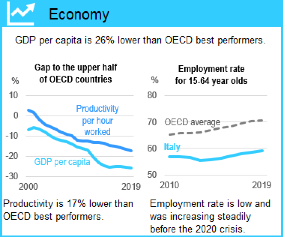

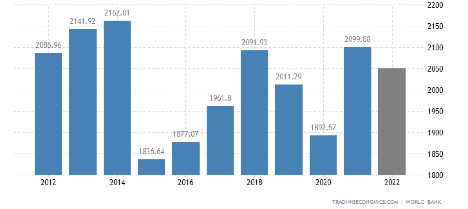

Italy’s economy has always had its ups and downs. Their economy is ranked as the ninth largest in the world and third in the European Union (EU). Italy relies on manufacturing and services to make its economy grow and provide jobs for its people. The services part of the economy comprises approximately 75 percent of Italy’s gross domestic product (GDP) and employs about 65 percent of its total employable population. As for the manufacturing sector, it makes up 25 percent of the nation’s total production while employing approximately 30 percent of Italy’s total workforce.

But given the recent situation with the Covid-19 pandemic, Italy’s economy is trying to rebound from problems the crisis brought about. Among these are the problems with unemployment, inflation, and ever-increasing global competition. Compounding these problems is the state of Italy’s public finances in which it is one of the largest debtors in the Eurozone as well as on a world-wide scale.

The recent prime minister, Mario Draghi, made every attempt to improve Italy’s economy but faced stiff opposition from political parties on the right and far-right. These road blocks were so severe, that Draghi handed in his resignation to President Sergio Mattarella in July who has called for national elections in September. Whether this will ultimately help Italy’s economic situation remains to be seen. In Italy, economics and politics walk hand-in-hand to the point where nothing of immediate significance is ever accomplished.

Italy’s current economic situation

In the past five years, Italy’s economy has seen its high and low points. From the years 2017 to 2019, the economy saw a slowdown period, which had the potential to rebound. But then the Covid-19 pandemic happened and Italy’s economy, along with the rest of the world, contracted in 2020. Italy’s economy contracted by 8.9 percent in 2020. Italy, like many nations around the world, went into a sudden and sharp recession. It was able to rebound in 2021 through resumed economic growth.

But a key problem with Italy is that it is really two nations and two economies. The North is regarded as being more conservative with political parties calling for splitting the country up. But the North is also a developed, highly industrialized region that is strongly dominated by private companies. If anyone were to relocate to Italy, the odds would be very good that they would settle in the North since their chances of getting a job would be excellent. Areas such as Milan and Turin have unemployment rates of less than 10 percent even when Italy’s economy is in the doldrums.

However, Southern Italy is largely agricultural and enjoys subsidies from the central government in order to be able to survive financially. The South also has a high unemployment rate in which cities from Naples down to Syracuse in Sicily have jobless rates of 20 to 25 percent, even if there is no economic recession. Political movements in the north want to break away from the south as well as from the EU and create its own economic entity that they believe will thrive and prosper.

Italy’s current situation is made worse due to its heavy dependence on imported Russian gas. Italy must severely rely on natural gas which makes up 42 percent of the nation’s energy mix. From that mix, 45 percent comes from Russia. The Italians face a dangerous problem if there are further EU sanctions against Russia that will mean a severe interruption or disruption to its natural gas supply. The EU may place financial and economic sanctions on Russia and the Russians may retaliate through their own actions that could cause Italy egregious harm. The harm would result in reduced manufacturing activity and a contraction of Italy’s GDP. Not to mention the effect on Italy’s inflation rate in 2022 and 2023. How well the Italian economy can come back from this action remains to be seen.

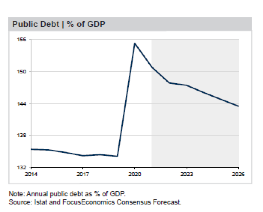

Italy’s financial situation is not projected to be going smoothly in the short-term. A key financial problem Italy faces is that it has the second highest ratio in terms of debt-to-GDP in the EU after Greece. Based on recent memory, many recall what this meant for the economy of Greece and the problems it brought to the EU and global economy. Compounding the current financial situation, Italy has the highest government deficit that any major economy in the EU has currently. Last year, Italy had a budget deficit rate of 7.2 percent. But for this year, it is projecting a target budget deficit of 5.6 percent if the economy does not encounter a steep and sharp contraction. If it does, then all bets are off and anything is possible.

“If GDP is going to weaken substantially, the dynamic doesn’t look pretty,” said Lucrezia Reichlin, an economics professor at the London Business School. “The market has now become quite pessimistic and possible recession in 2022 is something many people expect.”

There is also the problem with Italy’s 10-year bond yield. The spread or difference that exists between Italy’s 10-year bond yield and Germany’s, which is regarded as a benchmark of political and economic risks of nations in the euro region, has gone up as high as 2 percent recently. The problem is that this is the biggest spread since the early times of the pandemic in which investors divested themselves of European government debt that were considered riskier.

Why is this happening?

There are key reasons why Italy finds itself in this economic quagmire.

First, Italy is dependent on Russia for its supply of energy, specifically natural gas. Italy is regarded as the second largest purchaser in Europe of natural gas following Germany. This is a severe problem that Italy has failed to address in the past and it is now becoming worse. Not only will a halt or decrease in the flow of gas from Russia hurt the Italian economy in terms of seeing a drop in its GDP, but individual Italians may face rationing within possibly a year. Why the Italian government and industry have not taken preemptive steps to lessen its dependence on Russian gas imports is a befuddling question.

Filippo Taddei, chief economist for Southern Europe at Goldman Sachs stated that, “The number one risk that currently exists in the European and Italian economy, in particular, is the risk that we get the full disruption of supply in natural gas.” With a full disruption of the natural gas supply, there will be a significant shrinking of the Italian economy which more than likely will lead to a recession by 2023. But the situation will get worse for Italians since a disruption of natural gas will also mean an inflationary trend in energy prices. It should be regarded as a direct correlation between supply and energy prices: As the supply of natural gas shrinks or is disrupted, then the higher that energy prices will go, eventually causing a recession that could hit Italy very hard.

Another reason that Italy finds itself in its current state is that the country is extremely vulnerable to ever increasing interest rates. The European Central Bank (ECB) will more than likely want to hike interest rates in order to take money out of circulation so that it can combat inflation. According to Carsten Brzeski, chief economist at ING, “Hiking rates by 0.5 percentage points and softening forward guidance shows that the ECB thinks the window for a series of rate hikes is closing quickly.”

The problem is further worsened that with energy prices spiking inflation, the ECB will feel the need to do quantitative tightening by raising interest rates. This is something that the Italian economy cannot afford at this point in time. Italy needs to spend money on investments that will expand and further diversify its economy as opposed to pumping it into energy subsidies. That is, making a long-term investment rather than a short-term quick fix that may not be beneficial after all.

A third key problem that Italy faces are the structural reforms the economy desperately needs. Italy’s economy has structural problems that have hindered its potential to become the EU’s and Europe’s economic powerhouse. For example, companies in Italy very often use cronyism as well as nepotism as the main factors in deciding who will advance or get a promotion. As technology makes more of an impact on the global economy, skill, knowledge, experience, and brains, are more in demand for numerous corporations. But in Italy the general rule is, “It’s not what you know, but who you know in order to get ahead.” According to a paper co-written by Bruno Pellegrino of the University of California, Los Angeles and Luigi Zingales of the University of Chicago wide spread cronyism and nepotism costs Italy between 13 to 16 percent in productivity growth.

This will hurt the Italian economy since the best and the brightest will either be ignored for opportunities to successfully takes reins of a company or leave Italy altogether for more lucrative possibilities abroad. Pellegrino and Zingales state that “Given this conundrum and the fact that the country’s institutions are intrinsically hard to change, it appears that Italy serves as a cautionary tale of the importance of building institutions that aren’t simply appropriate at one historical juncture, but that are also attuned to the pace of technological progress.”

Other structural reforms that Italy acutely needs in order to build its economy deal with:

- Improving its infrastructure

- Making governmental administration effective and efficient

- Improvements to the efficiency and equity of the nation’s tax structure

- Encourage competition among different companies in diverse industries

- Reduce or eliminate the chaotic government structure which hinders economic growth

These are only a few of the problems Italy faces that is hurting its economy. But looking at the bigger effect on the EU is an even greater concern.

What this means to the EU

Italy’s economic and financial situation could be a significant problem for the EU. First, the situation regarding Italy’s sovereign debt could worsen and may surpass what happened to Greece some years ago. In 2019, Italy’s public debt was 134.8 percent of its GDP. But in 2020, it was 155.3 percent while in 2021 it was 150.8 percent. This a serious problem for Italy since they must borrow heavily in order to keep their government functioning. This will mean that Italy will need to pay higher amounts of interest in order to satisfy its debt obligations and still be able to borrow in the future. The European Commission (EC) and the International Monetary Fund (IMF) have agreed that gross financial needs, in an ideal situation, should stay below 15 percent of GDP and go to 20 percent of GDP at the very most if public debt were to stay at a financeable level and therefore sustainable.

Secondly, the EU Commission and the European Council is in the final stages of approving for Italy 25 percent of the €750 billion from the Next Generation EU (NGEU) recovery fund. From the NGEU, Italy is to receive €191.5 billion in which €68.9 billion would be grants while €122.6 billion will be long-term loans that will have a low interest rate. The key to these funds will be for long-term investments such as improving infrastructure, ecological projects, digitalization, education, schools, and research. The EU is a major stakeholder in Italy’s economy and it is the last entity that wants to see it fail financially. The EU must make sure that Italy’s economy can rebound through the efficient, effective, and prudent use of these funds. If not, there could be serious repercussions for all of Europe.

What now?

Italy is currently being hit on many sides. Among these problems are that its economy is on the downside as it faces inflation, shortages of natural gas from its Russian source, political chaos with the resignation of Prime Minister Mario Draghi, and the far-right parties looking to tear the country asunder. The Italian people are just now recovering from the Covid-19 pandemic and seeing some semblance of life returning to normal.

But does this normality mean a return to economic turmoil and political uncertainty? This is what Italy’s next Prime Minister must deal with and help the country set a new course toward better times. While this will be difficult, it is doable. And if it is doable, then this will set a new precedent for Europe’s third largest economy.