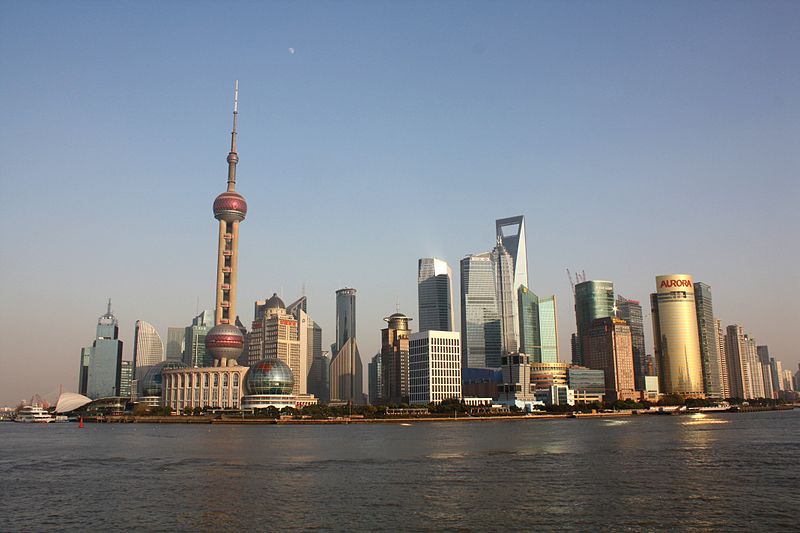

The performance of the Chinese economy over the last three decades was truly dazzling for many. But it was especially disappointing for the proponents of a positive correlation between economic success and democratic features, such as transparency in official economic transactions, establishment of the rule of law, and the implementation of active checks-and-balances on state officials. That is because China was rapidly elevated to a level of economic success (in macroeconomic terms) while it was still ruled by an opaque, omnipotent, and unaccountable single-party regime engulfed in rampant corruption. This means that although the principles of economics suggest the opposite, corruption and economic growth advanced hand-in-hand in China. Nevertheless, at this juncture the real question is whether these two dynamics of the Chinese economy were complementary in nature, or if growth was accomplished despite rampant corruption.

Although relevant studies suggest that corruption was brought under control during the last decade, it is still an important factor defining the political and economic environment in China. Recent studies reveal that the overall level (considering minor and major cases in total) of corruption flattened out and was well under control after the mid-1990s in China.* The Corruption Perceptions Index (CPI) issued by Transparency International (TI) also ranks China better today than it did in the 1990s.Considering that (Yong, p.361) China received a grade of 6.5 by TI in 2011, compared with 7.57 in 1995, it is clear that China fared well in the last decade in its struggle against corruption. [1] Nevertheless, the total amount of money involved in corruption actually increased despite the decrease in the total number of cases; therefore the real situation is much more serious than it looks—especially concerning major cases of corruption. [2]

Economic repercussions

Contrary to the theory which claims corruption is a lubricant in bureaucracies which are not bound to efficient legal mechanisms or which are compressed from both sides by heavy regulations and involution, corruption is actually a true source of economic loss according to empirical data. For instance, data from TI indicates that the total amount of money lost to corruption every year is between $20 to $40 billion in transition economies and developing countries. In the case of such African states, the index reveals that money lost to corruption accounts for nearly a quarter of the annual GDP of the respective countries. (Wen, p.495)In case of China though, the overall picture seems relatively better. The total amount of money involved in corruption in China annually is estimated to correspond to between 3%and 5% of the country’s GDP. However, considering that around 1.5% of the GDP is wasted through corruption in just public infrastructure projects and government purchases, it is clear that the concentration and absolute total of money involved in corruption in the public sector points to a severe situation. [3]

Corruption has many concrete side effects on the economy. For instance, Chinese bodies combating corruption have revealed that in many instances country governments waste potential agricultural development spending on administrative spending, payroll, cars, and real estate. Even the slowing speed of agricultural development and rural household incomes witnessed since the 1980s is considered to be a result of such organizational corruption on the part of local governments. (Luo, p.287) It is also known that a great share of the money laundered out of China originates from corruption and embezzlement. According to some estimates, around $24 billion is illegally gained and secretly laundered out of China every year. [4]

On the other hand, corruption has a strong influence over the perceptions thatshape economic dynamics in a country. Because of the high levels of corruption (and especially the widespread bribery in China) a lack of confidence emerges on the part of investors—which is discouraging, especially for foreign firms as they are often compelled to refrain from entering the market and conducting business due to the corrupt practices of officials. As transaction costs become unpredictable, the operational stability and the business culture of globally-active firms is threatened in China. [5] A lack of transparency in the system leads to corrupt behavior such as nepotism and tax fraud as well, which render the economy inefficient to some extent as markets are distorted and fair competition is inhibited. [6]

Firms operating in the Chinese market are also inhibited by extra opportunity costs and they are further discouraged from investing due to a visible disregard to private ownership rights by the government itself. As local governments prey on local enterprises, including private, state-owned, and foreign companies, some of these enterprises need to cut their remaining costs set aside for technological upgrades, or regarding plans to expanding their businesses. Numerous levies and charges on small businesses—especially imposed in line with an illicit rent-seeking motive by a score of governmental departments, local governments, and various state agencies—serve as a tool of deterrence against further investment. [7]

Evolving patterns of corruption

Despite all its detrimental effects, some theorists argue that high-level corruption is more predictable and it bears reduced transaction costs while lowering risk in economic terms. Therefore, the bureaucratic elite and the business elite collude in a mutually-sustaining relationship as “business partners” in paving the country’s developmental path to growth through the provision of reciprocal material incentives.[8] As a matter of fact, the Chinese economy performed much better than the rest of the world between 1979 and 2002, when GDP per capita in China grew by a factor of ten, or 500.8 percent in real terms, while the global average was 44.6 percent. [9] Chinese GDP growth averaged 10.4% annually between 1991 and 2011. Indeed, GDP per capita in China increased thirteen-fold from 1980 until 2010. [10] Deeply surprising many China-collapse theorists, China became the world’s second largest economy on 14 February 2011, as its economic volume reached $5.3 trillion. [11]

A relevant reason for why corruption did not totally inhibit economic growth and enrichment in China is that administrative corruption, which is identified with embezzlement and misappropriation, was mostly eradicated by successful reforms in the field of governance and anti-corruption. Minor corruption usually takes place through administrative means which rely on the direct plunder of public assets, and which victimizes the whole economic structure. On the other hand, major corruption which has increased and intensified recently, is mainly conducted through bribery, a transaction between two parties which are both beneficiaries. While administrative corruption causes insecurity for property rights from the perspective of investors and causes capital flight, transactive corruption, around which major cases revolve, does not involve the systematic destruction of an economy’s essentials.

The structural transformation in patterns of corruption in China which shape the current relationship between the increased rates of corruption and economic growth took place through the marketization of the Chinese economy. Unlike the early years of economic reforms initiated in 1978, the 1990s saw the emergence of new economic actors and channels of profit, legitimate as well as illegitimate. This transformation created a class of factory managers and private entrepreneurs as it reached saturation by the 1990s. This new entrepreneur class was able to manipulate capital accumulation, thanks to rapid economic growth and increasing profits, in the name of greasing the skids of the bureaucratic machinery. Instead of directly pillaging the essentials of the economy, which would be a detrimental act in relation to their own interests as well, these people discovered a mutualistic pattern concerning their relations with the (rest) of the state bureaucracy, which is unusual in traditional communist systems. [12] It is important at this juncture to note that disciplinary corruption involving non-economic and mostly politically-motivated behavior also increased at the same time; although such forms of corruption have minor economic ramifications according to empirical data. [13]

The changing pattern of corruption became all the more apparent as the share of the markets in the Chinese economy grew due to continued reforms. Corrupt transactions involving the transfer of public assets from state procurement to free markets, which gained pace in the 1990s and with the privatizations of the last decade, only accelerated this process. As markets were more efficient and the motor force behind growth, economic success was correlated with increasing corruption. Even though corruption is proven to be detrimental to growth in capitalist economies, such a specific case of misallocation and inefficiency as a result of transactive corruption in a transition economy can only lead to “marginal costs” as described by economists. China’s case is therefore essentially different from ones identified with cronyism, kleptocracy, and detrimental structural corruption that are valid in many other developing countries. It is, however, rather similar to the cases of the East Asian Tigers.

Future prospects

There is light at the end of the tunnel in case of China if we assume the argument set forth here is valid. The marginal costs of corruption, although increasing, are today easier to combat in China. There is much public attention on these areas thanks to awareness generated by the media, which serves as a limited check-and-balance institution. The relevant Chinese state institutions are able to find the necessary public support and political legitimacy, therefore, to combat corruption.

The roots of the problem are being targeted today. Alongside corruption involving public officials, which is a reflection of a deeper, private culture of corruption, commercial bribery was also targeted successfully by a special campaign in 2005. A similar five-year campaign came to an end in 2008, following the establishment of the National Bureau of Corruption and Bribery in 2007. Therefore we can say that through revising legal frameworks and successive campaigns, Chinese efforts have produced fruits in at least controlling the overall level of corruption. Also, due to reforms by the Chinese government in the fields of administrative organization, auditing, taxation, public procurement, financial recentralization, and the recruitment procedures regarding public officials, corruption has been brought under control to a certain extent, especially after the 2000s. Added to these was the increasing role of the private sector that prevented the public sector from becoming overwhelming in the economy. [14]

At the heart of China’s immunity to deeper blows caused by the rise in corruption lies the fact that the Chinese market is too big and irresistible for many investors, despite structural impediments such as rampant bureaucratic corruption. Also, the Chinese population and potential is too large to let structural deficiencies overshadow its absolute gains. Such a unique potential is only partially mobilized today in favor of economic development due to structural and social impediments which also lead to corruption. Still, China is able to maintain a complicated but functioning bureaucratic order in a huge country with a gigantic population and economy. The current situation, although severe in relative terms, is not something that can impede the overall development of the economy and its systematic essentials in China.

Nevertheless, there is a deeply structural element beneath widespread corrupt practices in China which needs to be ultimately eliminated in the long-run: the “unruly” rule of the Communist Party over the economy and the alternative political hierarchies (factions) active within. It is clear that Chinese authorities need to appeal to political and institutional reforms, since administrative precautions cannot combat all kinds of corruption—as demonstrated by the current situation in China. There are no well-established checks-and-balances over the Communist Party’s authority; even administrative organs responsible for combating corruption are not independent of the political penetration of factions and the Party at large. The increase in major and grand cases of corruption point to vital political stakes, and their revelations point to major conflicts between political factions dominating every rank of the state hierarchy. Thus, we can conclude that although corruption is not a major cause of economic inefficiency today, its economic as well as political ramifications will become more difficult to cope with in the future without the structural reforms exemplified by democratic, free-market economies.

*A case is considered “major” only if the accused person holds a country-level, departmental, or higher position and the money involved exceeds 10,000 Yuan according to provincial reports.

Bibliography

[1]Wedeman, A. “Growth and Corruption in China”, China Research Center Articles, Vol.11, No.2, 2012, available at:http://www.chinacenter.net/growth-and-corruption-in-china/ (Accessed on 31 December 2013) [2]Yong, G. “Corruption in Transitional China: An Empirical Analysis”,TheChina Quarterly, Vol.194, 2008, 349-364. [3]OECD. “Fighting Corruption in China”, Governance in China, 2005, 105-131. [4] OECD. “Fighting Corruption in China”, Governance in China, 2005, 105-131. [5]Wen, S. “The Achilles Heel that Hobbles the Asian Giant: The Legal and Cultural Impediments to Antibribery Initiatives in China”, American Business Law Journal, Vol.50, No.3, 2013, 483-541. [6] Wen, S. “The Achilles Heel that Hobbles the Asian Giant: The Legal and Cultural Impediments to Antibribery Initiatives in China”, American Business Law Journal, Vol.50, No.3, 2013, 483-541. [7]Luo, X. “Booty Socialism, Bureau-Preneurs, and the State in Transition: Organizational Corruption in China”, Comparative Politics, Vol.32, No.3, 2000, 273-294. [8]Shliefer, A. & Vishny, R. “Corruption”, Quarterly Journal of Economics, Vol.108, No.3, 1993, 599-617. [9]Wedeman, A. “The Intensification of Corruption in China”, The China Quarterly, Vol.180, 2004 895-921. [10] Wedeman, A. “Growth and Corruption in China”, China Research Center Articles, Vol.11, No.2, 2012, available at:http://www.chinacenter.net/growth-and-corruption-in-china/ (Accessed on 31 December 2013) [11] Wen, S. “The Achilles Heel that Hobbles the Asian Giant: The Legal and Cultural Impediments to Antibribery Initiatives in China”, American Business Law Journal, Vol.50, No.3, 2013, 483-541. [12] Wedeman, A. “Growth and Corruption in China”, China Research Center Articles, Vol.11, No.2, 2012, available at:http://www.chinacenter.net/growth-and-corruption-in-china/ (Accessed on 31 December 2013) [13]Ko, K. & Weng, C. “Structural Changes in Chinese Corruption”, The China Quarterly, Vol.211, 2012, 718-739. [14] Ko, K. & Weng, C. “Structural Changes in Chinese Corruption”, The China Quarterly, Vol.211, 2012, 718-739.Source: Turkish Weekly