By Arthur S. Guarino

Stock buybacks are gaining in popularity among publicly-owned corporations and many of their shareholders. However, the financial implications for the corporation could be masking serious long-term problems and possibly hurt rather than help shareholders.

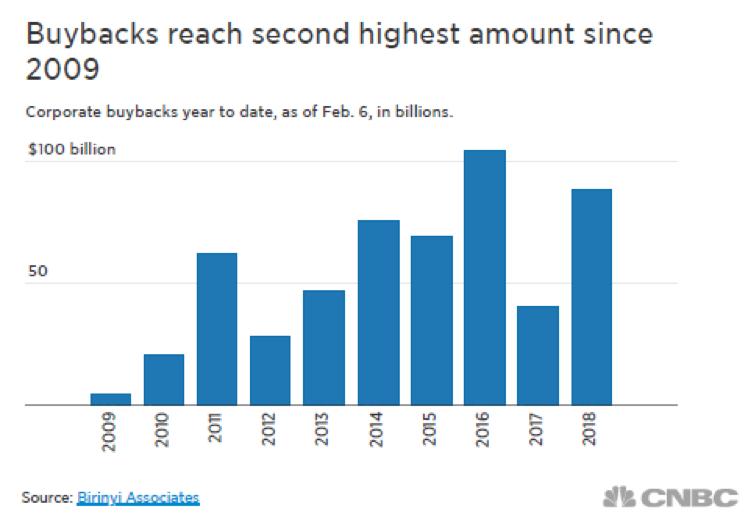

Many stock investors look for ways to acquire a better return on their investment and with the passage of the recent tax bill by Congress, that opportunity has increased. Corporations that had cash overseas can now bring it to the United States and distribute the funds to shareholders in the form of stock buybacks. According to information from Birinyi Associates, corporations announced stock buybacks totaling $88.6 billion in the first two months of 2018 alone, which is double for the same period in 2017. One of the nation’s largest banks, Wells Fargo, announced a stock buyback of $22.6 billion which dwarfs the largest buyback of 2017 of $7 billion by Comcast. Financial strategists at JP Morgan Chase & Companyproject that buybacks will exceed $800 billion in 2018. But the problem is whether the disadvantages of stock buybacks actually outweigh the advantages for both the shareholders and the corporation?

What are stock buybacks?

In simple terms, a stock buyback, also known as a stock repurchase, occurs when a corporation buys back its own common stock from its shareholders. A company may have an excess of cash and wishes to give some of these funds to its shareholders through buying back their own shares of common stock. Here a company once again owns its shares and there is a reduction of the shares outstanding in the market place. A company can perform a stock buy back by going into the open market and become like any other buyer of its stock. Another way a company can buy back its shares is through a tender offer.

By the use of a tender offer, shareholders are presented with an offer or opportunity by the company to submit, or tender, some or all of their shares within a certain time period. The tender offer must state the number of shares the company is willing to buy back as well as the price it is open to pay for the shares, usually at a premium or above the market price. If the shareholders accept the offer, they must state the amount of shares they will tender and the price they will accept. When the company gets all the offers, it must find the correct balance in order to purchase the shares at the lowest cost.

Once a company repurchases its own shares it can retire them and make them into treasury stock or shares that will be held in the company’s treasury department. These treasury shares no longer pay dividends and could possibly be reissued at some point in the future if the company needs a new infusion of cash for a merger or acquisition or purchase an asset and sell shares of the treasury stock in order to do so.

Stock buybacks were not always permitted legally since they were considered as a way to manipulate a stock’s market price by artificially boosting it. However, in 1982, Rule 10b-18 was issued by the Securities and Exchange Commission which provided a legal process allowing stock buybacks. A key stipulation of the rule is that the corporation buying back its shares is not allowed to repurchase more than 25 percent of the average daily volume of shares.

Reasons for stock buybacks

There are various reasons why a corporation has stock buybacks:

Raise market price of undervalued shares: There are times when a company’s executive management team feels that their common stock price is lower than it should be or undervalued. Management may feel that for all their effort, energy, work, and diverse factors such as profitability or operating cash flow, the stock market has not given the stock its due by having a higher market price. Management may feel that the best way to remedy this perceived injustice is to repurchase its common shares and, following the economic principles of supply and demand, cause the stock price to attain the level it should be at. Management may also be under pressure from the company’s board of directors or its shareholders that the stock market price is too low and that it should be raised 10, 15, or 20 percent. Management may be pressured to raise the market price or else face being replaced by another group of managers who can successfully perform the task.

Maximize shareholder wealth by distributing cash: There are times when shareholders or the board of directors feel that the company is holding too much cash in its coffers. Cash is the most liquid of assets a company holds but will generally earn the lowest return on assets (ROA). Shareholders may feel that the excess cash should be distributed to them as a return or reward for investing in the company rather that staying in the company’s vault. Management may feel that given industry standards or possibly planning for an acquisition, or to have funds in case of an emergency, a substantial amount of cash is necessary. Many activist investors recently have pushed management teams to increase the number of stock buybacks so they can have quick access to cash for a short-term investment in the company. The key is that shareholders will not just receive the market price or a tender offer, but the stock buyback will include a premium for buying back the shares. This will cause management to pay out more cash than they may be ready to give.

Raise a company’s earnings per share (EPS): A company’s management team may feel pressured by the board of directors that the company’s EPS is too low and therefore not an attractive investment for potential shareholders. Wall Street stock analysts often cite EPS as a key reason for purchasing the stock and tout companies that have consistently rising EPS, whether it is a growth company or a mature firm. For many companies this is very difficult to perform given the ups and downs of the macro-economy, the industry the company is in, and the unknown events that lurk around the corner. When a company buys back their common shares outstanding, but the company’s net profits or earnings stay the same, the company’s EPS will increase from quarter to quarter and year to year. This will many times be perceived as a highly favorable event by the company’s shareholders, stock analysts, and Wall Street and result in a higher stock price in the market.

Cash outflow reduction: When a company buys back its own shares, this will decrease the dividends it must pay. On a cash flow statement, the dividends paid to shareholders, whether to common stock or preferred stockholders, is regarded as a drain on cash. Analysts will see this and often make a negative report on the company’s financial situation, which will drive down the market price. If there are fewer shares outstanding due to a stock buyback, fewer cash dividends will be paid and more cash will be retained by the company. Analysts will pick up on this move by the company’s management and sing high praises for the action, thereby raising the market price of the stock. Healthy cash flow for any company is always a positive aspect that management should strive for, but through a stock buyback it may be done in order to appease only stock analysts. An example of this is the stock buyback recently announced by chipmaker Broadcomin which they stated in April that they would buy back approximately $12 billion worth of their common shares. Tom Krause, the Chief Financial Officer of Broadcom stated that the company was “maintaining our policy of delivering 50 percent of trailing 12-month free cash flow to shareholders in the form of dividends while adding the ability to use the balance of our free cash flow not only for acquisitions but also for opportunistic buybacks.”

Reduce dilution of shares outstanding: Many corporations have generous employee stock option plans (ESOPs) which are designed to reward mid-level and upper level managers for their performance in running their departments. Sometimes ESOPs are used in place of monetary bonuses. However, too much in shares awarded in ESOPs will have the problem of increasing or diluting the number of outstanding shares when the options are exercised by the managers. This could eventually cause the company’s stock price to drop when the options are exercised. A stock buyback could be used to offset the increase of shares outstanding in an ESOP and keep the stock price at a high or what management perceives as a favorable level.

The negative aspects of stock buybacks

While there are certain parties who love stock buybacks and the accompanying financial rewards, others feel that there are severe problems with the concept outweighing the perceived benefits.

Artificially raise stock prices: When a firm repurchases its own stock, it is taking shares from the marketplace thus lowering supply. Even if demand for the stock remains constant, lowering supply will cause the stock’s market price to rise. Here management has raised the stock price without raising revenues, or increasing market share, or even inventing a new product but just by taking shares off the market. While this practice is not illegal, the question is whether it is ethical since the stock buyback may mislead potential investors who are not aware of management’s action. Management may argue that the stock buyback was necessary in order to increase the stock’s undervalued price. But the question remains: Is it ethical?

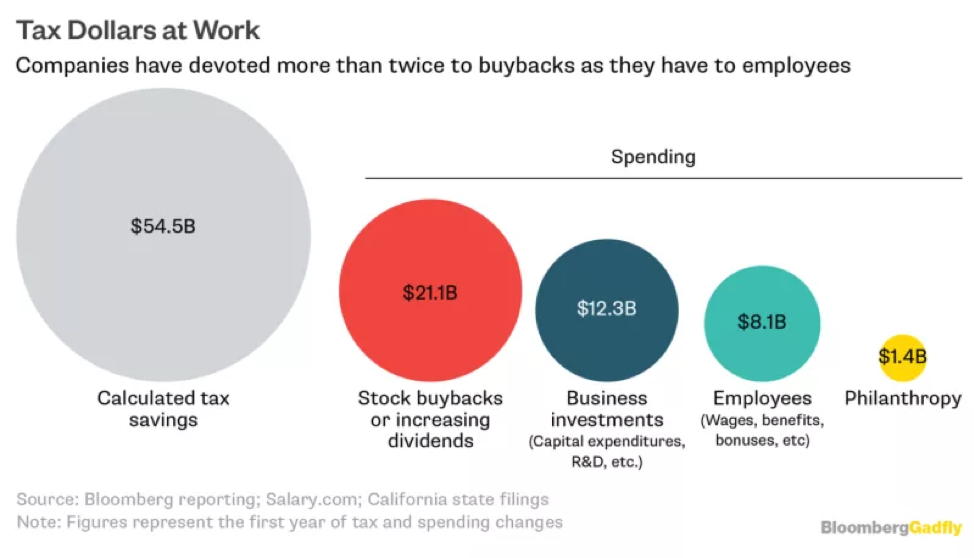

Funds used for other purposes: Rather than repurchasing its own shares, a company could reinvest the funds for such things as research and development, expanding its operations, hire more workers, or pay off high-interest debt. While buying back shares puts money into shareholder pockets, it takes funds away from other aspects of the company that could provide long-term benefits such as increasing profits, investing in new technology, or inventing new products. Of 449 companies of the S&P 500index publicly listed from the years 2003 to 2012, these firms used 54 percent of their net profits, totaling $2.4 trillion, to repurchase their own shares on the open market. Adding to this was dividend payouts that took an additional 37 percent of company earnings. These were funds that could have been used for other purposes that would have increased the market value of the firm in the long run.

Exacerbate wealth inequality in society: Currently, in the United States there is an inequality of wealth among the populace. For example, approximately 80 percent of all common stocks are held by the wealthiest 10 percent of Americans. This imbalance of wealth in American society means that when a stock repurchase occurs, the wealthiest will only see their riches increase. According to University of Massachusetts Lowell economics professor William Lazonick, “Stock buybacks have been a prime mode of both concentrating income among the richest households and eroding middle-class employment opportunities.” With the passage of the Tax Cut and Jobs Act (TCJA) this could spur on even more stock buybacks and further the disparity of wealth in the United States. According to Goldman Sachs, they estimate that firms in the S&P 500 in 2018 will return $1.2 trillion to shareholders through stock repurchases as well as dividend payments which is a 23 percent increase from last year.

Executives will reap financial benefits: Quite often executives are compensated through a combination of salary, generous benefits, and common stock incentives. Executives are given common shares if they reach certain objectives set by the board of directors. The shares are then the property of the executives who can hold on to them indefinitely or eventually sell them in the open market. Through a stock buyback, these executives can get cash from the corporation just like any other shareholder. According to a report by Professor Lazonick, “Annual mean remuneration of CEOs of 475 companies listed on the S&P 500 from 2007 through 2016 ranged from $9.4 million in 2009, when the stock market was in the dumps, to $20.1 million in 2015, when the stock market was booming. The vast majority of this total remuneration, ranging from 53 percent in 2009 to 77 percent in 2015, was in the form of realized gains from stock-based options and awards.”

Stock buybacks may not be carried out: It is very possible that a company may announce a stock buyback and never follow through on its announcement. Companies may announce a time for a stock buyback, the market price increases, and then never carry it out. Companies are really under no obligation to fulfill a stock buyback but may make an announcement just to see the market react favorably and buy more shares and thereby boost the price. If there is a downward movement in the stock market or the United States’ economy hits a recession, a company may renege on the stock buyback. But the stock price may stay at the inflated price and the company has not done anything really beneficial to earn the elevated price. For example, in 2007 Home Depotannounced a $10 billion stock buyback but later pulled the offering due to the residential real estate crisis and its effect on the stock market.

Can there really be any benefits?

Purchasers of common stock are like any other investors: they are looking for a good return on their money. Companies and their management teams are under extreme pressure to meet investors expectations and increase shareholder wealth in the short and long term. But given different factors such as market performance, trade policy, changes in their industry, and the state of the macro-economy, attempting to meet investor’s expectations can be very difficult. The real problem is whether a firm’s management will go to extreme measures to meet those expectations and if it will actually hurt the company and shareholders in the long run.