State and local governments feeling financial effect of Covid-19

State and local governments in the United States have seen their budget forecasts turned upside down due to the Covid-19 pandemic crisis. Governors and mayors across the country must now plan for lower revenues, cutting back on services, and even severe layoffs in order to salvage their budgets and stay out of the red.

The Covid-19 pandemic is having a devastating impact across the American economy, from massive layoffs to corporations cutting dividends to small businesses permanently closing their doors. But getting hit especially hard are state and local governments as they have seen a drastic reduction in tax revenues and dramatic climbs in expenditures that they did not anticipate. State and local governments provide services and the infrastructure that millions of Americans rely on. State and local governments not only contribute to the nation’s economic growth, but they are also large employers. In 2019 alone, state and local governments contributed 20 percent to the overall growth of the nation’s gross domestic product (GDP). As for employment, states such as Missouri and Wyoming employ 13.1 percent and 21 percent of their respective state’s workforce.

States and cities have seen a sudden decline in sales tax revenues because consumers have stopped frequenting restaurants, bars, and stores due to fears of the spread of Covid-19. Companies have laid off millions of workers because consumers are not spending the same amounts of money as they did just seven months ago. States and local governments are also spending money for items such as Covid-19 testing kits, medical supplies, more health care workers, and emergency relief efforts as well as more funds than anticipated for unemployment benefits and Medicaid.

These additional expenses just were not in their budgets, and to compound matters even further, many states and local governments are required by their constitutions and laws to submit a balanced budget annually, regardless of the situation. In normal times, states and local governments would have looked to the federal government for help. But these are not normal times. Besides having to confront an invisible foe, Covid-19, the federal government has even suggested that aid may not be coming as hoped. Senate Majority Leader Mitch McConnell, Republican from Kentucky, flat out stated in April that he would rather permit the states to declare bankruptcy than to offer them a bailout. With a severe drop in revenue and much higher than anticipated expenditures, state and local governments have their hands full with no end in sight to this crisis.

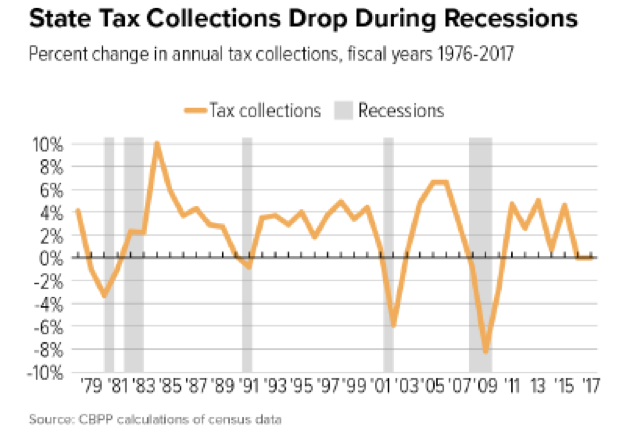

Drop in revenues

States and local governments rely on a variety of sources for revenues, not just on property or income taxes. For example, for states that do not have an income tax they are regarded as great places to live, work, and do business. This is a key reason why many Americans either relocate to states such as Florida or Texas. These states use the lack of an income tax as a substantial lure for companies looking to set up their corporate headquarters in a tax friendly environment. For senior citizens and working individuals, the appeal of no income tax, as well as year-round beautiful weather, make Florida and Texas great places to reside. However, Florida has a sales tax in which it uses to raise more than 70 percent of its revenues and that tourists generally pay 20 percent of that amount. Florida needs for its populace to get out and spend money in order to raise substantial amounts of tax revenues. Florida also needs tourists to visit places such as South Beach with its many restaurants and bars, Epcot Center, Disney World, and the beaches up and down its coast and spend, spend, spend in order to raise tax revenues through the state sales tax. But the problem is that with tourists, both from the United States and globally, reluctant and scared to travel due to the Covid-19 pandemic, how can Florida get the tax revenue it expects through its sales tax. The same can be said about Nevada and Hawaii which heavily rely on tourism to bring in tax revenues.

According to a recent survey of cities made by the United States Conference of Mayors and the National League of Cities, the situation is bleak. The survey results showed that 88 percent of responding cities were expecting a revenue shortfall in 2020 due to the Covid-19 pandemic and this number rises to 98 percent for cities that had a population count of 50,000 to 500,000 people. While cities such as Las Vegas have seen a dramatic drop in tourism dollars, and also a drop in sales taxes, other cities and states see a huge drop in income tax revenues as workers are furloughed, and/or laid off. The problem is worsened that other sources of revenues are also dropping such as business licenses, court fees, library fees, real estate transactions taxes and fees, and toll collection from bridges, tunnels, and highways. For example, my brother is a pharmacist and takes the Garden State Parkway in New Jersey to get to his place of employment in the central part of the state. Prior to the Covid-19 pandemic, it took him 45 minutes to get to work. During the pandemic, and due to a severe drop of people travelling to work via the Parkway, it would take him 25 minutes on the same route. The Parkway is a toll road and the state of New Jersey lost millions of dollars in revenue due to fewer people taking the highway to get to their jobs.

Other projections for loss of state and local government revenues are even more dire. In a survey conducted by the National Association of Counties, counties having more than 500,000 people were projecting a revenue loss of greater than $70 billion. Those counties that had between 50,000 and 500,000 people were expecting a drop in revenue of more than $30 billion while those with populations of less than 50,000 were estimating losing approximately $10 billion in tax revenues.

According to a report by S&P Global Ratings published in early April 2020, it expected that the Covid-19 pandemic would severely affect state and local government credit conditions. This is based on serious reductions in such areas as personal income tax receipts, sales and uses taxes, motor fuel taxes, leisure and hospitality taxes, gaming revenues, corporate income taxes, and property taxes. For example, the report stated that states expected a significant decline in personal income tax receipts due to workers either being laid off or furloughed or a delay in filing income tax payments to later in the year.

The states that will most likely feel the worst of the revenue decline will be California and New York. According to a report by TD Economics filed in mid-April 2020, it is projecting that California will see a drop of $24 billion in revenues while New York will lose $12 billion from their current fiscal-year enacted budgets. In terms of revenues, these would probably be the two states hit worst by the Covid-19 pandemic. These drop in revenues will cause a budget shortfall in 2020 of $21 billion for California and $5.8 billion for New York. This not counting the loss of $6 billion in tax revenue that New York City would experience in 2020.

States and local governments are heavily dependent on these diverse sources of revenues. But if they cannot obtain these funds, they will be forced to borrow heavily. For example, Buffalo, New York will be forced to borrow over $27 million in order to stay above water. While in New Jersey, Governor Phil Murphy borrowed $9.9 billion in order to offset revenue losses due to the Covid-19 pandemic. This will most likely cause the state’s credit rating to go further downwards and making it more expensive for the state to borrow money, now and in the future.

Severe cost cutting

The American states are facing a huge expenditure of funds in order to combat the Covid-19 pandemic. One key area that the states will be using huge amounts of money is dealing with public health costs. This will entail using billions of dollars for such aspects as staff and supplies for testing, paying for overtime for doctors, nurses, and other staff for hospitals, setting up emergency clinics and hospitals, purchasing protective equipment, and tons of cleaning supplies.

Among the sums of money that has been appropriated by the various states include:

- California: $1 billion

- Michigan: $125 million

- Minnesota: $200 million

- Arizona: $55 million

- Maryland: $50 million

- Georgia: $100 million

- Washington: $200 million

These funds are mainly coming from the various states “rainy-day funds”. These are sums of cash put aside by the various states for emergency purposes. These rainy-day funds are fine, well, and good, but the problem is that given the magnitude of the Covid-19 pandemic and its effect on the individual states and their populace, the funds could be completely used by the end of 2020. If these rainy-day funds are not replenished immediately, the various states will have a difficult time acquiring financial capital to pay for supplies and personnel to combat the Covid-19 pandemic.

The problem is further compounded by services and programs that the states and local governments must still provide their populace. This includes such items as trash pickup, police and fire fighting services, education, housing, food programs for the poor, mental health services, and Medicaid in those states where local governments are involved in cost sharing. There are also pension plan contributions for state and local government employees, health coverage for these employees, overtime, and other assorted benefits.

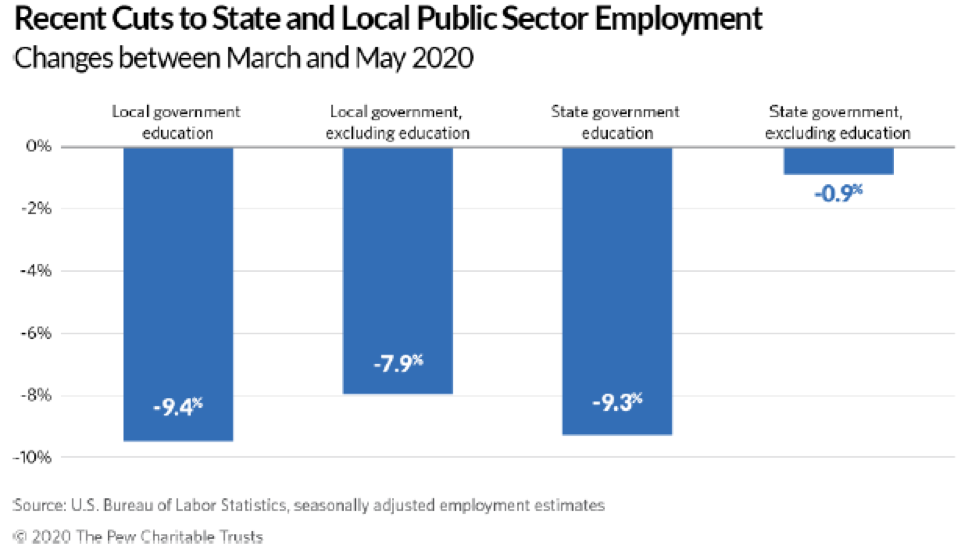

If the states and local governments cannot meet these obligations, and it seems in many cases they will not be able to, then budget cuts are required. For example, teachers may lose their jobs resulting in classrooms having more students. One estimate has school districts losing revenues nationally by an average of 15 percent resulting in one in 12 teachers losing their job. The worst-case scenario has one in 5 teachers losing their jobs. Between February and April 2020, the state of Wisconsin lost 1 in 5 state and local public education positions. The seriousness of this situation harkens back to the days of the Great Depression of the 1930’s when teachers in New Jersey were told they would still have a job, but no salary.

Teachers would not be the only jobs that would be cut. States such as Michigan have instituted a hiring freeze and the state has halted all discretionary spending unrelated to the Covid-19 pandemic as well as grant programs. Michigan is also contemplating layoffs involving nonessential state employees.

The states are pushing the budget cuts onto the local and city governments. “We have no choice but to hold back 20 percent of all payments,” said Freeman Klopott, a spokesman for New York Governor Andrew Cuomo’s Division of the Budget. “These are responsible budgeting actions required to maintain fiscal integrity, and we encourage local governments−which have many tools at their disposal−to also budget responsibly in these difficult times.”

Another problem that state and local governments have is that many are not permitted to run budget deficits. For some states it is written into their constitutions that the legislature and the governor must have a balanced state budget every year, while others just have it as a law. This means that these states must make budget cuts so that there can be a balanced budget either at the end of the year or in midyear. There are only four states that have no balanced budget requirements in their constitution or as a law.

The problem is not just what is happening currently, but also what could happen in the coming year. Many cities and states will need to start working on their budgets and anticipate if the pandemic gets worse or even if it stays the same. Cities are already making budgets that anticipate job cuts. For example, Santa Monica, California has cut 337 full-time positions and 144 temporary jobs that is designed anticipate a major restructuring of the city government in the expectation of a 23 percent budget reduction.

States are also concerned about what is occurring in the private sector as companies, large and small, are laying off personnel. With massive layoffs comes an increase in unemployment benefits. There are currently 50 million Americans who are out of work with over 1 million workers filing for unemployment benefits weekly. These benefits must come from the coffers of the individual states. This situation will only make matters worse for the states.

Congress needs to do more

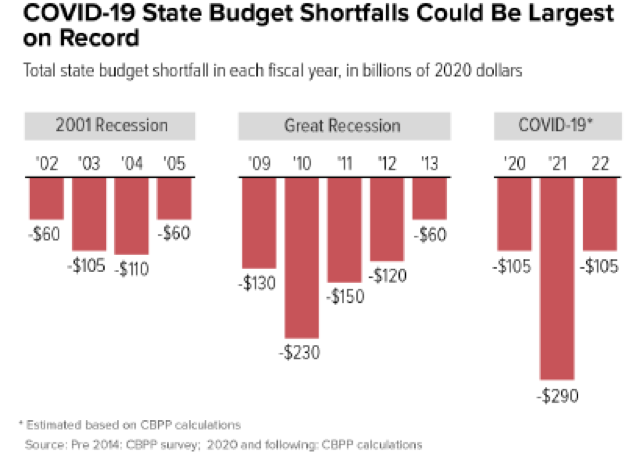

The United States is in the middle of a financial crisis that is worse than the Great Recession of 2008-2009. States and local governments were not prepared for the devastating onslaught of the Covid-19 pandemic and could cause cities, towns, and counties to declare bankruptcy if there is no help soon. While Congress has enacted a $2 trillion relief package in the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020 this is not enough. More is needed and on a more frequent basis. The states and local governments cannot do it on their own, and rainy-day funds are not enough. What should occur is a $2 trillion relief package every two months that would address different problems the states and local governments are facing. The reason is that if the states and local governments go under financially, then it is only a matter of time before everyone else follows.