By Shashank Ramesh

Introduction

Terrorist financing has posed a significant challenge in countering terrorism, as financial strength is vital to conduct all terrorist activities. Terrorist financing refers to the procuring of financial means to promote and assist terrorist activities. It may involve funds that are procured from authentic and legal sources, such as personal donations and profits from businesses and charitable organizations, as well as from criminal sources, such as the drug trade, the smuggling of weapons and other illegal goods, fraud, kidnapping, extortion and money laundering. Understanding terrorism finance facilitates the overall ability to understand terrorists, their organisation, their support structures, and their methods. This in turn, helps in the overall goal of defeating terrorism.

How important is money to the terrorist organisations? Can ideology alone drive any organisation to success? How do many of these terrorist organisations function? These are some of the questions that many wonder about. Ideology, for a terrorist organisation is the most important driving force that imparts identity to it and becomes its unique selling proposition, however it is money that acts as the lifeblood which helps them organise, coordinate and execute their actions. Many counter terrorist agencies try to take the path of battling against these mischievous organisations on a physical level which have proved to be frivolous in nature, this has more often resulted in creation of binaries in the society as the impact of such battles affect the entire population in the ecosystem, resulting in an ‘us vs them’ tussle with the government. It is also said that it is impossible to remove terrorism from its roots by just eliminating terrorists who overtly fight. In order to see any positive results in the future, two important sources of terrorists must be targeted. These sources are – Ideological source and the financial source. Without considering these sources, just attacking the terrorist groups on the superficial level will not solve the problem. It needs a methodological approach to stop the supply of people and money to the cause of terrorism. This paper deals with the analysis of the latter, the source of money, or the source of finances for terrorism and how prepared the world is in general, and India in particular, to tackle the issue of terrorism financing.

Terrorism and Terrorism Financing

Understanding some basic concepts of terrorism is essential before starting with its financial aspect. Terrorist financing is just one aspect of the overall issue of terrorism. Along with financial, it has been a cultural, religious and ideological battle waged on a nation’s government in order to alter the power paradigm, from either internal, external or both the sources with an aim to destabilize the government, their major tool being the fear they generate by inciting violence or by announcing the possibility of inciting violence on especially the uninitiated non-combatant civilians but also on the security forces of a country. Terrorism has been a very challenging concept for scholars to define, as there is no consensus in identifying a common unifying definition for terrorism. Etymologically, the term terrorism means “practicing the trembling” or “causing the frightening” as the word terror is derived from the Latin word ‘terrere’ which means to frighten or tremble, and the suffix ‘isme’ refers to practice, hence giving the meaning “practicing the trembling” or “causing the frightening”.[1] There is no commonly accepted definition for terrorism, scholars have highly contested about various characteristics of terrorism with varying perspectives, this has resulted in a plethora of definitions coming from different agencies and scholars, highlighting various aspects of terrorism. According to Alex Schmid and Albert Jongma, “Terrorism is an anxiety-inspiring method of repeated violent action, employed by (semi) clandestine individual, group, or state actors, for idiosyncratic, criminal, or political reasons, whereby—in contrast to assassination—the direct targets of violence are not the main targets. The immediate human victims of violence are generally chosen randomly (targets of opportunity) or selectively (representative or symbolic targets) from a target population, and serve as message generators.”[2] This definition throws light on some important features of terrorism such as its motives and purposes, but it leaves out some important aspects such as the systematic nature of terrorism, the power dynamics of terrorism among others. Miryam Lindberg, in her work ‘Understanding Terrorism in the Twenty-First Century’ has listed down some important points that define terrorism, they are – i) it’s about power ii) it is a systematic and planned act iii) it is designed to inflict fear iv) it is carried out by non-state actors v) Terrorists are rational. They make favourable and economic decisions in order to achieve their targets.[3]

From the above mentioned points, two points must be highlighted to begin with terrorism financing, the first point being – terrorism is a systematic and planned act, and the second point is – terrorists are rational. Many scholars have suggested that terrorist organisations function in a very systematic fashion. To put it in corporate terms, activities such as recruitment, training, procurement of explosives, logistics, etc., are systematically planned and executed with finance playing the most important role in keeping this process running. Along with their day to day functioning, the planning and executing of terror activities generally depend on their monetary strength. Hence, they not only have to make rational choices regarding planning and execution of terror activities, but also regarding their source of income. Not all organisations are as rich as Islamic State of Iraq and the Levant (ISIL) or as popularly funded like Palestine Liberation Organization (PLO), they need to have a functional source of revenue in order to survive and function. Generally, they have multiple sources of revenue such as donations, weapon trafficking, drug trafficking, trafficking of other illegal goods, money laundering etc.

Terrorism Finance and Money Laundering

“There are hundreds wishing to carry out martyrdom-seeking operations, but they can’t find the funds to equip themselves. So funding is the mainstay of jihad.”[4] A statement made by Sheik Saeed, one of the top leaders of Al Qaeda, stating the importance of the flow of finance to the terrorist outfits to carry out terror activities. However, on the outset, terrorism doesn’t seem like an expensive act. The cost of the most vicious terrorist attacks have been reported to be very low. The cost incurred to carry out the 9/11 attacks, which set the benchmark for the future terrorist attacks, was reported to be just $500,000, the cost of the attacks in Paris in 2015, which created a lot of panic not only among the Western countries but in all over the world, was reported to have costed $10,000 or less[5], and the cost of carrying out 26/11 Mumbai attacks, which rocked the entire country and has been deemed as one of the worst attacks in India, is reported to be just in the range of 2 -2.5 crores.[6] Sean Paul Ashley, in his article, ‘The Future of Terrorist Financing: Fighting Terrorist Financing in the Digital Age’, argues that these estimations do not provide a complete picture of running a terrorist organisation. These estimations only include the people on the screen carrying the attack, and the explosives that are made out of cheap materials which are used for attacks. This indicates ‘only the tip of the iceberg’[7] and does not represent the actual tectonic cost of a terrorist organisation. For a terrorist organisation to thrive, a consistent and functional flow of revenue is highly essential, as its day to day functionalities depend on a consistent source of income. The terrorist organisations need to spend substantial amount in order to sustain their influence and govern their troops. Al-Qaeda’s maintenance and administration expenses take about 90% of their total income, whereas only 10% is spent for operational purposes.[8]

Terrorist financing is generally understood as an activity which deals with collecting and accumulating funds in order to support terrorism or donating to the terrorist outfits with complete knowledge regarding the intensions of the receiver of the funds. It is often associated with money laundering because of the similarity in the transactional process of both the activities as same methods are employed to disguise the source of both the activities. An important distinction between the two is that, the source of terrorism can also be legal in the form of charity and donation, as well as illegal, through criminal activities. The source of revenue which calls for money laundering is essentially criminal. Before elucidating on the relationship of money laundering and terrorist financing, it is essential to understand money laundering.

“Every criminal needs to ‘launder’ the proceeds of crime, but where organized crime, drug trafficking and corruption are involved, the consequences of money laundering are bad for business, development, government and the rule of law.”[9]

Money laundering refers to the activity of concealing an illegal source of revenue belonging to an organisation or an individual, transferring it through various channels, changing its form and misrepresenting its source in order to give a legitimate image to the funds which are generally generated through criminal activities. The above quote from Asian development bank’s document ‘Countering Money Laundering and the Financing of Terrorism’ underlines the severity of the issue. It is carried out all across the world as the highly complex nature of the global financial system has provided enough opportunities for fraudsters to manipulate the financial and legal organisations. Profit making criminal activities generally have well defined strategies to convert their profits into legitimate revenue, these activities make use of certain loopholes in the financial and legal systems in various countries. The issue of money laundering is a global phenomenon, as it is not bound by any national boundaries. The money laundering mafia is transnational in nature, the money is moved to various countries through various sources in order to safeguard it from public attention. The United States Department of States, in 2012 prepared a list of countries which are a matter of concern regarding money laundering activities under three headings – Countries/ jurisdictions of primary concern, countries/ jurisdictions of concern and countries/ jurisdictions monitored. There were over 200 countries/jurisdictions that were evaluated and classified in the list, out of which 66 countries were listed as Countries/ jurisdictions of primary concern which included countries such as India, United States of America, China, Australia, France, Germany, Canada and Japan among others. Further, 68 countries were classified as Countries/ jurisdictions of concern[10], which provides a staggering image of the magnitude of the challenge posed by money laundering to the global political and financial system. As per a study conducted by The United Nations Office on Drugs and Crime (UNODC) in order to find out the magnitude of money laundering, it was found that in 2009, criminal proceeds amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) being laundered.[11] The different sources of income that are illegal and needs to be laundered are drugs trafficking, weapons trafficking, illegal trafficking of animals and animal products, human trafficking, trafficking of all types of illegal items, tax evasion, bribery, kidnapping, extortion, corruption, fraud, counterfeit currencies etc., and different mechanisms that are used to launder the money are casinos, horse racing, lotteries, single premium insurance policies, smurfing, electronic funds transfers, creating shell corporations, securities transaction, real estate investments etc. among others.

One of the most substantial definition of money laundering has come from United States Department of Treasury. It defines money laundering as “the process of making illegally-gained proceeds (i.e. “dirty money”) appear legal (i.e. “clean”). Typically, it involves three steps: placement, layering and integration. First, the illegitimate funds are furtively introduced into the legitimate financial system. Then, the money is moved around to create confusion, sometimes by wiring or transferring through numerous accounts. Finally, it is integrated into the financial system through additional transactions until the “dirty money” appears “clean.” Money laundering can facilitate crimes such as drug trafficking and terrorism, and can adversely impact the global economy.”[12] This is one of the most apt definition on money which gives a vivid description of money laundering and its impact on the society. It classifies the whole laundering activity into three parts – placement of the funds into the financial system, layering the funds by moving it and transferring it through numerous accounts to create confusion and finally integration of the funds into the financial system as a legitimate source of revenue. The second and the most important aspect of the definition is the mention of the adverse effect of money laundering – terrorism.

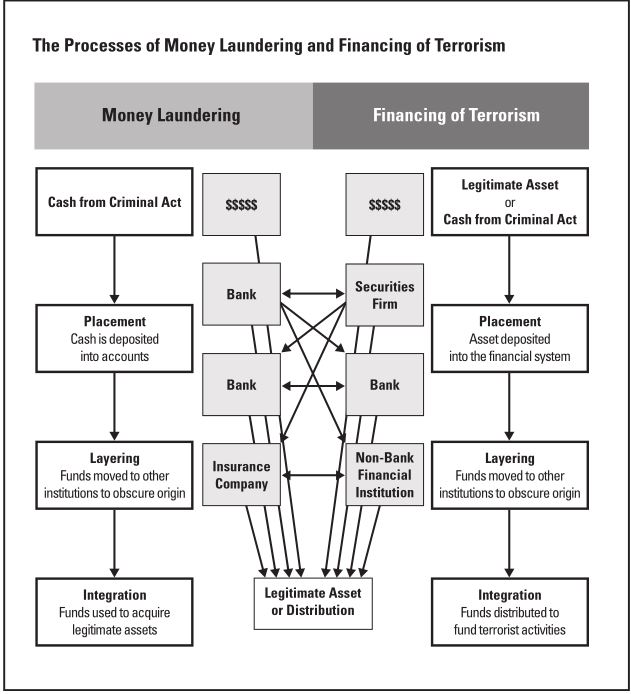

The similarities and dissimilarities of money laundering and terrorism financing is well depicted by the figure below.[13]

The image depicts three phases of money movement in the process of money laundering and terrorist financing (placement, layering and integration) which happens to be similar for both the activities, it also informs about the source of money laundering and terrorist financing and the final purpose of both the activities which sets them apart. The image also shows the different channels such as banks, insurance companies, non-bank financial institutions, security firms etc., that are used to transfer the funds by the participants of both the activities.

The process of money movement varies from organisation to organisation and from activity to activity. The above mentioned process which has been accepted by the academic fraternity only acts a guide to understand movements of the funds in general. In practice, organisations need not necessarily follow the same pattern, they may improvise by bringing in additional steps or by skipping the existing ones according to their convenience. These three steps, however, largely covers the overall process of funds movement. It starts with ‘placement’, where the money that is extracted from criminal activities are placed in a financial organisation for money laundering, and in the case of terrorist financing, the funds that are extracted could be from legitimate or illegitimate sources. The placement of money in financial institutions start the process as they facilitate the next step in the process called ‘layering’. Layering of funds are done by moving or transferring the funds to various accounts in order to disguise the original source of the funds. When the source of the funds is successfully disguised through by layering it extensively, it is ‘integrated’ back to the financial system as a legitimate source of income, and in the case of money laundering, it is integrated with the organisation which needs funds in order to carry out its terror activities.

The greatest challenge in tracing terrorist financing is that it includes all forms of money laundering to generate funds and it also gets funding from legitimate sources which do not have any traces of crime on it. The legitimate source of funding could arrive from donations, charity in the name of religion, fund raising, income generated by NGO’s etc., among others. This makes it extremely difficult to track the dough behind terrorism. The Global Relief Fund (GRF) started as a non-profit making NGO in the United States to provide humanitarian aid to the Muslims in the war affected countries such as Bosnia, Afghanistan, Lebanon etc. In 2002, the U.S. Department of the Treasury announced that GRF has links with Al-Qaeda, Osama Bin Laden and other major terrorist groups and has supported them financially by raising funds in order to assist their terror activities.[14] It is very difficult to keep a tab on the NGO’s as they are not under the government, also many NGOs working on religious sector holds an emotional connect with the society, making it further challenging for the governments to interfere in their activities. It was reported that NGOs in India received nearly Rs 12,500 crores from foreign contributors in 2013 and only 2% of the country’s estimated 20 lakh NGOs reported it, and the purpose of the money received was not mentioned any of the NGOs.[15] This establishes the depth of the challenge that counter-terrorist forces face in dealing with just NGOs itself, which is one among the many sources of finance of terrorism. In order to tackle this, there are two important steps that any government must adopt, the first step is to identify the possible sources and the second step is to establish a strong legal framework in the financial segment and as well as in the local law and order system.

Countering Terrorism Financing in India

Terrorism in India has a reasonably long history. The North-eastern states of Manipur, Assam, Nagaland and Tripura (among others), Punjab and Jammu & Kashmir has been the hub of terrorism activities, which have resulted in the creation of many dangerous terrorist organisations. There have been various attacks carried out on various parts of India outside of these three mainstream locations. Main cities such as Mumbai, Delhi, Bangalore, Hyderabad, Jaipur etc., have witnessed strikes from terrorists, Mumbai, especially being the most targeted among all the metro cities. Lashkar-E-Taiba, Jaish-E-Mohammad, Indian Mujahiddin, Hizb-Ul-Mujahideen, Manipur People’s Liberation Front, Khalistan Commando Force, United Liberation Front of Assam (ULFA), SIMI etc., are some of the prominent groups that are actively functioning in India. The North-eastern states, Punjab and Kashmir have been the safe havens for most of the organisations. As of 2015, India has banned a total of 39 organisations under section 35 of Unlawful Activities (Prevention) Act, 1967,[16] highlighting the presence of the shadow of terrorism in India. Institute for Economics and Peace, in its Global Terrorism Index named India as the 6th most affected country by Terrorism for the year 2015.[17] This further accentuates the threat that India faces from terrorism. In 2016 itself, there has been at least three attacks in India by terrorist outfits, targets being Pathankot, Pampore and Dantewada. There is a need to improve India’s counter-terrorism policy with including the cracking down of terrorist finances as a top priority along with the strategic dimensions of counter-terrorism.

Identification of possible sources of finance for terrorism in India

Jammu & Kashmir, Punjab and North-eastern states of Manipur, Assam, Nagaland and Tripura have been the hub of the terrorist activities of India. These three regions are distinct in their characteristics and the nature of challenge they impose. While in Punjab, it has largely been peaceful after the end of the Khalistan movement in the mid-1990s, the Gurdaspur attack on July 2015 indicates the fear of possible resurrection of militancy in Punjab, Jammu & Kashmir and the Northeast have seen continuous terrorist activities and has been a constant source of concern to India. Almost all the recent vicious terrorist attacks carried out could be link one of these regions. Financial strength of major organisations functioning in these two regions have been sound and secure, and one could understand that in the manner in which terrorism has found a strong foothold.

During the 1970’s, Khalistan movement was one of the major challenge India faced, as it gained a lot of momentum in this period, it could collect millions of dollars as funds to run its campaign. The major source of funds that Khalistan movement received came from the ISI of Pakistan, drug trafficking and Sikh diaspora in Canada, UK, US, Germany and other parts of the world among others. Diaspora funding has been one of the major source of income to the secessionist groups in Punjab. One can also see that diaspora funding coming to Kashmir from the Kashmiri diaspora across the world.

The issue of Jammu & Kashmir has been primarily the demand to separate the state from India and form an independent, sovereign nation. Organisations such as Lashkar-e-Taiba, Hizbul-Mujahideen, Jaish-e-Mohammad, Harkat-e-Mujahideen and Al Badr are actively functioning in the state and in other parts of the country with an intention to snatch J&K away from India.

N.S. Jamwal, in his article ‘Terrorists’ Modus Operandi in Jammu and Kashmir’ writes that around 75% of the funding of terrorist activities in J&K is funded by Inter-Services Intelligence (ISI), Pakistan and various political wings of Kashmir, around 15% comes from abroad, and the remaining 10% is generated in Kashmir through activities such as kidnaping, extortion, selling narcotics, collection in the mosques etc. He further states that about 90% of the payments are received through Hawala channels even from distant countries such as Dubai, US, UK and other European countries.[18] This gives us a birds eye view on the inflow of funds into Kashmir’s terror groups from different sources. Although the level of violence has come down in Kashmir since 2001, a report from Kashmir Herald stated that the terrorist infrastructure in robust and growing. The financial source of terror has been intact and unhindered. It also goes on to state that approximately INR 250 to 300 million is pumped in to Kashmir by Pakistan every month in order to support the activities of secessionist and militant groups.[19] Pakistan has also involved in circulating fake Indian currency notes across the country through Bangkok, Nepal, Sri Lanka and Bangladesh.

Pakistan has reportedly setup production units in Dubai to manufacture fake Indian currency notes.[20] U.S department of State, in one of its reports stated that “India also faces an increasing inflow of high-quality counterfeit currency, which is produced primarily in Pakistan but smuggled to India through multiple international routes. Criminal networks exchange counterfeit currency for genuine notes, which not only facilitates money laundering, but also represents a threat to the Indian economy.”[21] Organisations such as Hizbul-Mujahideen has actively circulated these fake currency notes that comes from Pakistan across the country to fund their terror activities in Kashmir. An investigation held by NIA had established the link between the counterfeit currencies, terrorist financing of organisations like Hizbul-Mujahideen and Pakistan.[22] It is reported that from January 2010 to June 2013, India has seized fake Indian currency notes worth approximately 107.33 crores.[23] The issue of fake currency notes has not being restricted to just Kashmir, it has also been used by the Northeast insurgent groups in generate funds. The huge inflow of fake currency notes from Bangladesh has directly affected the Northeast. Insurgents generate funds by taking protection money from smugglers along with using fake currency to fund their activities. “A part of the funding to any terror and insurgent organisation, including those in the North East and Assam, comes from illegal trade – mainly of tobacco, drugs and fake currency. This is a phenomenon we have witnessed world over”[24] Assam Additional Director General of Police Mukesh Sahay gave this statement when asked about the source of funds flowing in Northeast.

Narcotics trade is another important source of terrorism finance, which has been funding terror activities in all the three regions. The nexus with drug trafficking and terrorism is very well known as this source has been thoroughly leveraged by terror groups across the world and the terror groups in India has been no exception. Khalistan’s secessionist groups had used this source well enough to set a shining example to the future terrorists. The resurgence of pro-Khalistan groups currently has coincided with the time when Punjab is the facing serious drug addiction issues. It is reported that addiction rate is roughly 70% among youth in Punjab and is about 64% in Gurdaspur, which was a bloody attack by secessionists in 2015. Around 99% of heroin confiscated in India in 2014-2015 was in Punjab.[25] The golden crescent (Pakistan, Iran and Afghanistan), which is the largest producer of opium in the world has established India has its base to smuggle drugs to the black markets in the western countries are using Punjab the important gateway to India. The downward trend in the state’s economy, increasing drug addiction and the re-emergence of terrorism in Punjab most certainly has a nexus, and must be immediately addressed by the government. Kashmir too, doesn’t fall behind in posing a similar kind of a challenge as it has also been established an important gateway to drugs coming in from the golden crescent. According to a survey sponsored by United Nations International Drug Control Program (UNDCP), just the Kashmir division alone has over 70,000 drug addicts.[26] If the golden crescent haunts the northwest of India, the golden triangle haunts the northeast of India. Golden triangle consists of Myanmar, Laos and Thailand, with Myanmar being a significant contributor. Myanmar is second only to Afghanistan in the production of opium. States such as Manipur, Mizoram and Nagaland acts as a gateway through which these drugs enter India. Drugs from the golden triangle are also trafficked through Uttar Pradesh, Bihar and West Bengal. The northeast and Kashmir valley also has indigenous production of drugs which are sold across Asia.[27]

Hawala networks are an important source in terrorism funding. They assist in the movement of the funds from one place to another, as the network of these hawala systems are very vast and clandestine in nature. They operate in parallel with or opposed to the traditional banking system and offer financial solutions to the criminals, illegal businesses and terrorist organisations. Funds are moved through various channels by hawaladars which are very difficult to track as most of these channels appear to be legitimate on the surface level, also they change channels very often in order to make sure that they don’t leave any trails behind. This makes tracking hawala system very challenging and a daunting task. It was reported that in 2007-2008 remittances that was sent to India through legitimate, formal channels amounted to USD 42.6 billion, and the hawala market amounted to about 30%-40% of the formal channel, which could be anywhere between USD 13 billion to USD 17 billion.[28] Another report reveals that through just Kerala itself, there is an annual remittance of over 23,000 crores, and Kerala along with Delhi has the highest numbers of hawaladars functioning.[29] There is a growing concern about the manner in which hawala is thriving in India and across the world.

Along with the above described methods, terrorists use other means of extracting funds such as kidnapping, extortion, collecting funds as ‘protection’ money for criminal activities, trafficking all sorts of illegal goods such as weapons, humans, animal products etc., (which follow the same pattern as drug trafficking) and various other means. To contain these activities, a nation not only needs a strong counter-terrorist forces, it also needs a vigilant local police force to track local activities that may have international connections, efficient legal system, and most importantly awareness in the local public about such activities so that they don’t take part in such activities and report such activities to the authorities when they come across any of these activities.

Tackling Terrorism Financing in India Through the Legal Framework

Since the turn of the new millennium, the monitoring of financing of terrorist activities has come into sharper focus in India. There are quite a few laws that have been put in place to keep the activities of money laundering and terrorist financing in check. However, most of these laws are hardly stringent and the punishments meted out to the perpetrators under these laws is really mild. These laws show that India is yet to take the issue of money laundering and terrorism financing seriously as much as the laws dealing directly with the mainstream terrorism activities pertaining to violence. There is an urgent need for the policymakers to formulate strong laws to attend to money laundering and terrorism financing by integrating the entire financial system of the country. Currently, there is no single unifying coherent law to attend to all the issues of money laundering and terrorism financing. These are some of the important legal acts passed by the government of India addressing the said issues:

The prevention of money laundering act – 2002: The prevention of money laundering act – 2002 is an act of the Parliament of India enacted to prevent money-laundering and to provide for confiscation of property derived from money-laundering. The PMLA seeks to combat money laundering in India and has three main objectives: (i) To prevent and control money laundering, (ii) to confiscate and seize the property obtained from the laundered money; (iii) to deal with any other issue connected with money laundering in India. The punishment for money laundering as per this law is rigorous imprisonment for not less than three years and can extend up to a maximum of seven years and the perpetrator is also liable to pay a fine of five lakhs.[30] This act was amended twice since its introduction in 2005 and 2009 respectively.

Foreign Exchange Management Act, 1999 (FEMA): The Foreign Exchange Management Act is an act of the Parliament of India, created to “consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India”[31] Hawala crimes are punishable under this act, and the punishment meted out to the perpetrator if found guilty under this act is – “If any person contravenes any provision of this Act, or contravenes any rule, regulation, notification, direction or order issued in exercise of the powers under this Act, or contravenes any condition subject to which an authorization s issued by the Reserve Bank, he shall, upon adjudication, be liable to a penalty up to thrice the sum involved in such contravention where such amount is quantifiable, or up to two lakh rupees where the amount is not quantifiable, and where such contravention is a continuing one, further penalty which may extend to five thousand rupees for every day after the first day during which the contravention continues.”[32]

Other legal acts that are incorporated in fight terrorism financing are: Unlawful Activities (Prevention) Act, Narcotic Drugs and Psychotropic Substances Act (Amendment) bill 2014 etc.

One the global level, there are international organisations such as United Nations and Financial Action Task Force (FATF) have been working to curb the illegal financial activities by providing a great deal of assistance to member countries. They have been conducting research and gathering information regarding aforementioned issues. The FATF is an inter-governmental body whose purpose is the development and promotion of national and international policies to combat money laundering and terrorist financing. To counter money laundering, in 2003/04, it came up with forty recommendations for the member nations to incorporate. In a nutshell, it recommended its member countries should criminalise money laundering on the basis of the United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988 (the Vienna Convention) and the United Nations Convention against Transnational Organized Crime, 2000 (the Palermo Convention).[33]

In October 2001, FATF came up with nine recommendations for the prevention of terrorism financing to its member countries, they are:

- Ratification and implementation of 1999 United Nations International Convention for the Suppression of the Financing of Terrorism.

- Criminalising the financing of terrorism and associated money laundering.

- Freezing and confiscating terrorist assets.

- Reporting suspicious transactions related to terrorism.

- International Co-operation

- Alternative Remittance – Each country should ensure that persons or legal entities that carry out this service illegally are subject to administrative, civil or criminal sanctions.

- Wire transfers – Countries should take measures to ensure that financial institutions, including money remitters, conduct enhanced scrutiny of and monitor for suspicious activity funds transfers which do not contain complete originator information (name, address and account number)

- Non-profit organisations – Countries should review the adequacy of laws and regulations that relate to entities that can be abused for the financing of terrorism. Non-profit organisations are particularly vulnerable, and countries should ensure that they cannot be misused: (i) by terrorist organisations posing as legitimate entities; (ii)to exploit legitimate entities as conduits for terrorist financing, including for the purpose of escaping asset freezing measures; and (iii) to conceal or obscure the clandestine diversion of funds intended for legitimate purposes to terrorist organisations.

- Cash Couriers – Countries should have measures in place to detect the physical cross-border transportation of currency and bearer negotiable instruments, including a declaration system or other disclosure obligation.[34]

On 9th December 1999, ‘International Convention for the Suppression of the Financing of Terrorism’ was drafted by the United Nations in order to criminalize financing terrorism activities. The convention also seeks to promote police and judicial co-operation to prevent, investigate and punish the financing of such acts. As of July 2015, the treaty has been ratified by 187 states; in terms of universality, it is therefore one of the most successful anti-terrorism treaties in history.

Conclusion

Terrorism is phenomenon that has dominated the world affairs in the last decade and a half and the current trends indicate that it will go on to do so in the future as well. It has become a challenge for all the major countries in the world to counter this phenomenon. In order to counter terrorism, countries must take on all activities of terrorism. In this aspect, countering terrorism financing becomes as important, if not more, as countering the acts of terrorism. On the global level, there has been some effort put on building institutions and infrastructure to take on terrorism financing. Organisations such as FATF and UNO are working on bringing countries together to cooperate and work together to take on terrorism financing.

In India, however, countering terrorism financing has not found the sort of importance in needs as India is one of the most affected countries by terrorism. There is an urgent need to build institutions and infrastructure that are capable to take on the flow of terrorist finances in an effective manner.

References:

- Jonathan Matusitz, Terrorism & Communication. A Critical Introduction (California: SAGE Publications, 2012) p. 1.

- Alex Schmid and Albert Jongma, Political Terrorism: A New Guide to Actors, Authors, Concepts, Data Bases, Theories, and Literature (Amsterdam: Transaction Books, 1988) p. 28.

- Miryam Lindberg, “Understanding Terrorism in the Twenty-First Century”, Grupo de Estudios Estratégicos, no 7651, 2010, pp. 2-3.

- Obama Stays The Course On Terrorist Financing, accessed on 31 March 2016.

- Robert Windrem, “Terror on a Shoestring: Paris Attacks Likely Cost $10,000 or Less” NBC News (New York), 18 November 2015, accessed on 31 March 2016.

- “Did the 26/11 terror strike cost ONLY Rs 25 lakh?”, accessed on 19 March 2016.

- Sean Paul Ashley, “The Future of Terrorist Financing: Fighting Terrorist Financing in the Digital Age”, Penn State Journal of International Affairs, (Pennsylvania) pp. 9-26.

- Thomas J. Biersteker and Sue E. Eckert, Countering and Financing of Terrorism, (New York: Routledge, 2008) p. 8.

- “Countering Money Laundering and the Financing of Terrorism” Asian Development Bank, 2003, accessed on 31 March 2016.

- “2012 INCSR: Major Money Laundering Countries”, U.S. Department of State, United States of America, 2012, accessed on 31 March 2016.

- “How much money is laundered per year?”, Financial Action Task Force

- “History of Anti-Money Laundering Laws”, United States Department of Treasury, accessed on 31 March 2016.

- Money Laundering and Terrorist Financing: Definitions and Explanations, accessed on 1 April 2016.

- “Treasury Department Statement Regarding the Designation of the Global Relief Foundation”, U.S. Department of Treasury, United States of America, 2002, accessed on 2 March 2016.

- Rahul Tripathi, “Rs 12,500 cr from abroad and only 2% NGOs report it: Home ministry” The Indian Express (New Delhi), 16 June 2014, accessed on 2 April 2016.

- “Banned Organisations”, Ministry of Home Affairs, Government of India, 2015, accessed on 2 April 2016.

- “Global Terrorism Index: Measuring and Understanding the Impact of Terrorism”, Institute for Economics and Peace, accessed on 2 April 2016.

- N.S. Jamwal “Terrorists’ Modus Operandi in Jammu and Kashmir”, Strategic Studies (New Delhi), Vol. 27, No. 3, 2003, p. 389.

- Kanchan Lakshman and Ajaat Jamwal, “J&K: Financing the Terror” Kashmir Herald (Kashmir), accessed on 2 April 2016.

- Arunava Chatterjee, “Exclusive: Pakistan’s ISI printing fake Indian currency in Dubai”, India Today (New Delhi) 13 October 2015, accessed on 4 April 2016.

- “2011 International Narcotics Control Strategy Report (INCSR)” Departmant of State, United States of America, 2011, accessed on 2 April 2016.

- Abhishek Bhalla, “Hizbul Mujahideen circulating fake currency in India, reveals NIA investigation” India Today (New Delhi), 24 May 2013, accessed on 2 April 2016.

- Animesh Roul, “Terrorism and Fake Indian Currency Notes (FICNs): A Growing Menace”, American Center for Democracy (New York), 22 February 2014, accessed on 2 April 2016.

- Insurgents, militants funded by drug and fake currency trade: Assam ADGP, accessed on 2 April 2016.

- Rishi Majumdar, “Shadow Lines: the drugs and terror track in Punjab” Catch News (New Delhi), 2 August 2015, accessed on 3 April 2016.

- Jaibans Singh, “Meeting the challenge of drug terrorism in Jammu and Kashmir”, ANI News (New Delhi) 26 November 2015, accessed on 3 April 2016.

- SP Saha, “Northeast: the Role of Narcotics and Arms Trafficking”, Indian Defence Review () 10 May 2014, accessed on 3 April 2016.

- “Hawala money in India linked to terrorist financing: US”, accessed on 3 April 2016.

- “Hawala Part 2: How Kerala became the hawala capital of India”, accessed on 3 April 2016.

- “Prevention of Money Laundering Act, 2002” Government of India, accessed on 2 May 2016.

- “THE FOREIGN EXCHANGE MANAGEMENT ACT, 1999” Government of India, accessed on 2 May 2016.

- Ibid

- “FATF 40 Recommendations”, Financial Action Task Force, accessed on 24 April 2016.

- “FATF IX Special Recommendations”, Financial Action Task Force, accessed on 2 April 2016.

Shashank Ramesh is a Postgraduate student at Manipal Univeristy, India