China’s economy needs to grow by leaps and bounds in order to feed its 1.4 billion people. This means having its factories and manufacturing plants produce goods that will be shipped around the world. But given the current situation with the Covid-19 pandemic, this has caused the demand for its goods to slow down and affect it economic and financial growth. Compounding its situation is the dilemma China’s leaders face with China Evergrande Group (Evergrande) which went from a meteoric rise to financial collapse.

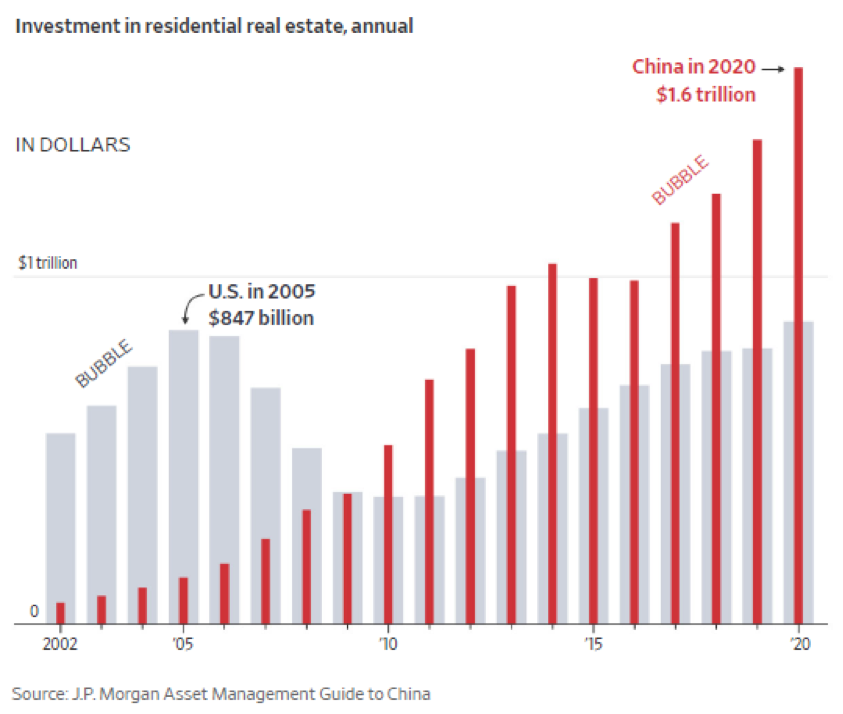

Evergrande is a 25-year-old real estate development company headquartered in the southern city of Shenzhen involved in the construction of apartment buildings and condominiums for China’s huge population. Taking advantage of the need for housing, Evergrande was able to borrow substantial amounts of financial capital but it overextended itself. Combined with the Chinese government’s recent policy to rein in the property industry, which could affect real estate connected industries, this has caused a huge dilemma for investors, the bond and debt market, and buyers of condominiums from Evergrande. This could possibly lead to a serious bursting of the housing bubble in China that many financial and economic analyst feared was bound to happen. The real problem is what the collapse of Evergrande and the Chinese housing market will mean to China’s economy.

Situation as it currently stands

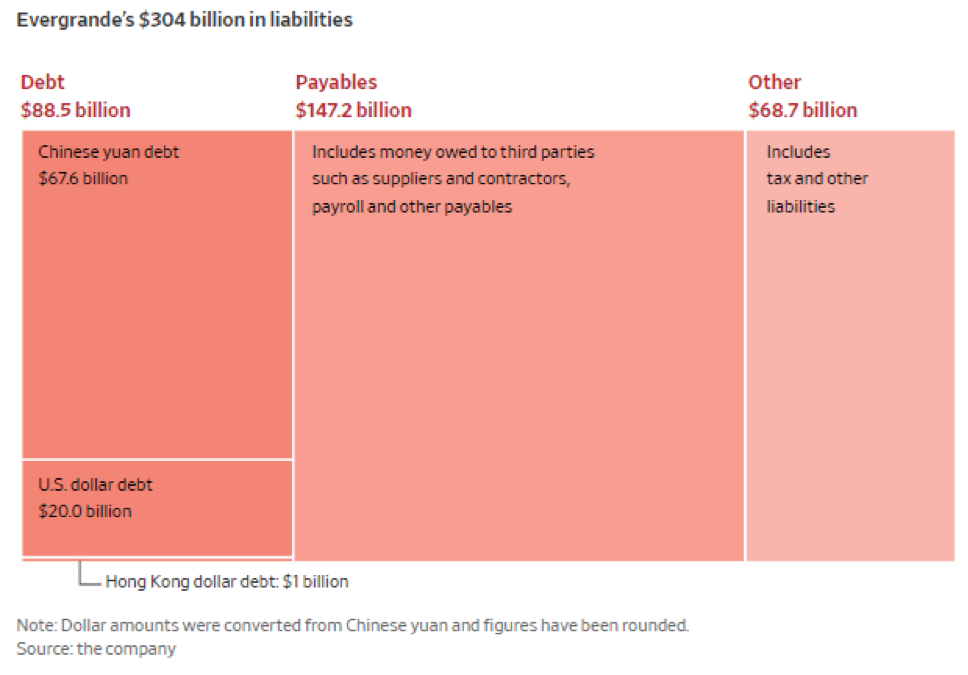

Evergrande’s situation is precarious at best since the company has managed to anger various parties vital to its existence. There are very angry and panicking home purchasers who have put up substantial amounts of money while waiting for approximately 1.6 million apartments to be finished. Various suppliers of cement, rebar, paint, wood, electrical parts, and piping, to name a few, are waiting to be paid more than $100 billion in overdue collections from Evergrande. Workers for Evergrande have made loans to the company in order to keep their jobs and to ensure that it stays afloat. However, there is no certainty that they will ever be repaid. To make matters worse, the Chinese government is considering allowing Evergrande to fail under the pressure of it having to repay debt exceeding $300 billion.

The financial markets have been deeply concerned about Evergrande’s situation and has reacted negatively by pushing down on shares of Chinese home builders and large multinational companies for fear of a financial collapse. S&P Global Ratings stated in mid-September 2021 that, “We believe Beijing would only be compelled to step in if there is a far-reaching contagion causing multiple major developers to fail and posing systemic risks to the economy.”

Evergrande’s flagship property business made an interest payment on an onshore bond in mid-September 2021. The Hengda Real Estate Group Company, which is the largest segment of Evergrande, held private negotiations with investors of an onshore bond in order to pay a 232-million-yuan coupon payment (equal to $35.9 million) that was due in the latter part of September. The bond has a five-year term with a maturity in September 2025 and a principal of 4 billion yuan.

Evergrande has become the world’s largest indebted real estate developer and China’s biggest issuer of junk bonds and debt. Evergrande has approximately $19 billion of publicly traded dollar bonds that are outstanding. The problem is that the market prices of these junk bonds had dropped to approximately 25 cents on the dollar, which reflected investors serious doubts on the creditworthiness of Evergrande’s financial situation. Investors are deeply concerned about whether Evergrande can repay its outstanding debt and bonds which could seriously harm financial markets. Many investors are worried that the possibility of default of Evergrande’s debt and bonds is very real and could be imminent.

Thu Ha Chow, a senior credit strategist and portfolio manager at Loomis Sayles in Singapore, states that, “This is a controlled, managed default that did not catch authorities or investors by surprise. It is not a ‘Lehman moment,’ but the market will be watching for any unintended consequences that may result.”

In late September 2021, Evergrande did not pay $83.5 million in coupon payments on its 8.25 percent bonds when they were due. This has caused investors to severely weigh their options on whether to further hold the bonds, or take a loss by selling at a deep discount. Either way, investors will lose on both the interest they were anticipating as creditors and the value of their bond investment. The situation only got worse as Evergrande missed another interest payment in late September totaling $47.5 million. It was not until late October that Evergrande finally made its long-awaited interest payments to the relief of creditors and the financial markets.

Evergrande must also contend with unfinished buildings and construction projects that further exasperate the situation. The company has numerous unfinished residential apartment buildings, in many cases 26 stories tall, in Lu’an, China. There is also an uncompleted $9 billion theme park which was planned to exceed the size of Disneyland in the United States. There were also plans to construct a $4 billion electric-vehicle plant in Lu’an. All these projects are either unfinished or have fallen to the wayside as never being started. This has angered Chinese government officials and could possibly hamper the nation’s drive to expand its macroeconomy through such projects. Due to this, the Chinese government may forgo financial support and a possible bailout of Evergrande in the near future.

Causes of the Evergrande situation

There are various reasons for the Evergrande situation.

Creative accounting practices: Evergrande, just like many other companies in the past, used creative accounting practices in order to make its financial statements look better than they actually were. The company did not make it clear to investors nor auditors its financial liabilities by using complex financing plans and arrangements. This included such tactics as asset sales, influx of financial capital, or government bailout. The company used odd and creative accounting methods so that it could overstate the company’s assets value in order to make it look better financially to investors and regulators. This was first noted in a report by Nigel Stevenson, an analyst at the accounting research firm, GMT Research, in 2016.

According to Stevenson’s report, Evergrande used approximately 400,000 largely empty parking spaces that were on the company’s books as being listed as investments. The company took the liberty of valuing each parking space at $20,000 each. But according to Stevenson, the parking spaces should have been regarded as inventory and be listed at less than their accounting value. Mr. Stevenson has stated that, “Evergrande is the only major developer to adopt this treatment.”

Friends in local government: Local governments in China are dependent on revenues that can be generated from construction of new buildings in their provinces. These local governments also want to see more job creation and this can be accomplished through having workers in new construction projects. Jobs put people to work which can expand the local economy and contribute to annual tax revenues for the provinces and the Chinese central government. Local government officials were willing to turn a blind eye to the financial and accounting practices Evergrande was using as long as the company’s projects built badly needed new housing in the form of apartment buildings. The provinces want to provide its people with better housing, but it came at a steep cost to China’s economic situation.

Investors who ignored the risks: Investors had a difficult time turning down the returns that Evergrande was offering on its dollar debt instruments. Evergrande was offering interest rates on its bonds that went from 7.5 percent to almost 14 percent. As one investor justified his investment with Evergrande, “I knew of the red flags, it’s one of the most levered companies out there. But it was one of the highest-yielding bonds in the market.” At one time that investor owned between $20 million to $80 million in Evergrande bonds.

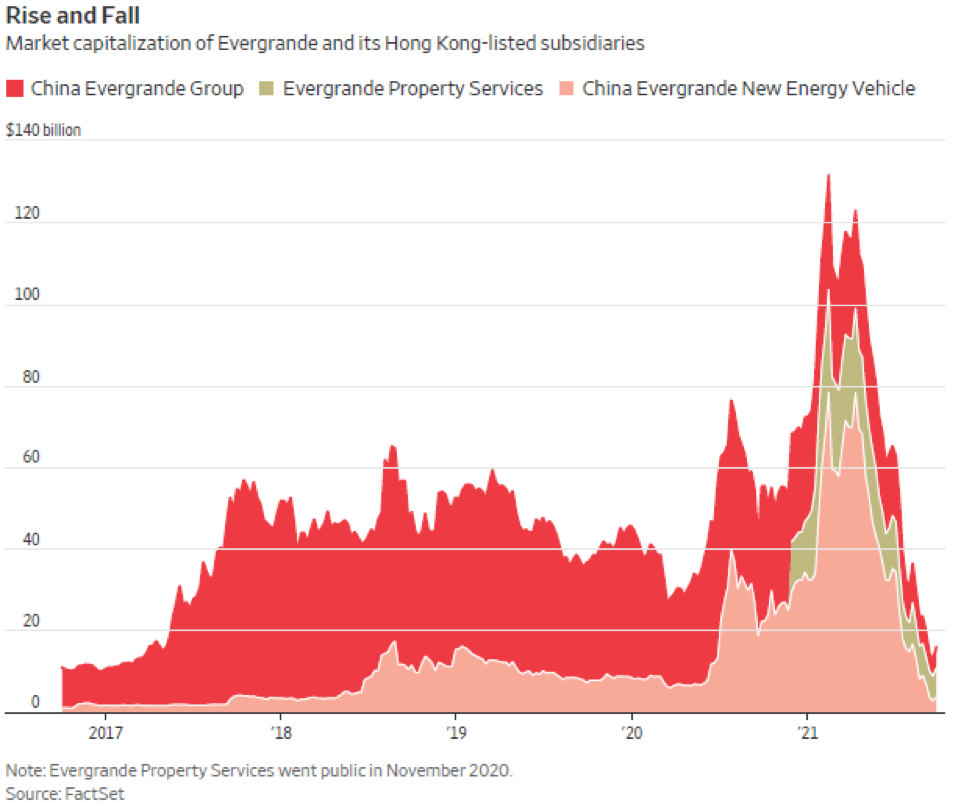

The problem is that with such high interest rates on those bonds, the risk was very high. And it was not just the situation with the bonds and overall debt of Evergrande. The company went heavy on stock repurchases in which the price saw a jump of more than 20 percent. This was a result of a $100 million stock buyback plan by the company’s founder and chairman, Hui Ka Yan. The stock buyback contributed more than $5 billion to Evergrande’s value in the market.

Evergrande also was involved in risky schemes to raise financial capital. The plan called for a reverse-merger plan of one of its subsidiaries on the Shenzhen stock market. While the plan ultimately raised $20 billion in a stock private placement the enticement for investors was that they could have their funds returned to them if the reverse-merger was not completed by the end of 2021. Evergrande eventually came to agreements with most of the large investors in the plan as long as they did not demand repayment. These deals underscore the lengths that Evergrande went to in order to acquire financial capital in order to help its projects come to fruition and entice investors to stay with the company.

Creative financing practices: Chinese property developers have used questionable financing practices that are widely used and could be very dangerous. One manner of raising capital is through the use of joint ventures. However, there is a severe lack of transparency by property development companies that would hurt investors. This lack of transparency would hurt investors since they must now make an estimation of the amount of debt a property development company may have. The lack of transparency is due to the fact that these joint ventures is not included in the developer’s balance sheet if it happens to have a minority holding.

There are also loan guarantees by the developers that can be quite hefty. According to S&P Global, a report was published in June 2021 in which there was an estimated 478 billion yuan, or $75 billion, of these guarantees made by Chinese developers who were rated. The problem here is that if a property developer fails, coming through on the guarantee debt payment can be extremely difficult if not impossible. But that is the key selling point of such arrangements: the guarantee made to investors and lenders.

Danger to China’s economy

The situation with Evergrande could be a serious problem for China’s economy. There are many Chinese who have purchased condominiums with companies such as Evergrande in order to have a better place to live. But the problem is that the Chinese property market is showing signs of a dangerous slowdown after a decades long rise that includes escalated home values and now a huge supply of empty apartments.

The Chinese economy has been able to expand thanks to its growing real estate market. Investors took advantage of such growth by investing in stocks of property development companies that saw huge price appreciation. Bond purchasers and lenders were able to get loans and bonds that paid high interest rates and enjoy a healthy cash flow as long as the companies were able to pay that interest when they were required to.

Local governments needed real estate development companies to do well so they could reap the land-sale revenues. For example, in 2020, land-sale revenues achieved a level of $1.3 trillion, which was equal to 84 percent of local-level fiscal revenue for that year. Local governments make their fees and any tax revenues from these land sales. This also means that local governments will need to alter their spending for infrastructure programs if the real estate boom were to slow down at a precipitous rate.

The Chinese macroeconomy is highly dependent on its real estate segment for a number of reasons. If Chinese households are willing to spend substantial sums on new apartments, whether as a place to live or an investment, then this means more money being put into the economy. This allows builders to sell the apartments they have constructed and pay their debts and pass on part of the profits in the form of dividends to common stockholders. This also permits builders to take on more construction projects which means hiring more workers and expanding employment opportunities. It also means the need to purchase cement, wood, copper pipes, and steel for more buildings desperately needed in a nation of 1.4 billion people. The real estate segment of China’s economy makes up 29 percent of the nation’s gross domestic product. This is a huge piece that the Chinese government and especially President Xi Jinping is aware of playing an important role. This is why President Xi is trying very hard to move China’s economy away from its reliance on the housing and real estate market for investment and economic growth and towards other endeavors such as technology and research and development.

The bottom line is that China needs to change its system regarding how and where investments can be made for those Chinese who wish to get a better return on their financial capital. While real estate can be a source of financial return, such as real estate investment trusts that exist in the United States, China must open up its investment markets in order to allow more places and opportunities to invest.