Two worlds in the same space: Main Street versus Wall Street

The economic consequences of the Covid 19 pandemic is affecting Main Street and Wall Street in different ways. It took a pandemic to finally convince economists and financial analysts that Main Street and Wall Street are really two diverse economic and financial spheres occupying the same space.

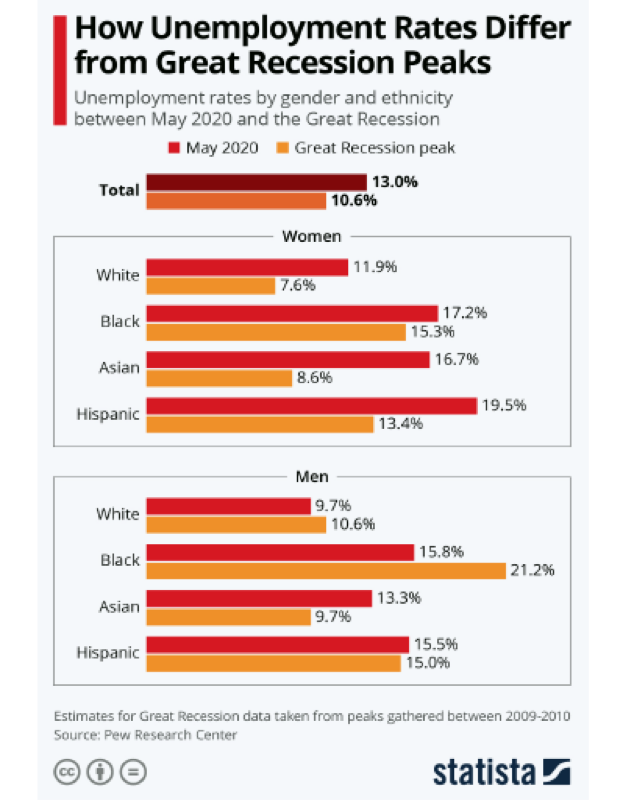

The Covid 19 pandemic is having devastating economic effects on the global economy. Not only is the pandemic causing massive unemployment, but an economic slowdown occurring faster and worse than the Great Recession of 2008-2009 and probably more destructive than the Great Depression of the 1930’s. Main Street U.S.A. is experiencing not only the loss of millions of jobs, but seeing many businesses closing their doors permanently due to economic collapse. Businesses that are still open have no idea if they will see customers come in the front door for the remainder of this and into the coming year. Business owners are urging their government leaders, in loud, distinctive, and scared voices, to remove restrictions and allow them to sell their goods and services so they can stay afloat.

Wall Street saw serious declines in the Dow Jones Industrial Average (DJIA), as well as in other major indices, as stocks took a serious tumble and investors lost trillions of dollars in financial capital in a very short time. This type of decline was last seen during the Great Recession of 2008-2009 and the Stock Market Crash of 1929. But the amazing thing is that, despite the recent downslide, Wall Street has rebounded sooner and faster than Main Street. While Wall Street has not yet recovered all of its losses from the start of the Covid 19 pandemic, it has been coming back to the point where many financial analysts feel that the DJIA could exceed its all-time high of 29,551.42 achieved on February 12th, 2020. Now the concern is why this has occurred and what it means to the American economy.

Main Street’s downward trajectory

Not since the Great Depression of the 1930’s has Main Street U.S.A. seen such a devastating period as the current one. When discussing Main Street this primarily means small businesses ranging from stores that are Mom and Pop operations with as few as two workers to larger enterprises such as restaurants employing fifty or even more people. But regardless of their size, these businesses have suffered immensely in such a short time period.

According to Main Street America (MSA), a network consisting of greater than 1,600 commercial districts throughout the United States and comprising about 300,000 small businesses, the news is not good. MSA conducted an online survey in April 2020 to better understand Covid 19’s impact on small businesses in which a vast majority had fewer than twenty employees. Among the findings of the survey were:

- Greater risk of permanent closure: Of the approximate 30 million small businesses in the United States, almost 7½ million are facing the severe risk of permanent closure in the next five months, while 3½ million faced the possibility of closing their doors in the next two months due to the financial crisis. The survey stated that almost two-thirds of business respondents are at risk of permanent closure if their businesses were facing disruption at the current rate for up to two months.

- Loss of business revenue: Almost 75 percent of the survey respondents stated that their business revenues were cut by half since the pandemic concern came about in early March 2020. Also, 57 percent of the survey respondents stated that their business revenues saw a drastic decline of 75 percent or more.

- Loss of jobs: There are approximately 35.7 million American workers who are small business employees who face the risk of being unemployed due to the financial effect of the pandemic. The survey respondents also stated that among those businesses with five or fewer workers almost 85 percent reported that anywhere between one and five employees could face the risk of being laid off.

The frightening part of the survey is that many small businesses are anticipating hard financial times due the Covid 19 pandemic unless there is a sudden turnaround or substantial aid from state and federal government programs. The ripple effect will be that small businesses will close down in masse resulting in huge amounts of unemployment, empty store fronts, and either a very severe economic recession or a depression.

Small businesses do matter since they have a significant impact on the American macroeconomy. According to the Center for Inclusive Growth, small businesses account for almost 50 percent of the jobs held by the nation’s workforce and almost 65 percent of all new jobs that are created. But a key problem for many small businesses is trying to survive the ups and downs they face. For example, according to the same study by the Center for Inclusive Growth, on average small businesses have just 27 days of cash on hand which is not a great deal in order for any business to survive. This means that many small businesses will need an infusion of cash in the form of grants, loans, or opening up of the American economy in a very, very short period of time.

A study conducted by the Federal Reserve Bank of Richmond in April 2020 collected data on the effects of Covid 19 on small businesses. The survey collected data from restaurants, food and beverage businesses, retail stores, and service firms. Among the findings of the study were that:

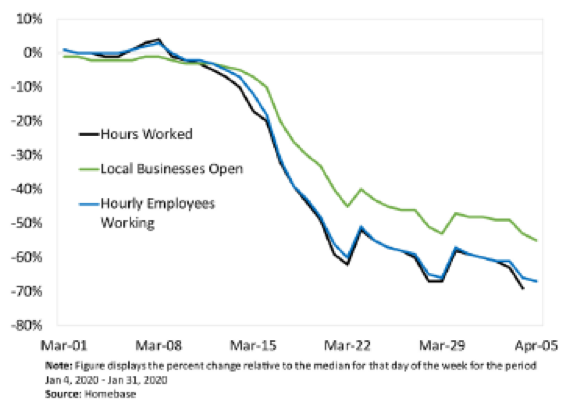

- Decline in hours worked by employees: The hours worked by hourly employees declined precipitously, while the number of local businesses that are open, and the number of employees working also dropped at a steep rate. The survey showed that the hours put in by hourly employees as well as the decline in the number of workers dropped by 70 percent yet only 50 percent of local businesses stayed open in the period from March 8th to April 5th. The problem here is that just about all these workers rely on putting in the most hours they can in order to make a livable wage.

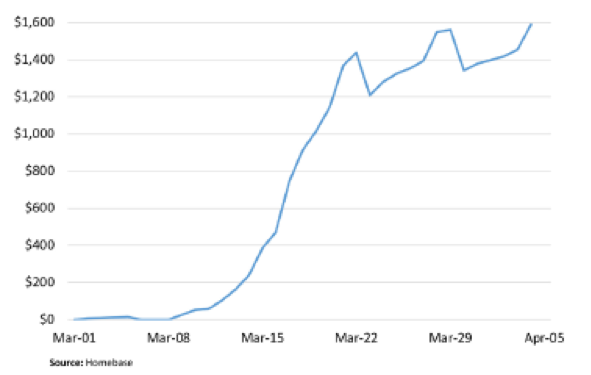

- Decline in monthly income per employee: The study also showed the average monthly income lost per worker in the areas of retail stores and restaurants was $1,600. These workers were already at the bottom of earnings for all workers and a loss of $1,600 per month only made things worse for them.

In order to help Main Street in its financial and economic dive, the Federal Reserve Bank has devised the Main Street Lending Program in which it will buy up to $600 billion worth of loans made to small and mid-sized firms. This program is designed to help lending to small and medium-sized businesses that were in good financial shape before the start of the pandemic. Among the features of the program are:

- Availability to certain businesses with up to 15,000 employees as opposed to the previous limit of 10,000 employees

- Loans could be either secured or unsecured, while previously they were only unsecured loans

- The introduction of the Main Street Priority Laon Facility which is a new lending plan having a higher maximum loan size

Hopefully, these programs will help Main Street at a time when it is desperately needed by both business owners and their employees.

Wall Street’s quick rebound

While Main Street is hurting very badly, Wall Street has seen a quick rebound that some analysts see as leading to new highs. For the DJIA, the high for the year and all time, was 29,551.42 achieved on February 12th, and it reached its low a little over a month later at 18,591.93. The DJIA closed on June 18th at 26,080.10 and some analysts fell the DJIA will reach and even surpass its all-time high. The S&P 500 Index started the year at 3,231 and saw its high for the year at 3,386.15 on February 19th, and its low on March 23rd at 2,237.40. The S&P 500 Index closed on June 18th at 3,115.34. So far, these two major indices are having a far better year than Main Street and showed a quicker rebound.

The key rules to keep in mind about Wall Street can be summed up as follows:

- The market does not like bad news: When the situation regarding Covid 19 was starting, the stock market and investors acted accordingly. Investors became very liquid very fast as they sought to minimize losses and head to quality investments such as Treasury bills regardless how low the yield was. The goal was to minimize losses and become liquid as soon as possible. Investors just wanted to safeguard their funds until volatility settled down. The stock market does not like bad news and investors became very scared. When the news is bad, cash becomes king. The bad news will cause major indices such as the DJIA and the S&P 500 to nose dive very fast.

- The market has a short memory: The stock market acts very quickly when there is bad news. But for good reasons or for bad, the stock market has a short memory. The stock market will go up, even strive for new heights when it hears good news and investors will flock back in as soon as they can. The stock market is concerned about tomorrow and if good news comes in the front door then doom and gloom exit out the back door. The stock market is really geared toward what will occur in the future and that good news will help bring a better tomorrow. As we are seeing currently, the unemployment numbers are not good, but the stock market is more concerned about what will occur six months or one year from now.

But the key ideas to keep in mind is that: Wall Street is not Main Street and Wall Street is not the macroeconomy. Both Main Street and Wall Street have been hit, and hit hard, by the Covid 19 pandemic. But each have reacted differently: Main Street sinking and Wall Street rebounding. This only reflects why they are two different worlds. Main Street reflects small businesses that are barely getting by with just enough financial capital to survive. However, Wall Street is based on the trillions of dollars in capital from rich investors, hedge funds, insurance companies, mutual funds, commercial banks, and investment firms that have a wide variety of financial strategies to see them through any down period or unexpected event. Many small businesses do not have the cash cushion to deal with unexpected events and usually must deal with each day as it comes.

The two are at opposite ends of the financial spectrum. “Wall Street has very little to do with Main Street,” says Joachim Klement, a market analyst at Liberum Capital in London. “And less and less so.” At one time in the United States, Main Street and Wall Street were interconnected and as one went so did the other. But in the last twenty or so years, each has gone in different directions and resulting in a change in the financial makeup of the United States.

“Stock ownership among the middle class is pretty minimal,” said Ed Wolff, an economist at New York University who studies the net worth of American families. He added: “The fluctuations in the stock market don’t have much effect on the net worth of middle-class families.”

Wall Street has become more of a casino using algorithms on how the actions of government and corporations will affect stock prices, now and in a few days. Once the probabilities are calculated and computer programs are devised, then stock is bought on margin or financial derivatives are purchased in order to derive double digit returns. Wall Street is pricing stocks and financial derivatives on what the world will look like in the future, whether it be tomorrow or next year. Small business owners on Main Street are just trying to make it their next payroll and have enough cash to pay their vendors. If they can keep their doors open on a week-by-week basis, then it can be considered a successful year.

Will they ever meet again?

For many economists and financial analysts, the big concern is what will be the long-term effect on the American economy on the divergence of Wall Street and Main Street. At one time, both co-existed in a convenient and harmonious manner and helped the American economy grow and prosper. A small business that was able to grow into a big firm was able to make that successful transition with an infusion of capital from Wall Street. The small business was able to grow from a Mom and Pop store into a coast-to-coast enterprise with thousands of workers and pay good dividends to satisfied stockholders. But those days are long gone, since Wall Street has other priorities such as quick returns, huge stock buybacks, and extensive use of exotic financial instruments that few can understand or explain. It is sad to see that those days when Wall Street and Main Street worked together are gone because it resulted in creating the strongest economy in the world for many decades, made jobs for millions of American workers, and provided financial safety and security this nation sorely lacks.