Why Biden’s Build Back Better plan is necessary

The Biden Administration is continuing its push to create and enhance social, economic, and climate change programs. But the key elements of the legislation and possible problems associated with it are what may prevent its coming to fruition.

Democrats in Congress and President Biden are attempting to get into law a $2 trillion package that will cover a wide range of objectives. The legislation, called Build Back Better (BBB), is wide ranging covering such areas as higher wages, access to quality and affordable health care, universal paid sick leave, combat climate change, and advance racial equity. The plan is considered very ambitious and critics feel it is not only expensive, but beyond the scope of the role of traditional government.

Congressional Democrats and the Biden Administration are claiming that these programs are not only necessary but way overdue in order to help the American people. While President Biden is well aware of the costs involved in enacting BBB, he is also concerned about resistance he is facing from people in his own party such Senators Joe Manchin of West Virginia and Kristin Sinema of Arizona. The Progressives in the House want the bill to become law as soon as possible. However, in order to make BBB a reality, it must be understood why the law is necessary and that the benefits outweigh its costs.

Key Elements of Build Back Better

The Build Back Better law has many key elements and among them are:

Create free and universal pre-K: The law would provide free universal preschool for children in the age bracket of 3- and 4-years old. This plan allows parents to send their pre-school children to any public school or childcare program of their choosing. The goal of the provision is to reduce the financial cost that millions of American families must bear when trying to send their children to a pre-school program. This would especially help low-income families and those earning less than $300,000 per year who will pay a capped amount based on their income level for child care for children under six-years old. This includes almost $400 billion to assist the states in providing universal pre-kindergarten and affordable child care programs over a six-year period.

Combating climate change: BBB provides $555 billion for climate change programs and would work toward reducing emissions in the United States. The goal of the program would be to reduce the nation’s greenhouse gas pollution by approximately one billion tons of carbon dioxide by the year 2030 which is equal to removing all U.S. automobiles from its roads for a one-year time period. The law also includes new spending for climate purposes of approximately $320 billion providing tax incentives for providers and buyers of wind, nuclear, and solar power so that there can be a swift movement away from carbon fuels such as coal, natural gas, and oil. Anyone purchasing electric vehicles would receive up to $12,500 in tax credits. The law includes $1 billion to construct electric vehicle charging stations, $2.9 billion to have the electric grid more conducive to transmitting wind and solar power, as well as $12.5 billion in rebates to homeowners purchasing and installing more energy-efficient appliances. The law goes even further with sponsoring and funding climate-friendly farming, forestry, and research programs, assisting communities to finance renewable energy projects, and helping rural electric cooperatives deal with the cost of converting from coal plants to renewable energy. Ultimately, the law will fund programs that will assist with fighting climate change in the next ten years.

Universal paid family and sick leave: The Biden plan calls for the creation of a federally paid for family and sick leave program for those who do not have such an option from their employer. While the plan initially called for 12 weeks of paid leave, after negotiations with Congress the plan has been reduced to four weeks. This revision includes family and sick leave with an estimated cost of $194 billion. The goal of the bill is to create a permanent and total national paid leave program designed to provide all workers, both employed and self-employed, four weeks of paid family as well as medical leave, whether for personal illness or to care for family members. The key provision of the bill would be that those workers requesting paid leave will be allowed a percentage of their income commencing at 90 percent and trending downwards for higher earners.

The crux of the plan is that there would be a guaranteed four weeks of paid leave for those workers who fall into the following categories:

- New parents

- Must take care of their own serious medical issues

- Must take care of a loved one who has a serious medical condition

The goal of the plan is to create a national paid leave program for the leading industrialized nation that does not have such a provision.

Child tax credit: BBB provides for an increase in the child tax credit to $3,000 from $2,000 for all children from the ages of six and older. For any child under six years old the new tax credit will be $3,600. This credit would be provided in the form of monthly checks, making it easier for parents to pay for childcare costs. The goal of the bill is to reduce child poverty by 50 percent and be able to take at least 5 million children from the depths of poverty. This provision would be an expansion of the American Rescue Plan passed in March 2021 and make the tax credit permanent. This program, through its use of direct payments to parents and caregivers, has made a significant impact in reducing food scarcity while taking 3 million children from the bounds of poverty as of August 2021.

These are only a few of the many elements of BBB that Congressional Democrats and President Biden hope to enact into law soon. But while the plan would benefit many Americans, critics claim there are significant flaws in BBB.

Possible problems

There are some critics who feel that Biden’s BBB plan has serious flaws which could affect the nation and ruin the effectiveness of the law.

Hurt childcare: Some critics charge that BBB would fashion a child care system of one-size-fits-all that ultimately would drive up the cost of such things as day care. They feel that day care centers would be imposed with new regulations that would be costly to implement and difficult to follow. They also state that BBB would require huge salary increases for child care workers that would drive out of business needed day care centers. That is, it would not be cost effective nor profitable to run such facilities and then working parents and single mothers would really be in a bind trying to find someone to take care of their children while they work. Critics feel that child care costs could increase by as much as $13,000 annually and that the federal government would have to foot the bill so as to cover the costs for families who would be hard hit by such increases.

However, the plan has significant benefits for working parents. The bill would fully fund child care for three years – from 2025 to 2027. In the three preceding years, BBB would have subsidies that will gradually go to more working and single parents. But the subsidies will cease in 2028.

This plan also includes the child tax credit that has been shown to reduce childhood poverty by 30 percent. The child tax credit has been beneficial for low-income families since research shows that 90 percent of the recipients use these funds for vital necessities and education. Under BBB, an infant’s family that is making up to $41,250 would have child care that is fully paid for.

Hurts climate change: Critics of BBB feel that a great deal of funds will be focused on combating climate change through the use of tax credits for clean energy programs. However, not include policies and programs that should be geared toward punishing individuals and companies that use dirty energy such as fossil fuels which includes coal. This is mainly done in order to adhere to the wishes of Senator Joe Manchin of West Virginia, a leading coal producing state. The bill has dropped the climate focus that originally was included which is a “clean electricity payment program” making payments to utilities relying on clean energy and placing fines on those who are not making any moves to reducing carbon emissions. Some critics feel that certain aspects of the climate change fight would be left to the private sector who really would not have much financial incentive to do anything about it.

The bill will place a fee on methane emissions that come with oil and gas production and transmission. The focus is on methane emissions because it is responsible for spewing carbon dioxide into the atmosphere. According to the writer, Rebecca Leber, methane emissions is at least 80 times more harmful at trapping heat than is carbon dioxide. Climate advocates are encouraged by this part of BBB but are still pushing for more substantial legislation in dealing with threats to the climate.

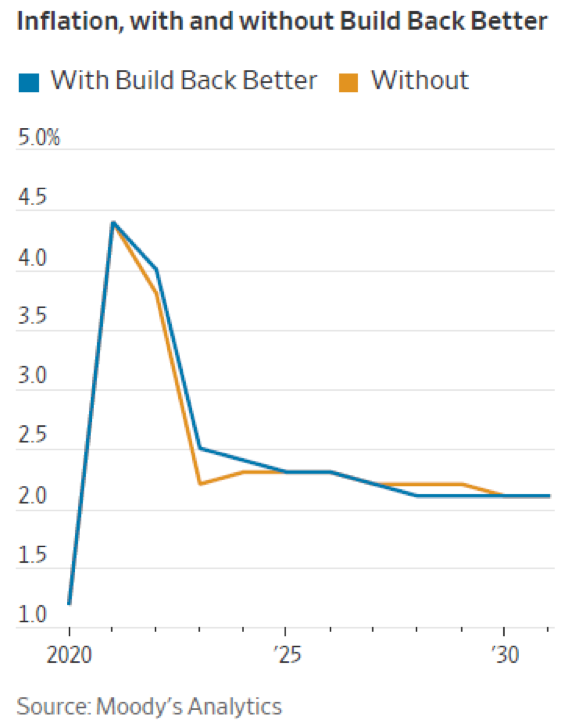

Rise in inflation: Some critics are deeply concerned that BBB will put substantial amounts of money into the nation’s economy and thereby cause inflation to skyrocket. The consumer price index (CPI) was reported recently to be at 7 percent, a rate not seen in the United States since 1982. Critics of BBB feel that the $2 trillion or so that the law would cost, will possibly boost inflation to 10 percent or very close to it.

According to Douglas Holtz-Eakin, president of the center-right American Action Forum: “We know there’s lots of spending in the bill, and that it’s front-loaded as part of the earlier years of implementation of BBB. . . . If you cut taxes and increase spending, financed by debt, that will put upward pressure on inflation.”

Other economists express similar sentiments. For example, Ethan Harris who is the head of global economics research at Bank of America states that, “You should wind up with primarily a deficit-financed spending bill that is going to be rolled out in an economy near full employment. . . . It will make the labor market even hotter and create even more price pressure.” Compounding the pressures from the supply chain disruptions and the labor shortage that is currently occurring due to the Coronavirus upsurge, these economists feel that inflation could go higher than anticipated.

But there are other economists who are not worried about the possible inflationary impact of BBB. Noah Smith, a former assistant finance professor at Stony Brook University states that, “I expect Biden’s bills to push upward on inflation, rather than downward. That said, the inflationary impact will be very small.” Others such as Jason Furman who was the chairman of the Council of Economic Advisers for President Barack Obama is on record as that “it’s more likely a small positive for inflation in 2022, because it’s preventing a big reduction in spending that would otherwise have happened that year.” He goes on to say that “over the medium and long term”, BBB will have minor effect on the nation’s rate of inflation.

Impact on American economy

The BBB plan would have an impact on the American economy in two key ways. First, the act would involve significant job creation. According to a report by the Economic Policy Institute (EPI), approximately 4 million jobs would be supported by the BBB law and would include:

- 1 million caregiving jobs

- 763,000 green jobs

- 556,000 manufacturing jobs

- 312,000 construction jobs

The EPI report also states that the BBB plan “expands upon more traditional infrastructure investments in the infrastructure bill in ways that promise to be transformative for social equity, manufacturing renewal, energy efficiency, and environmental sustainability.” This includes:

- An expansion of child, earned income, and child and dependent care tax credits that will give a benefit in financial security to families

- Funding for child and elder care as well as universal prekindergarten that will reduce the inequality and lacking of the nation’s caregiving structure

- Investments in manufacturing, technological research and development, renewable energy generation, climate change plans, rebuilding the nation’s industrial base, and cutting energy costs for both businesses and households

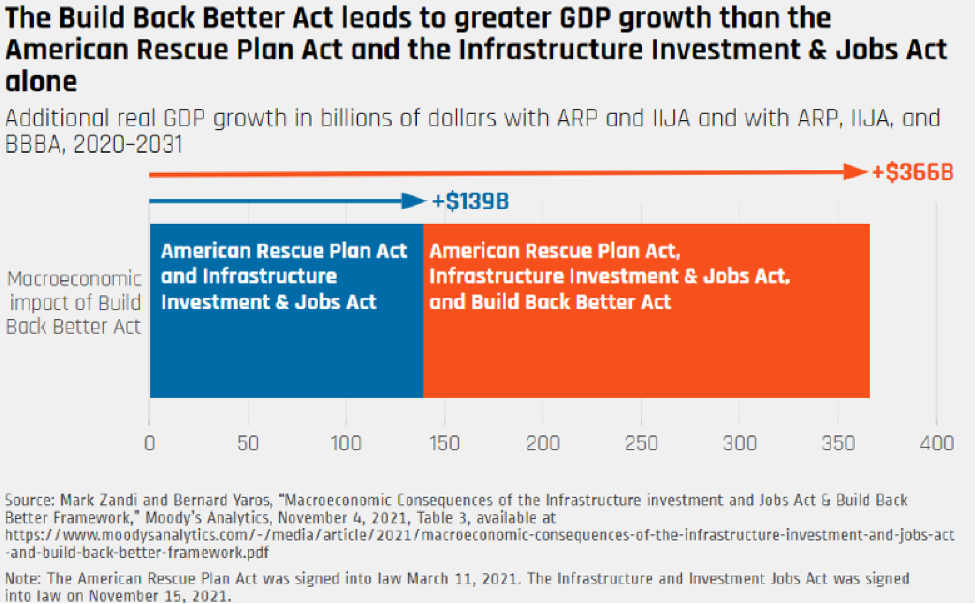

The other impact on the American economy would be economic investment and growth. Independent organizations including Oxford Economics and Moody’s Analytics have predicted that the rate of economic growth would be greater as well as increase the American workforce in the long term. These organizations have used models that show higher long-term productivity and an increased number of women in the workforce that outweighs the cost of funding BBB. Oxford Economics has predicted that there will be 0.5 percent higher economic growth in 2022 and a 0.9 percent increase in 2023. Moody’s Analytics has predicted that 2.4 million jobs would be added to the American economy by the tail end of 2025 through the implementation of the BBB plan.

The $2 trillion plan could be a wise investment for the American economy and have long-term benefits in substantial ways. The key is getting the Congress to pass BBB and watch the rewards for the American economy.