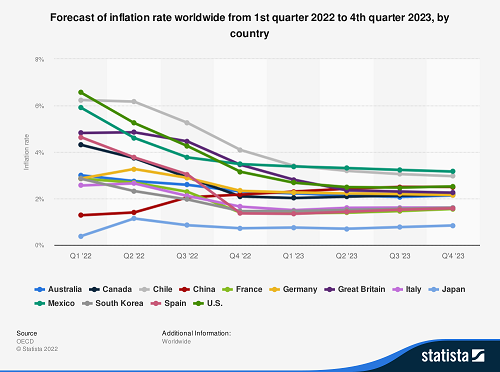

Inflation will eventually go down as the Fed will raise interest rates later in July and in subsequent months. The rise in prices is ultimately the consequence for rescuing the American economy when it needed help. It will take a matter of time until consumer prices come down to a reasonable level. But the key idea to keep in mind is that the Fed did not fail in its initial response in rescuing the American economy: The side effect of inflation was to be expected.